Royal finances

The British royal family has wealth and receives income from several different sources, some with very long histories.

The British royal family has wealth and receives income from several different sources, some with very long histories. This explainer sets out where the royal family gets its money and how much derives from the taxpayer, what power it has to spend it, and what other public costs or revenues are associated with the royals.

Where does the royal family receive its income from?

The royal family gets most of its funds from three different sources:

- Government funding: paid to the royal family each year through the Sovereign Grant, to support official royal duties such as royal visits.

- Private property owned by family members by virtue of their royal position: primarily two private collections of land and property – the Duchy of Lancaster and the Duchy of Cornwall – owned by the monarch and the monarch’s eldest child, respectively.

- Private wealth and investment income owned by family members personally: money or assets that members of the royal family inherited through historic family wealth rather than by virtue of their role, and the income received from investing that.

What government funding does the royal family receive?

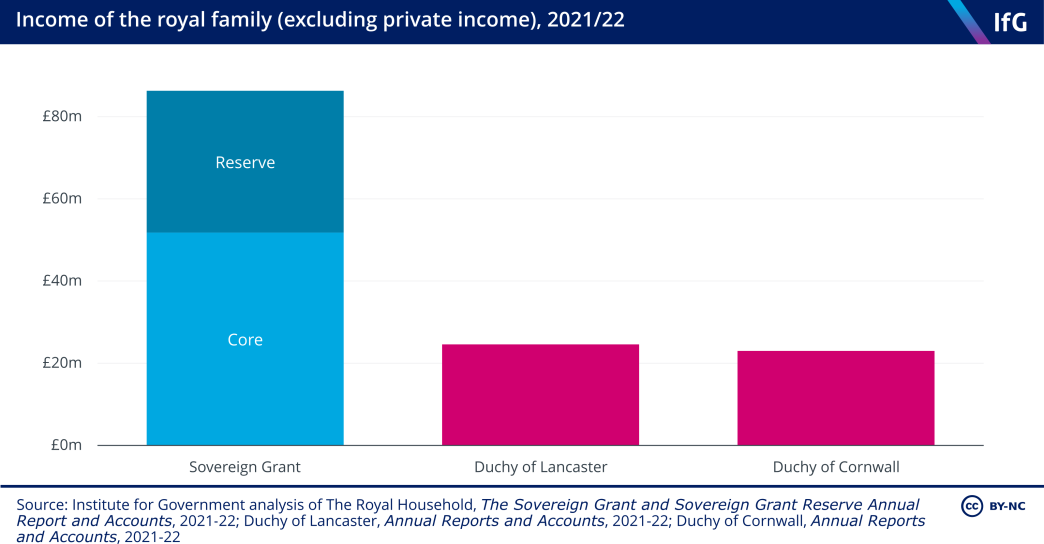

The reigning British monarch receives a sovereign grant from the government each year to support their official duties – such as receptions and garden parties – and to cover running costs – such as for royal travel and building maintenance. The monarchy received a sovereign grant of £86.3m in 2021/22, making it the largest declared source of royal income.

The grant is calculated as a proportion of profits from the ‘Crown Estate’, which is a holding of land and properties valued collectively at £15.6bn in 2022. The Crown Estate includes almost £8bn of properties in London, particularly the West End, as well as about half the land along the shoreline of England, Wales and Northern Ireland. It is owned by whoever is the British monarch at the time. 64 The Crown Estate, Integrated Annual Report and Accounts 2021/22, 15 June 2022, www.thecrownestate.co.uk/media/4123/the-crown-estate_annual-report_2021-22.pdf

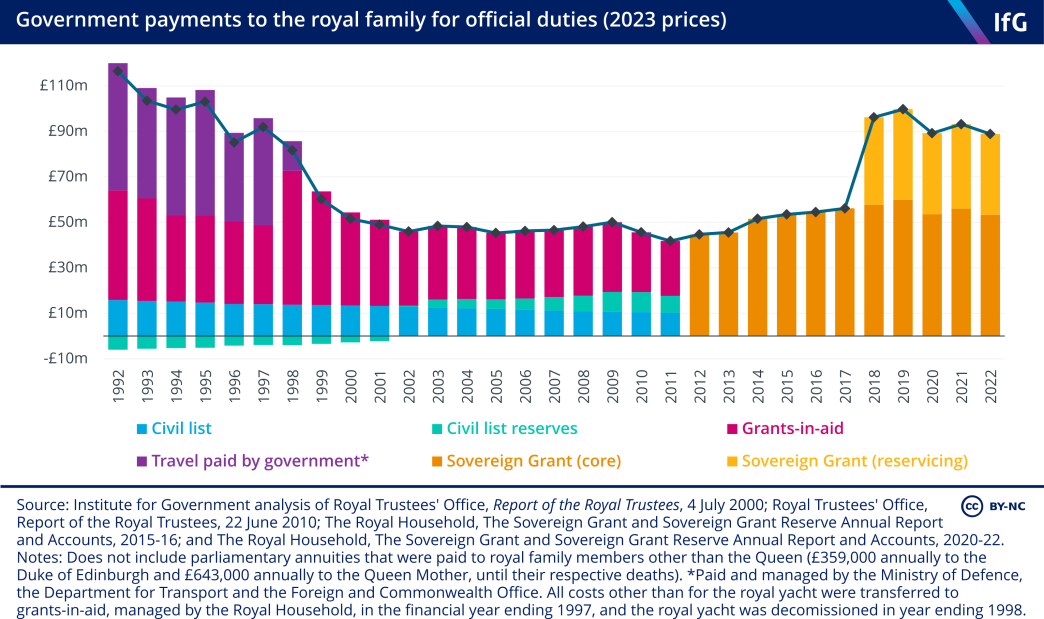

While the figure is reviewed every five years, the Sovereign Grant is normally calculated at 15% of the crown estate profits. But to support the refurbishment of Buckingham Palace, the grant was increased in 2017/18 to 25% of profits, with the intention of returning to 15% in 2027/28. 65 BBC, Queen to receive £6m pay increase from public funds, 27 June 2017, www.bbc.co.uk/news/uk-40412343 And if Crown Estate profits fall, the Treasury are also legally obliged to top up the grant to prevent a fall in value. This was the case in 2020. 66 Forrest A, Queen to receive government ‘bailout’ to top up income after Crown Estate hit by economic slump, The Independent, 24 September 2021, www.independent.co.uk/news/uk/politics/queen-bailout-coronavirus-sovereign-grant-royal-family-b572508.html On top of this income, the royal family also benefit from the Crown Estate by living rent-free in its properties.

How was the monarch’s income from the government determined in the past?

In the past, the entire profit of the Crown Estate was considered the property of the monarch, used in part to fund some of the civil service. 67 The Crown Estate, ‘Our history’, webpage, no date, www.thecrownestate.co.uk/en-gb/about-us/our-history But by 1760, profits had reduced over time and government was mainly funded from tax. George III then reached an agreement with parliament whereby the monarch would no longer be responsible for funding government, and Crown Estate administration and profits would be redirected to the Treasury. Since then, the Treasury has paid the royal family an annual income in return. 68 The Crown Estate, ‘FAQs’, webpage, no date, www.thecrownestate.co.uk/en-gb/resources/faqs/#:~:text=In%201760%2C%20George%20III%20reached,known%20as%20the%20Civil%20List; www.thecrownestate.co.u…

The income paid by government was originally determined by the ‘civil list’ (with the amount of money decided by the Treasury at regular intervals and voted on in parliament) alongside ‘grants-in-aid’, which were provided by government departments for particular purposes such as property maintenance (from the Department for Digital, Culture, Media and Sport and its predecessors) and travel (from the Department for Transport). When Queen Elizabeth II succeeded to the throne in 1952, the amount paid through the civil list was £475,000 (data on grants-in-aid are not available this far back). This is equivalent to £14m in 2021 prices, although it was fixed in cash terms for 20 years so it was only worth around £7m by 1971 when the cash amount was increased.

The model was reformed in 2012. The civil list and grants-in-aid were abolished and replaced by the Sovereign Grant, which is directly linked to Crown Estate profits.

What is the Sovereign Grant spent on?

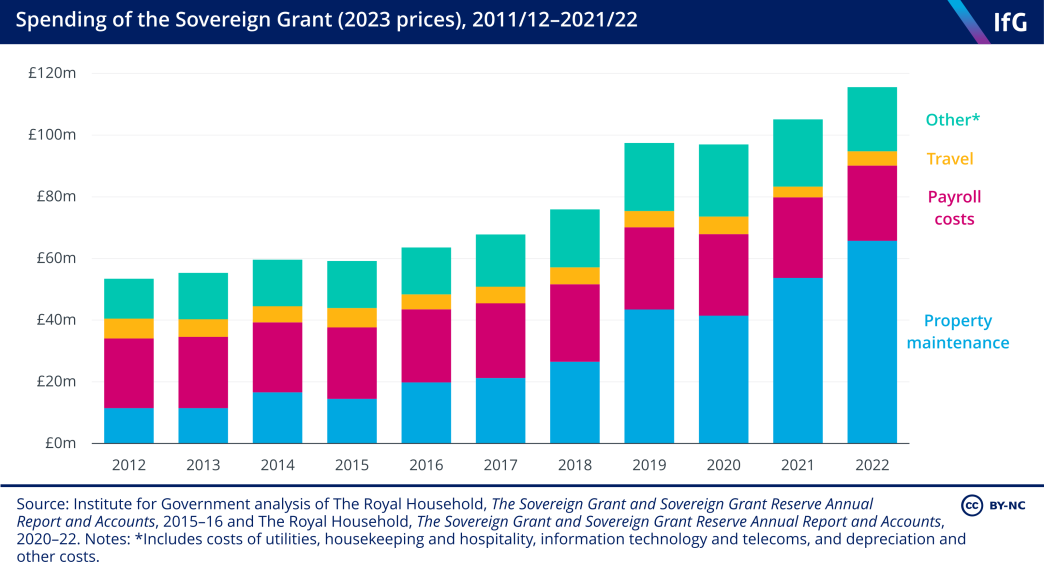

How the Sovereign Grant is spent is detailed in annual reports. It can only be spent on things needed for royal duties, with most spent on upkeep of properties and staff costs.

What funds do the royal family get from property owned by virtue of their position as royals?

While profits from the Crown Estate are paid to the government, the royals also own other property by virtue of their position as royals from which they receive the profits personally.

The duchies

The Duchy of Lancaster (formed in 1337) includes 18,000 hectares of rural land mainly in the north of England as well as various commercial and historic properties throughout England and Wales. It is worth £640m in total – generating around £40m per year in income 69 The Duchy of Lancaster, Report and Accounts 2023, www.duchyoflancaster.co.uk/wp-content/uploads/2023/07/DoL-2022-23-Annual-Report-and-Accounts.pdf – and owned by the reigning British monarch (currently King Charles III).

The Duchy of Cornwall (formed in 1265) includes 53,000 hectares of land primarily in south-west England. It is worth £1bn in total – generating around £25m per year in income 70 Duchy of Cornwall, Integrated Annual Report 2022, https://duchyofcornwall.org/assets/pdf/integrated-annual-reports/2022/duchy-of-cornwall-integrated-annual-report-2022-final.pdf – and owned by whoever holds the title of Duke of Cornwall (currently Prince William). The Duke of Cornwall is the eldest son of the reigning monarch or, if the monarch has no son, the monarch themself.

Royal family members personally keep profits from the duchies and can spend them as they wish. The way the money is spent is not public. However, while assets in the duchies can be sold, the royals are not entitled to any proceeds from capital sales, which much be reinvested in the estates. And although neither duchy is legally obliged to pay any tax, Queen Elizabeth II started voluntarily paying income tax on the profits of the Duchy of Lancaster in 1993, as did King Charles III on his Duchy of Cornwall estate.

Administration, management and investment decisions for the Duchy of Cornwall are led by the Duke of Cornwall, with advice from a council of officials. But the Treasury must approve all large property transactions to protect the long-term value of the estate.

In contrast, the Duchy of Lancaster is managed by the chancellor of the Duchy of Lancaster, a minister in the Cabinet Office without a fixed government role. But this position involves little practical involvement in the duchy – with its day-to-day activities led by a council of officials.

Both duchies must send annual accounts and reports to parliament. But as the income is treated as private income, what it is spent on is not made public.

Other property owned by virtue of royal positions

Alongside the duchies, the British monarch ‘in right of the Crown’ owns a set of royal palaces (not within the Crown Estate) and part of the Royal Collection of art, but they do not get income from these. Of the palaces, some are lived in by the royal family (e.g. Buckingham Palace) and so are managed and funded by the royal family itself. Others are now historic landmarks (e.g. the Tower of London) and are managed by Historic Royal Palaces, an independent charity contracted by the government.

The Royal Collection – one of the biggest art collections in the world – is managed by the Royal Collection Trust, a charity that reinvests any income received from ticket sales, gift purchases, or donations. Some of the collection is owned ‘in right of the Crown’, while other pieces are owned by Charles III personally.

While laws explicitly state that proceeds from sales of properties in the duchies must be reinvested, the issue is less clear for this other property owned ‘in right of the Crown’. Currently this is just a hypothetical debate because the King is unlikely to try to sell any of the palaces or works of art. But some argue the King does theoretically have the right to do this and take the proceeds 71 The Guardian, The convenient fiction of who owns priceless treasure, 30 May 2002, www.theguardian.com/uk/2002/may/30/jubilee.education; Hansard, Ethiopian Manuscripts, HC Deb 19 July 1995 vol 263, http://hansard.millbanksystems.com/written_answers/1995/jul/19/ethiopian-manuscripts#S6CV0263P2_19950719_CWA_1348 , while others disagree. 72 Hansard, Royal Finances, HC Deb 09 July 2002, vol 338, https://publications.parliament.uk/pa/cm200102/cmhansrd/vo020709/halltext/20709h03.htm

What wealth does the royal family own privately?

The family also has its own personal wealth – often inherited from family – and personal income generated from that. This includes privately owned properties (e.g. the Balmoral and Sandringham estates), art and jewellery collections, a stamp collection estimated to be worth over £100m 73 Pemberton B, ‘The Queen has a stamp collection worth a staggering £100MILLION… and she loves to show it off to visitors at Buckingham Palace’, The Sun, 17 September 2019, www.thesun.co.uk/fabulous/9940870/queen-stamp-collection-100million and private savings. The royals can invest or sell these to generate income, and are required to pay all usual taxes on them.

There is no duty on the royals to publish details on these funds.

What other public costs are associated with the royal family?

The Sovereign Grant is the main source of taxpayer funding for the royal family, but there are other public costs associated with their activities that are not covered by the grant. These include:

- Metropolitan police costs for events – with £3.5m spent on policing for the Duke and Duchess of Sussex’s wedding in 2018, 74 Thames Valley Police, ‘Policing the wedding of Their Royal Highnesses the Duke and Duchess of Sussex and the visit of The President of the United States’, blog, 23 November 2018, www.thamesvalley-pcc.gov.uk/news-and-events/thamesvalley-pcc-news/2018/11/policing-the-wedding and £6.3m for the Duke and Duchess of Cambridge’s in 2011. 75 ITV, William and Kate’s royal wedding cost police £6.3m, new figures reveal, 23 April 2018, www.itv.com/news/2018-04-23/william-and-kates-royal-wedding-cost-police-6-3m-new-figures-reveal During the diamond jubilee celebrations, 6,000 officers and 21 police boats were on duty for the busiest days but no cost estimate has been published. 76 King B, ‘Who pays for the Diamond Jubilee?’, Channel 4 News, 2 June 2012, www.channel4.com/news/who-pays-for-the-diamond-jubilee

- General security costs for the royal family – covering senior royals at all times (including global travel) and junior royals for official engagements. 77 Higham A, ‘Royal Family security: Which royals get protection - and who DOESN'T?’, Express, 20 March 2021, www.express.co.uk/news/royal/1408270/royal-family-security-which-royals-get-protection-meghan-markle-prince-harry-evg These costs are not discussed publicly by the royals or the police. Estimates range from several million to a hundred million pounds per year for the family. 78 Wood V, ‘How much would Harry and Meghan’s security detail cost?’, The Independent, 9 March 2021, www.independent.co.uk/news/uk/home-news/harry-meghan-security-cost-canada-b1814316.html; Duell M, ‘All the WORKING Royals who don't get full protection demanded by Harry and Meghan’, Mail Online, 10 March 2021, www.dailymail.co.uk/news/article-9346083/Meghan-Markle-interview-Members-Royal-Family-dont-police-protection.html; Hills M, ‘Who will be paying for Prince Harry and Meghan Markle's security costs now they've moved to LA?’, Evening Standard, 30 March 2020, www.standard.co.uk/insider/royals/prince-harry-meghan-markle-security-costs-who-will-be-paying-a4376191.html; Worrall P, ‘FactCheck Q&A: Does the monarchy pay for itself?’, 4News FactCheck, 1 June 2012, www.channel4.com/news/factcheck/factcheck-qa-does-the-monarchy-pay-for-itself

- Military procession costs – such as the military parades, RAF flypasts, and navy ship processions which occurred for the diamond and platinum jubilees. 79 King B, ‘Who pays for the Diamond Jubilee?’, Channel 4 News, 2 June 2012, www.channel4.com/news/who-pays-for-the-diamond-jubilee

- Local government logistical costs – including costs for councils during royal visits and to the Greater London Authority during royal events. Costs to local councils have been reported to be between £9,000 (in 2004 prices) 80 Colchester: Cost of royal visit is 'a modest £9,000', Daily Gazette/Essex County Standard, 26 November 2004, www.gazette-news.co.uk/news/5430437.colchester-cost-of-royal-visit-is-a-modest-9000/ and £58,000 (in 2007 prices) per visit. 81 Smith M, ‘Royal visit wipes out council reserves’, Daily Echo, 16 October 2007, www.dailyecho.co.uk/news/1763235.royal-visit-wipes-out-council-reserves; Worrall P, ‘FactCheck Q&A: Does the monarchy pay for itself?’, 4News FactCheck, 1 June 2012, www.channel4.com/news/factcheck/factcheck-qa-does-the-monarchy-pay-for-itself The Greater London Authority budgeted £2m for screens, road closures, and signage for the 2012 diamond jubilee. 82 King B, ‘Who pays for the Diamond Jubilee?’, Channel 4 News, 2 June 2012, www.channel4.com/news/who-pays-for-the-diamond-jubilee

However, none of the figures above are official cost estimates and the true cost is highly uncertain.

What business does the royal family generate for the UK?

This explainer has detailed some costs to the public purse from the royal family. However, the royal family may also generate economic benefits. As with the costs in the previous section, any estimate of the size of these benefits is highly uncertain. They include:

- Royal-themed products – such as memorabilia, royal-themed food, copycat royal clothes and other goods (estimated by some as worth tens of millions of pounds 83 Prynn J, ‘Royal baby news: Duke and Duchess of Cambridge's third child could give UK economy huge £87m boost’, Evening Standard, 24 April 2018, www.standard.co.uk/news/uk/duke-and-duchess-of-cambridge-s-third-child-could-boost-give-uk-huge-ps87m-boost-a3822021.html ), as well as TV shows such as The Crown.

- Tourism – as seen, for example, with the 28% increase in Eurostar train bookings to the UK before the Duke and Duchess of Cambridge’s royal wedding. Tourists then spend money with UK businesses.

- Trade – with the royal brand supporting UK products both directly – through royal warrants (trademarks granted by the royal family) – and indirectly – supporting a brand of ‘Britishness’, for which the royal family sometimes functions as ambassadors by attending industry events internationally. 84 Brand Finance, Monarchy 2017, 29 November 2017, https://brandirectory.com/download-report/bf_monarchy_report_2017.pdf

- Keywords

- Constitutional reform Public spending Tax

- Institution

- Monarchy

- Public figures

- King Charles III

- Publisher

- Institute for Government