Local government section 114 (bankruptcy) notices

What is a section 114 notice, and why have councils been issuing more of them recently?

What does it mean when a local authority goes “bankrupt”?

Local authorities cannot actually go “bankrupt” in the way that a company or an individual can. Instead, they issue what is known as a section 114 notice. This is a report from the council’s finance officer that they believe that the authority is about to incur expenditure that is unlawful according to the Local Government Finance Act 1988.

24

https://www.legislation.gov.uk/ukpga/1988/41/section/114

Expenditure can be unlawful for various reasons. But the primary reason why most authorities issue a section 114 notice is because they expect their expenditure to exceed their income for a particular financial year – which is not permitted under the 1988 Act.

What happens after an authority issues a section 114 notice?

Once a finance officer issues a section 114 notice, the authority may not incur new spending unless the finance officer permits it to do so. After that, council leadership must meet within 21 days to discuss how to bring their expenditure in line with funding. Elected members and officers, as well as central government, will examine options to balance their budget for the year. During this time, residents are unlikely to notice any difference in their neighbourhood services or council activity.

Options the council might pursue include:

Spending cuts

Local authorities will look for savings from the various services they provide. However their options are limited because they have statutory (legal) responsibilities to provide certain services, such as social care – though it is often difficult to determine the minimum level of service provision required. Some local authorities have argued that central government should reduce their statutory duties to relieve pressure on their finances. 25 https://dmscdn.vuelio.co.uk/publicitem/6aa6294c-8f7d-4e4b-8f69-b52454788db6

Reallocating budgets

Councils have two budgets. Capital budgets include money with which to buy, construct or improve physical property like buildings, street lights, IT systems and the like. 26 https://www.gov.uk/government/statistics/local-authority-capital-expenditure-and-receipts-in-england-2021-to-2022-final-outturn/local-authority-capit… Resource budgets fund day-to-day service spending. The two are supposed to remain separate – but central government can grant a ‘capitalisation direction’ to allow a local authority to use its existing capital budgets to cover day-to-day spending. This is often the response to a section 114 notice.

Capitalisation directions also allow councils to use assets sales, usually to be returned to their capital budgets, to fund day-to-day costs. However one danger with doing this is that it can only be done once, while demand for an authority’s services is indefinite, and so this approach often does not solve underlying issues.

Council tax rises

The government limits the amount that local authorities can raise council tax by in any one year without triggering a referendum among residents. For 2023/24, the limit is 5% for authorities with responsibility for social care. But the government has allowed some local authorities that have issued section 114 notices the power to raise council tax above that limit. In 2023/24, the government allowed Croydon

27

https://www.bbc.co.uk/news/uk-england-london-64892461

to raise its rates to 15%, and Thurrock

28

https://www.bbc.co.uk/news/uk-england-essex-64741541

and Slough

29

https://www.lgcplus.com/finance/slough-agrees-9-99-council-tax-increase-13-03-2023/

to 10%.

Central government intervention

If the government feels that a local authority is not meeting its ‘best value duty’ 30 https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/5945/1976926.pdf , p.6 it can intervene in its management. (This can happen without a section 114, but is a common outcome of a notice).

This intervention can come in the form of either direct instructions to make certain changes, or with the appointment of ‘commissioners’ to take over some or all operations. When the government appoints a commissioner, the officers and members of the council are then accountable to them for the period of their time in the authority.

Direct support (“bailouts”)

If the government chose to, it could provide local authorities with funding to cover their in-year deficits or to repay some of their loans. But this is rare. The government is reluctant to be seen to underwrite local authority finances, in case it encourages risky behaviour in others.

How common is it for a local authority to issue a section 114 notice?

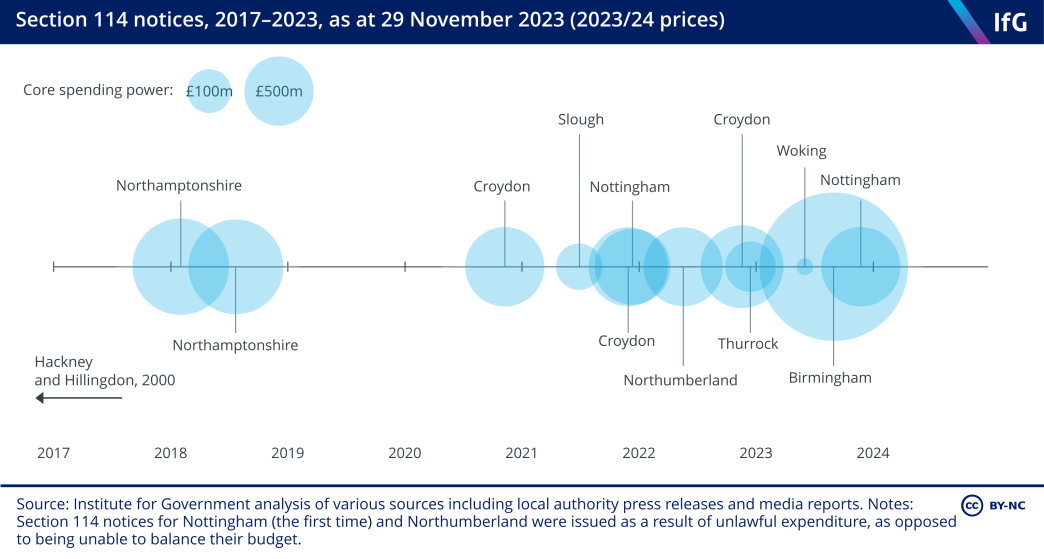

Fourteen councils have issued section 114 notices since the Local Government Finance Act 1988 became law. Hillingdon and Hackney councils were the first and second to do so, in 2000.

After Hillingdon and Hackney there were no section 114 notices until 2018, when Northamptonshire issued two. There have been a string of section 114s since, including Croydon issuing three separate notices. With the exception of Nottingham (for its first section 114 notice) and Northumberland – whose section 114 notices related to illegally incurred expenses – all have been because an authority has not been able to balance its books. On 29 November 2023 Nottingham became the latest authority to issue a section 114, its second in two years. Nottingham issued its most recent section 114 because it could not balance its budget in 2023/24. 32 https://www.nottinghamcity.gov.uk/media/jmzb22b0/report-made-under-part-viii-s114-3-of-the-local-government-finance-act-1988-291123.pdf

There is no correlation between the party that has political control of an authority and the likelihood of issuing a section 114 notice.

Why are councils issuing section 114 notices more frequently?

Each local authority that has issued a section 114 notice has done so due to some degree of financial mismanagement. But the context in which this has occurred, and the incentives that authorities were responding to, is important. In the first half of the 2010s the coalition government imposed sharp cuts on local authorities: between 2009/10 and 2021/22, funding for local authorities in England fell by 10.2% in real terms.

In the same time demand for services – particularly children’s and adult social care – increased substantially. And, more recently, the cost of providing services has risen markedly too, especially during the current bout of inflation.

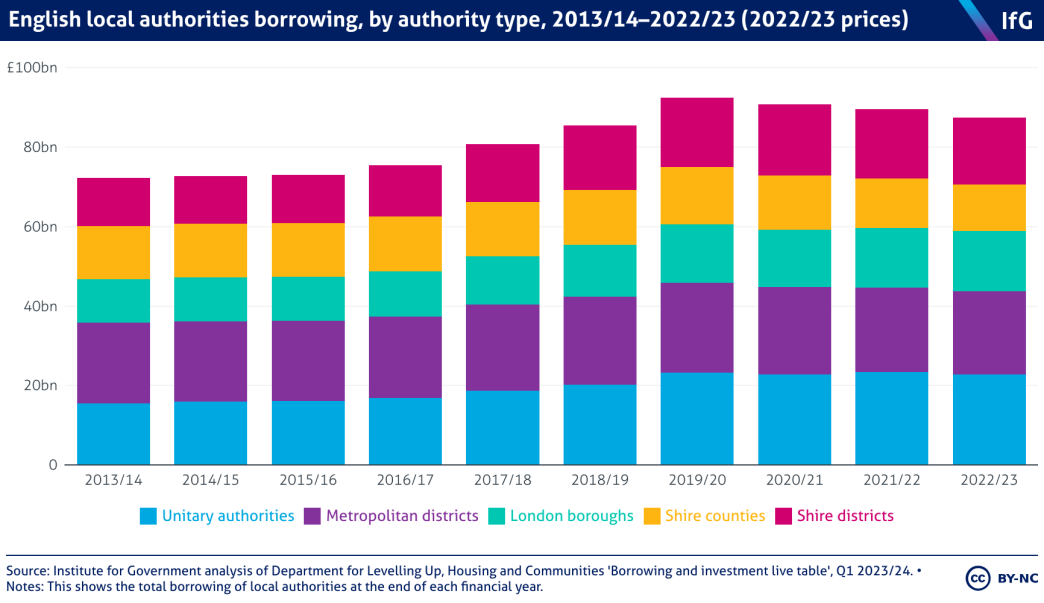

In response to these financial pressures, local authorities looked to other sources of income. Some opted to borrow large sums to invest in assets that generate income, such as commercial property. undefined https://www.nao.org.uk/wp-content/uploads/2021/11/The-local-government-finance-system-in-England-overview-and-challenges.pdf , p.33 Rising interest rates have made it more difficult for local authorities to service their debt, contributing to lower financial resilience.

Finally, the Public Accounts Committee has reported an “unacceptably high backlog in local government audit”.

undefined

https://www.nao.org.uk/wp-content/uploads/2021/11/The-local-government-finance-system-in-England-overview-and-challenges.pdf , p.33

While improved audit almost certainly would not have prevented most authorities from issuing section 114 notices, it could have shed light on risks in some councils’ finances.

Will more local authorities issue section 114 notices?

Quite possibly. There are several authorities who have recently warned that they are at risk of doing so. Last year, Kent and Hampshire county councils warned that they may issue section 114 notices due to rising demand and cost pressures and insufficient funding. undefined https://www.nao.org.uk/wp-content/uploads/2021/11/The-local-government-finance-system-in-England-overview-and-challenges.pdf , p.33 SIGOMA – a representative body for 47 municipal authorities – published a survey which showed that five of their members were at risk this year, with a further nine likely to join them in 2024/25. undefined https://www.nao.org.uk/wp-content/uploads/2021/11/The-local-government-finance-system-in-England-overview-and-challenges.pdf , p.33 Coventry, undefined https://www.nao.org.uk/wp-content/uploads/2021/11/The-local-government-finance-system-in-England-overview-and-challenges.pdf , p.33 Somerset, undefined https://www.nao.org.uk/wp-content/uploads/2021/11/The-local-government-finance-system-in-England-overview-and-challenges.pdf , p.33 Guildford, undefined https://www.nao.org.uk/wp-content/uploads/2021/11/The-local-government-finance-system-in-England-overview-and-challenges.pdf , p.33 Kirklees, undefined https://www.nao.org.uk/wp-content/uploads/2021/11/The-local-government-finance-system-in-England-overview-and-challenges.pdf , p.33 and Southampton undefined https://www.nao.org.uk/wp-content/uploads/2021/11/The-local-government-finance-system-in-England-overview-and-challenges.pdf , p.33 – among others – have all warned that they may have to issue a section 114.

- Publisher

- Institute for Government