The history of HM Treasury

When was the Treasury created and how has its role changed over time?

When was the Treasury created?

The UK Treasury’s history dates back almost a thousand years. Its functions have evolved over this time, reflecting changes in the economy, society and the role of government.

Its origins are ‘as mysterious as the migration of eels’, 23 Henry Roseveare, The Treasury, 1969, p. 20. but it can be traced back to one ‘Henry the Treasurer’ who served under William the Conqueror. 24 Henry Roseveare, The Treasury, 1969, p. 20. The Exchequer was established later in the 12th century to oversee royal income and expenditure, with the chancellor of the exchequer a royal official responsible for this duty. Former Treasury officials recall a course which dates the origins of “Treasury control” of spending with the creation of the Treasury Commission in the 17th century, following the (financial) disaster of the Dutch Raid on the Medway – the culmination of the second Dutch War of 1667.

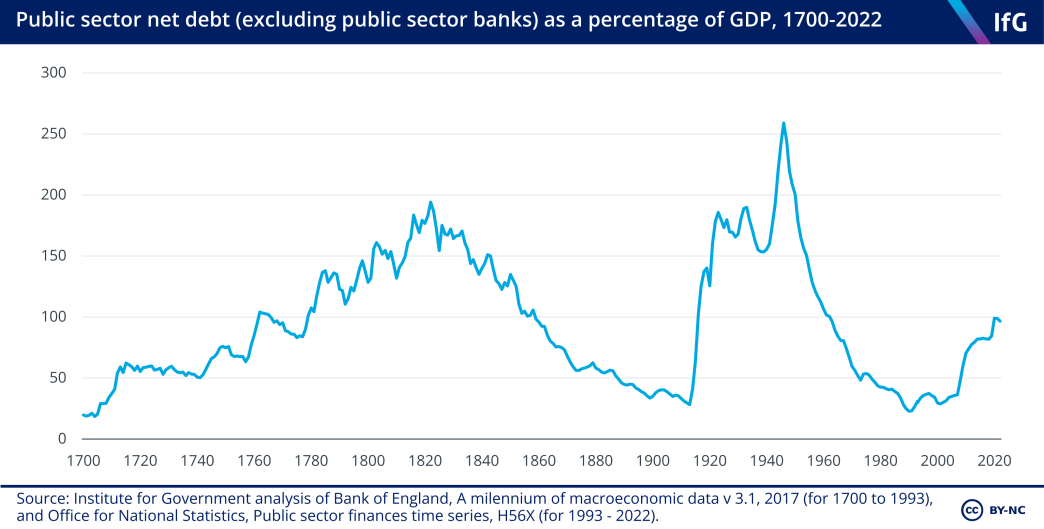

During the 18th and 19th centuries the Treasury's role evolved to include more complex tasks, including the management of public debt, which grew significantly due to wars and colonial expansion. The Treasury also started to oversee tax policy, which became increasingly important as a source of government revenue.

How did the Treasury's role change in the 20th century?

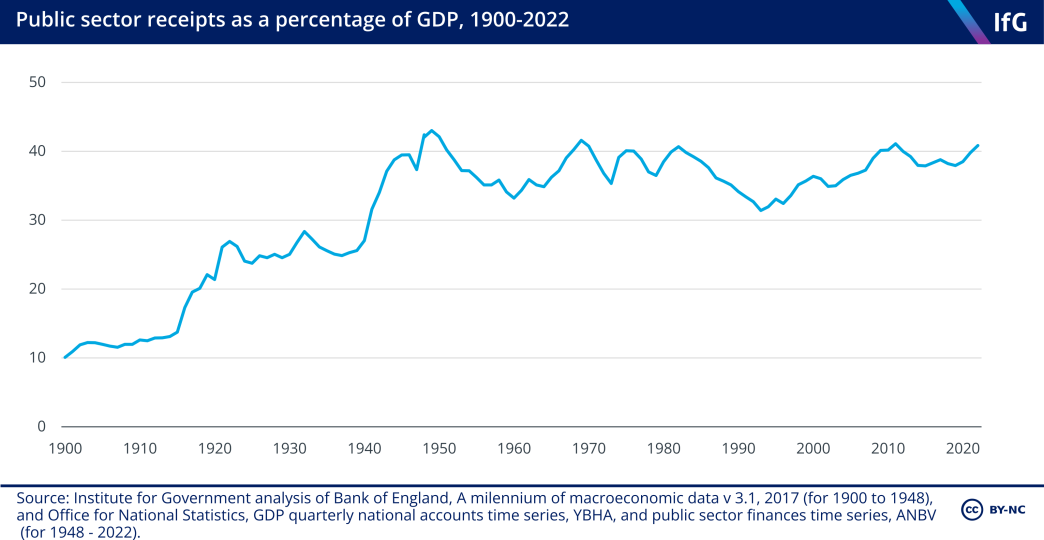

The Treasury’s evolution was accelerated by the economic upheaval caused by the First World War and its aftermath, which saw the financial footprint of the state rise sharply and only decline a little before the Second World War heralded another surge. During this time the department also began to play a key role in macroeconomic management, including monetary and fiscal policy. With the Treasury firmly in control of the public purse strings, the British state expanded to a size it had never seen before.

Central to this was the Treasury’s close involvement in managing the UK's massive post-war debt and implementing the government's economic planning efforts. The Keynesian consensus in favour of active economic management led to the Treasury deploying fiscal and monetary policy much more vigorously, 33 Though it should be observed that interest rates often went many years little changed speeding up or slowing the economy through various fiscal levers (though, interestingly in the context of 2022-23, often leaving interest rates unchanged for years) in response to currency constraints on the one side and the demands of politics on the other. 34 The best narrative description of this system in action can be found in Brittain S, Steering the Economy, Penguin Books, 1971

The UK’s serious bouts of inflation in the 1970s contributed to a shift in policy-making towards monetarism, leading to far higher interest rates and a deep recession. The Conservative governments of 1979 onwards also prioritised market-based reforms that reduced the direct role of the state in the economy, including the flagship policy of privatising hitherto nationalised industries – a policy the Treasury played a key role in devising. This approach was largely adhered to by the Labour government that followed. 35 Blair T, speech to the annual meeting of the World Economic Forum, Davos, 28 January 2000. The Treasury's role in public expenditure management evolved during this period too, with multi-year spending reviews, accompanied by public service agreements. 36 Balls E, ‘The Political Economy of Public Spending Reviews: The UK Experience Since 1997’, M-RCBG Associate Working Paper Series No. 113, Harvard Kennedy School, April 2019, www.hks.harvard.edu/sites/default/files/centers/mrcbg/files/113_final_V2.pdf

It took a while for the UK government to settle on an enduring macroeconomic ‘method’, which it eventually found in the form of inflation targeting, pursued by an operationally independent central bank, from 1998 onwards. The Bank of England gained more responsibility for operational management of monetary policy, with only occasional assistance from the Treasury’s tax and spend powers during emergencies such as the 2008 financial crisis.

By the end of the 20th century, the Treasury had completed its evolution into the shape it takes today. The state now takes over 40% of GDP through taxation and other revenues, up from 10% at the start of the 20th century.

The biggest reform of the Conservative-led coalition government that followed was to establish the Office for Budget Responsibility in 2010 to provide independent forecasts for the economy and tax revenues; 37 Pope T, Hourston P and Coggins M, ‘Office for Budget Responsibility (OBR)’, Institute for Government, 28 October 2022, www.instituteforgovernment.org.uk/explainer/office-budget-responsibility-obr 38 HM Treasury, Charter for Budget Responsibility: Autumn 2020, January 2023, assets.publishing.service.gov.uk/media/63d15c6cd3bf7f3c4900f11a/Charter_for_Budget_Responsibility_-_AS22_-_FINAL_as_published_in_draft.pdf a reform motivated by a desire to increase the credibility of fiscal forecasts by reducing the potential for “politically motivated wishful thinking”. 39 Organisation for Economic Cooperation and Development, OECD Independent Fiscal Institutions Review: Office for Budget Responsibility (OBR) of the United Kingdom, September 2020, www.oecd.org/gov/budgeting/review-of-the-office-for-budget-responsibility-obr-of-the-united-kingdom.htm

What are the Treasury’s functions and responsibilities?

Throughout all this evolution, the Treasury has continued to hold the primary responsibility for managing the government's finances and supporting the stability and health of the economy (except for a short, contested period in 1964–47 when the Department for Economic Affairs attempted to take some ground). Its functions now include economic policy, fiscal policy, monetary policy (albeit with the Bank of England in operational control), public expenditure, public revenue, financial regulation, international finance and financial services policy.

The Treasury’s latest publicly available strategy, its ‘Outcome Delivery Plan’, notes the department also has a role to play in other priorities across government. These include the economic recovery from the pandemic, attempts to reduce poverty and increase entry into the workforce, and efforts to meet the UK’s net zero targets.

40

Reflected also in the Treasury’s 2021 net zero review.

- Topic

- Public finances

- Keywords

- Economy Public spending Budget Tax Public sector

- Position

- Chancellor of the exchequer

- Department

- HM Treasury

- Publisher

- Institute for Government