Scottish government 2023/24 budget

The Scottish government’s annual budget allocates devolved spending in Scotland for the next financial year and sets some tax rates.

The Scottish government’s annual budget allocates devolved spending in Scotland for the next financial year and sets some tax rates. Deputy first minister John Swinney announced the budget for 2023/24 on 15 December 2022.

What is the outlook for the Scottish economy?

Scottish Fiscal Commission (SFC) forecasts accompany Scottish budgets, outlining Scotland’s expected future economic performance. Its December forecasts for 2023/24 largely mirror the UK-wide forecasts produced by the Office for Budget Responsibility (OBR) published ahead of the chancellor’s autumn statement.

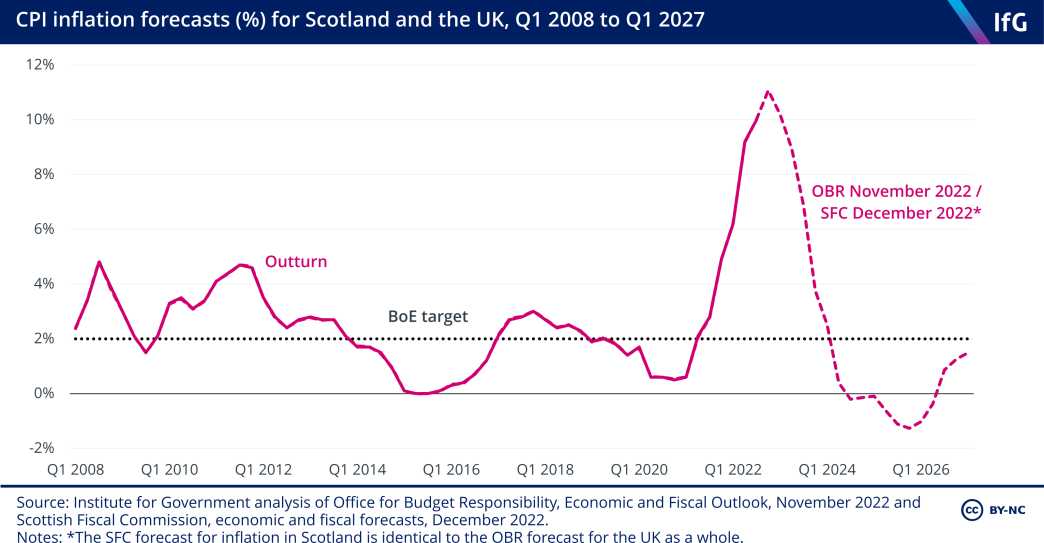

The SFC’s inflation forecast for Scotland is the same as the OBR’s for the UK as a whole. It projects inflation will fall from 8.9% to 2.5% in 2023/24, before turning negative in 2024/25.

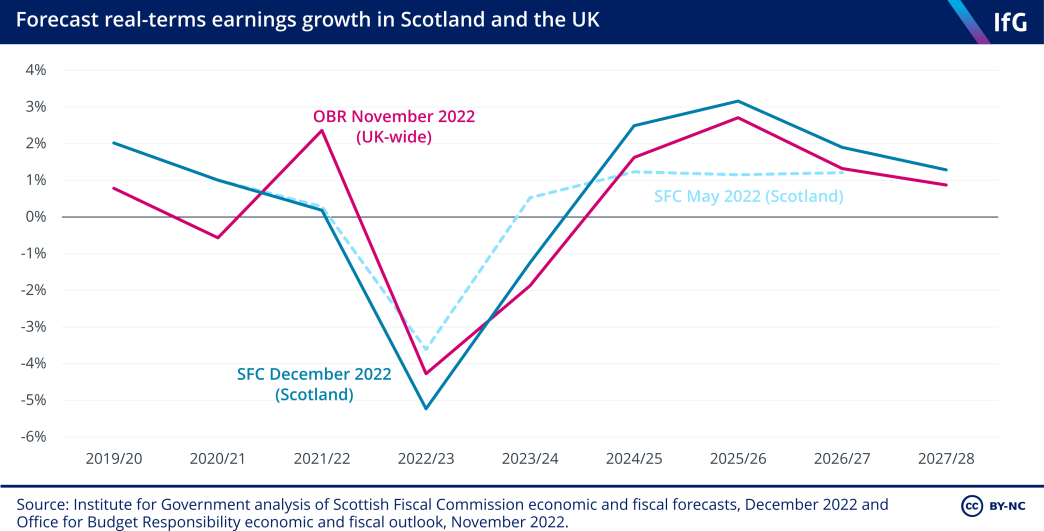

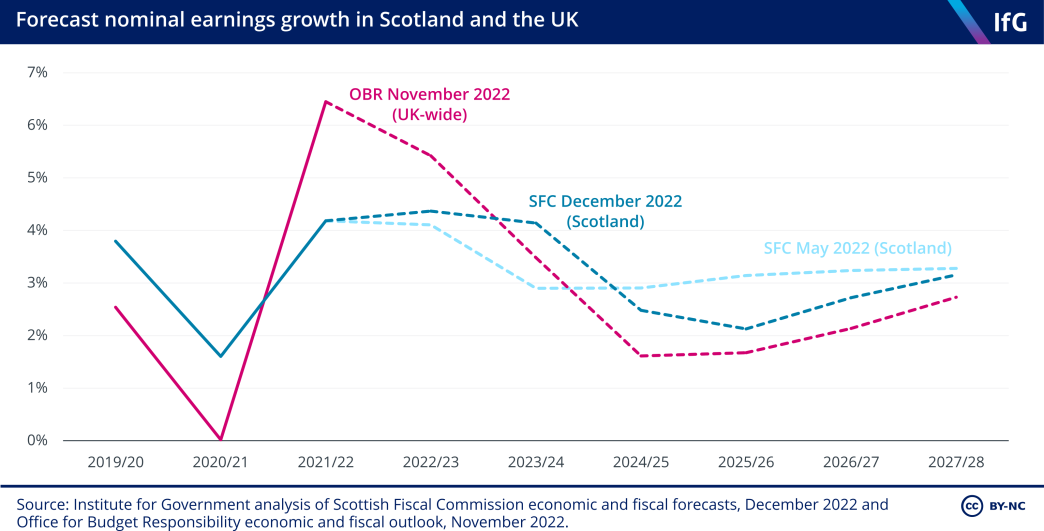

The SFC expects the fall in real-terms earnings in Scotland to be more severe in 2022/23, but to perform better than the rest of the UK from 2023/24. Real-terms earnings are forecast to fall by 5.2% in Scotland in 2022/23, compared to the OBR forecast of 4.3%. They are expected to rise again from 2024/25, but are not expected to be higher than 2016 levels until at least 2026/27.

What is forecast revenue in 2023/24?

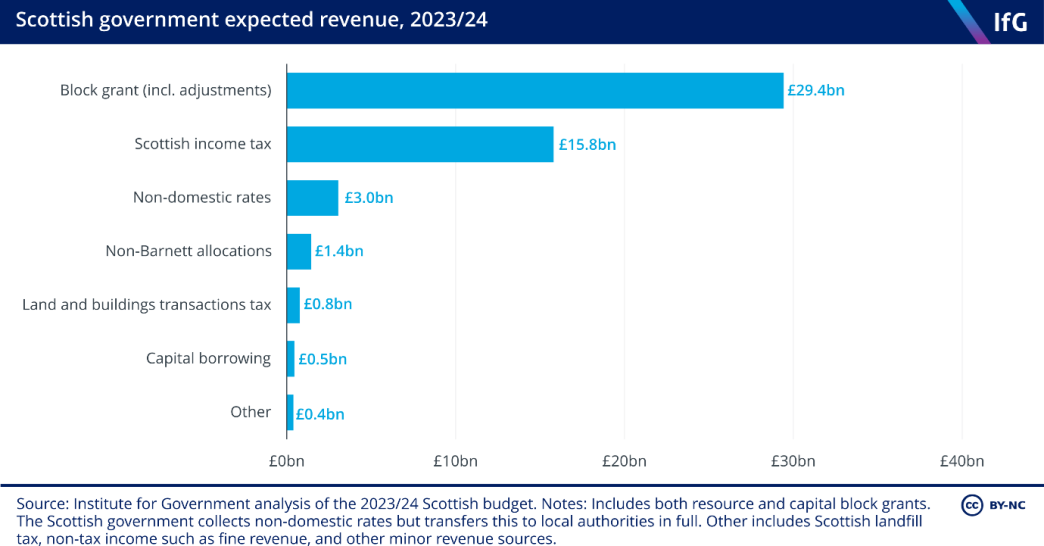

In the 2023/24 budget, total Scottish government revenue is projected to be £54.1bn. Real-terms revenue is similar to 2022/23 (including in-year revenue changes, such as additional Barnett consequentials). The block grant from the UK government (after adjustments) is £29.4bn, or 54% of forecast revenue. Including non-Barnett allocations it rises to £30.4bn, or 60%.

Devolved income and property transaction taxes are expected to raise £19.6bn or 38%, with £15.8bn from income tax. Capital borrowing is expected to account for just £450m (1%). Other minor revenue sources, such as landfill tax and income from fines, account for the remainder.

How has the Scottish government used its tax powers in this budget?

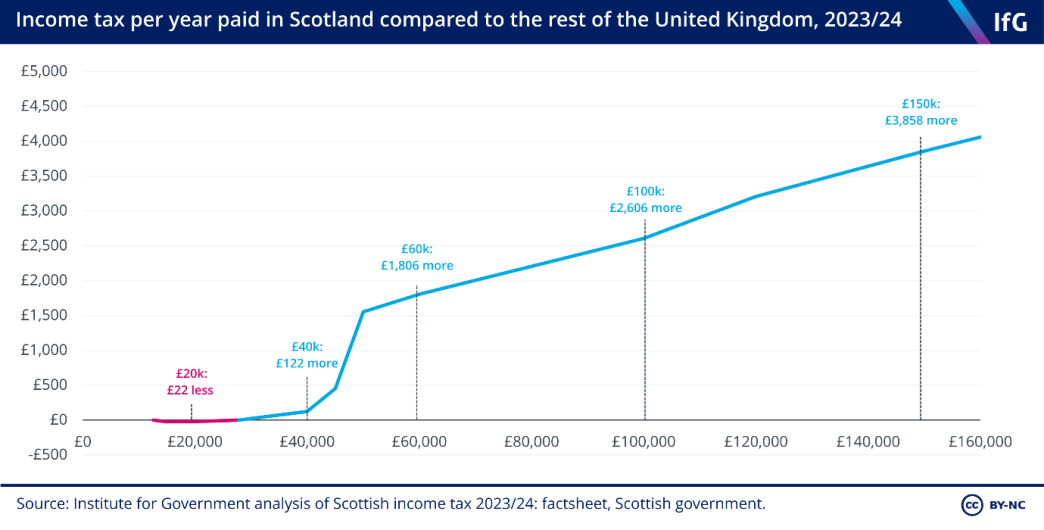

Swinney announced a rise in income tax for wealthier Scots, increasing the ‘higher’ and ‘top’ rates of tax from 41% to 42%, and 46% to 47%, respectively. This continues SNP policy of divergence in income tax rates from those set by the UK government. The equivalent rates elsewhere in the UK are 40% and 45% (the higher rate is also applied at a lower level of income in Scotland thanks to repeated freezing of the higher rate threshold).

The Scottish government followed the announcement made by chancellor Jeremy Hunt in the autumn statement by reducing the additional rate threshold from £150,000 to £125,140.

Thresholds for the other rates were also frozen at their current levels. The 19% ‘starter rate’ is paid on earnings between the centrally set personal allowance of £12,570 and £14,732, the 20% ‘basic rate’ between £14,733 and £25,688, and the 21% ‘intermediate rate’ between £25,689 and £43,662. In the rest of the UK, the 20% basic rate applies on earnings between £12,570 and £50,270.

Higher earners consequently pay more income tax in Scotland than the rest of the UK. From April 2023, people earning £50k and £150k will pay £1,522 and £3,858 more respectively.

The SFC forecasts that the new 42% and 47% rates will raise an additional £129m in 2023/24. Overall income tax receipts are expected to increase by £830m by 2027/28 compared to its May 2022 forecast – increasing the spending power of the Scottish government. This is largely due to ‘fiscal drag’: high inflation has led to higher than expected nominal earnings growth (as employers offer pay rises to respond to, if not match, current inflation rates), meaning that more people will be ‘dragged’ into higher and additional rate bands – frozen centrally and in Scotland – even if their real earnings fall or remain static.

Land and buildings transaction tax (LBTT, equivalent to stamp duty) will also be maintained at the current rates of 2% for purchases between £145k and £250k, 5% between £250k and £325k, 10% between £325k and £750k, and 12% over £750k.

This is much higher than the equivalent taxes in the rest of the UK. Tax on a £200k property purchase (the average house price in Scotland) is £1,100 higher than in the other UK nations, with the differences increasing for higher value properties.

The supplement charged for second home purchases will increase from 4% to 6%. However, despite this the SFC expects an overall drop of £47m in LBTT compared to its May 2022 forecast. This is because interest rate rises and the wider economic downturn are expected to reduce house prices and the number of transactions.

No major changes were announced for non-domestic rates or council tax. Although local authorities are able to increase council tax if they see fit, Swinney said he encourages councils to “consider carefully the cost pressures facing the public”.

Where has the Scottish government prioritised spending?

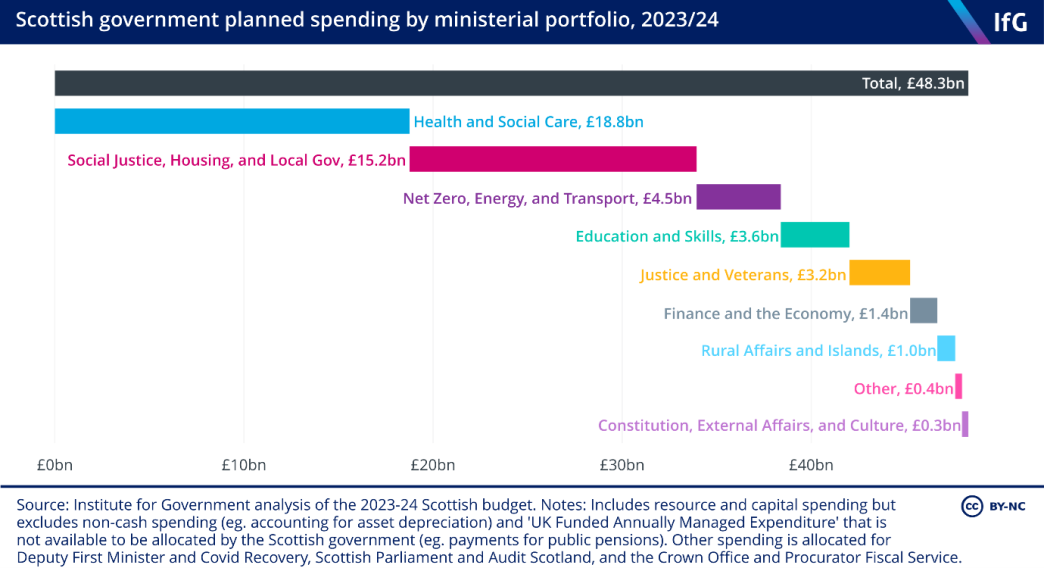

Over two thirds of Scottish government spending is allocated to two ministerial portfolios. The health and social care portfolio makes up 39%, at £18.8bn; the social justice, housing, and local government portfolio accounts for 32%, at £15.2bn.

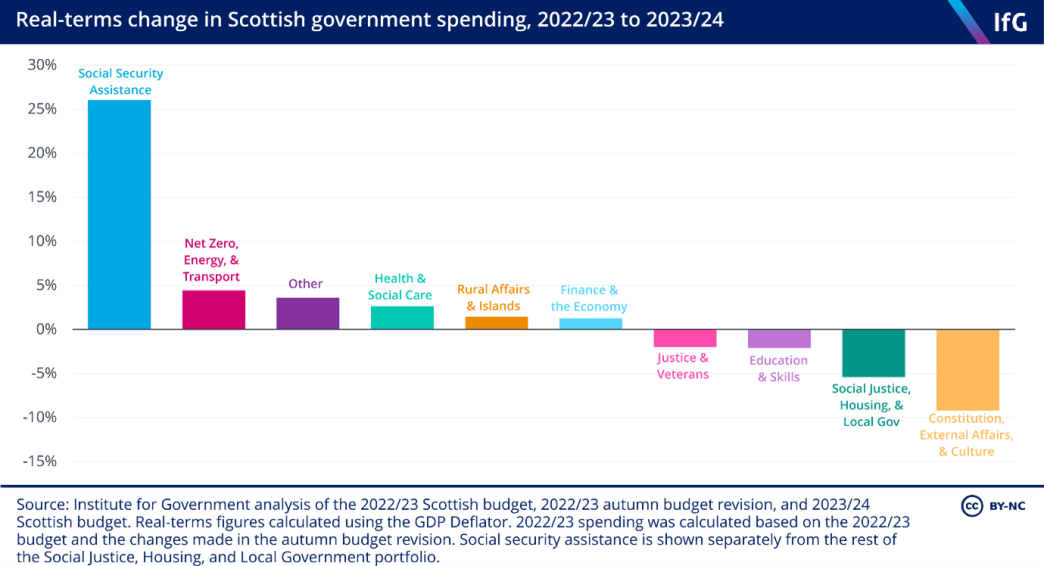

The Scottish government has prioritised spending increases for the NHS and expanding eligibility for and the level of social security payments. The SFC projects that social security spending will increase by 5.5% in 2023/24, due to expanded eligibility and the up-rating of Scottish government benefits in-line with CPI inflation.

In the medium term, social security spending will take up a larger proportion of the Scottish government’s overall budget. The UK government adjusts the Barnett formula allocation to fund social security provision in Scotland at UK rates, but the Scottish government has widened the scope of existing payments and introduced additional payments, such as the Scottish Child Payment. In total, the SFC expect more than £6.5bn to be spent on social security in 2027/28 in real terms, compared to £4bn in 2023/24.

Spending on the rest of the social justice, housing, and local government portfolio is expected to fall in real terms. The constitution, external affairs, and culture portfolio will also fall sharply, driven partly by a reallocation of £20m previously allocated for a 2023 independence referendum.

- Topic

- Devolution Public finances

- Keywords

- Economy Spending review Tax Welfare

- United Kingdom

- Scotland

- Political party

- Scottish National Party

- Position

- Scottish cabinet secretary

- Devolved administration

- Scottish government

- Legislature

- Scottish parliament

- Publisher

- Institute for Government