Financing infrastructure

Financing is distinct from funding, and there are two broad ways to this applies to infrastructure.

What does 'financing' infrastructure mean?

Financing is how you pay upfront for infrastructure. In this context, it refers to how governments or private companies that own infrastructure find the money to meet the upfront costs of building it.

Financing is distinct from funding infrastructure: funding is how taxpayers, consumers or others ultimately pay for infrastructure, including paying back the finance from whichever source government or private owners choose.

There are two broad ways to finance infrastructure – publicly or privately. But these work differently for infrastructure that is publicly owned (flood defences, the rail network), compared to privately-owned infrastructure (communications and utilities). Not all privately-financed infrastructure is privately owned since publicly-owned infrastructure can be privately financed as well.

What are the options for financing publicly-owned infrastructure?

1. Public finance

Public finance for infrastructure comes from a variety of sources, principally taxation but also public borrowing. Although there are sometimes calls, including from the Opposition, to borrow specifically to invest in infrastructure, governments do not borrow to raise money for specific projects, but rather to allow more public spending.

Public finance for infrastructure projects will appear on the public sector balance sheet in measures of public sector net debt.

2. Private finance

Private financing for public infrastructure projects involves government borrowing money from private investors to pay for specific projects.

This is typically done through project finance where a project-specific company is set up to deliver a particular infrastructure project. That company then borrows the money and contracts typically transfer responsibility for designing, building, operating and maintaining an asset to these companies in which investors have managerial responsibilities.

A well known form of project finance was the ‘Private Finance Initiative’ (PFI) – sometimes referred to as public-private partnerships (PPPs).

A variety of investors provide private finance, including banks, insurers, pension funds and private equity firms. Investments by banks declined after the financial crisis, but institutional investors such as insurers and pension funds have become more interested in financing infrastructure projects.

The types of investors who will be willing to finance a project depends on the amount of risk involved, as indicated in the table below:

What are the options for financing privately owned infrastructure?

In England, communications and utilities infrastructure (e.g. water, gas and electricity) are privatised.

In theory, the same two options – public or private finance – should be available. But, in practice, privately-owned infrastructure is almost exclusively privately financed through project finance, as described above, or corporate finance.

Corporate finance involves existing companies (rather than a project-specific companies) borrowing money on their balance sheets, as regulated water companies do.

However, governments can offer financial support for specific projects with funding injections and guarantees. In return for a fee, government guarantees the transfer of project risks from private owners to the Government. They do this by promising the investors that they will be repaid even if the project company which owns the asset is unable to make repayments.

This support can help stimulate private investment, especially in riskier projects where private investors may not be able to mitigate or insure themselves against specific risks.

How does the UK currently finance infrastructure?

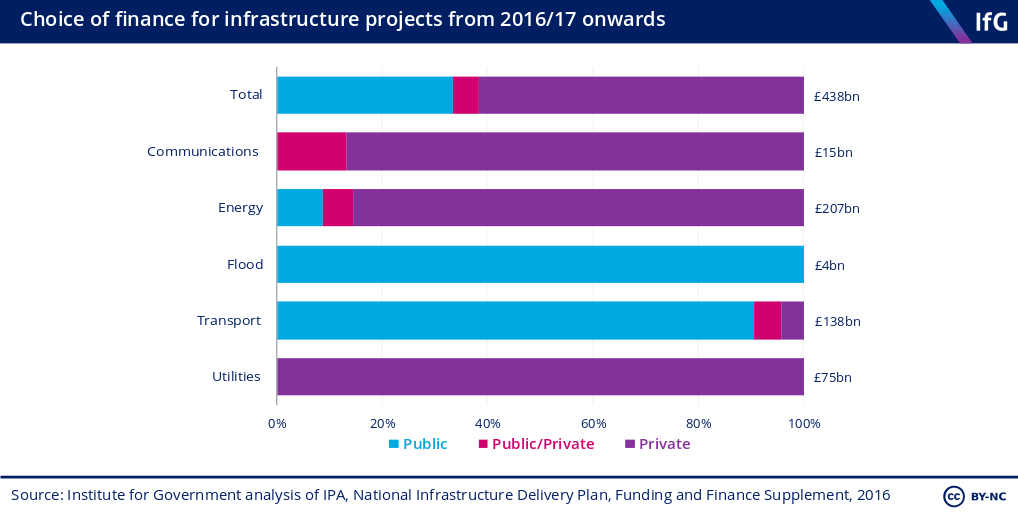

Publicly-owned infrastructure generally uses public finance and privately-owned infrastructure generally uses private finance. There are exceptions: in energy, nuclear decommissioning is publicly financed, for example. On occasions, a mixture of public and private finance is used for a project.

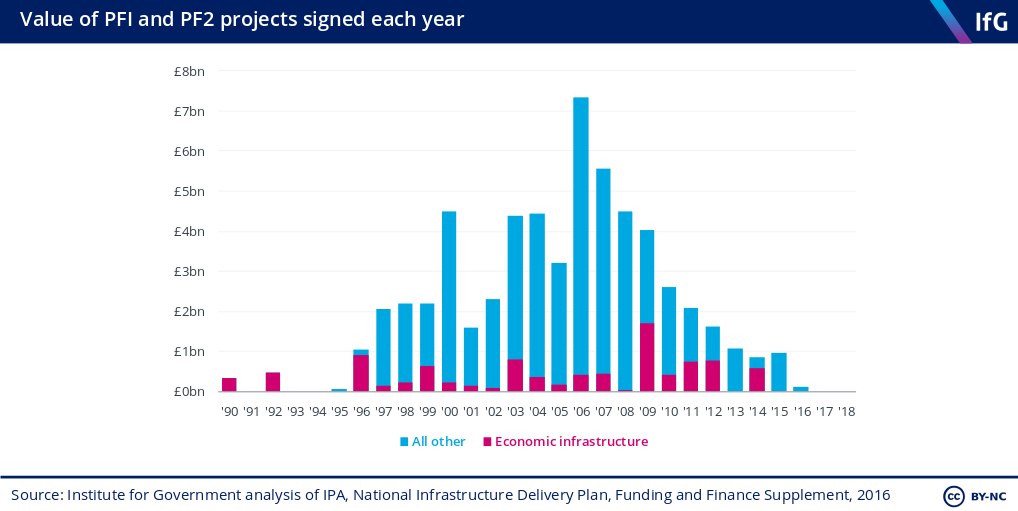

Historically, a particular form of private finance contract known as the Private Finance Initiative (PFI) was the most common way to privately finance public assets. By 2010, the use of PFI had declined significantly due to both the financial crisis and controversy over the cost of the deals. In 2012, the Government launched Private Finance 2 (PF2), in a renewed attempt to stimulate private finance, though it has only been used to finance six projects.

The latest Treasury estimates show that PFI and PF2 delivered 717 projects across government between 1990 and 2016 with a total capital value of £59.5bn.

In the 2018 Budget, the Chancellor announced that the Government will not use PF2 to finance projects in future. But the Government will still support private finance in infrastructure using other tools such as Contracts-for-Difference (for energy generation projects), and the UK guarantees scheme (open to energy, housing, transport and social infrastructure projects).

The renewed debate over privatisation is also likely to return attention to the merits and shortcomings of private finance in infrastructure.

What are the benefits and drawbacks of the different financing options for infrastructure?

| Financing Option | Benefits | Drawbacks |

|---|---|---|

| Public finance |

Lower costs: The Government can borrow more cheaply than the private sector because gilts are lower risk. There will also be lower procurement costs since fewer private parties are involved compared to privately financed projects. Flexibility: Departments retain greater flexibility over future maintenance costs by retaining control of the asset. |

Competition for spending may lead to underinvestment: With limited budgets, infrastructure projects must compete against other spending priorities. Raising taxes and public borrowing are politically contentious. Expensive (but necessary) investment in infrastructure may be delayed when decisions are driven by short-term electoral politics. Length: Agreement to finance infrastructure through public finance can take a long time since it must go through a Spending Review. Cost and time overruns: When a project is publicly financed, the government usually manages contactors directly. The public sector does not always do this effectively, which can lead to cost and time overruns. |

| Private finance: publicly-owned infrastructure |

Cost and time overruns less likely: The commercial expertise of the private sector and investor due diligence should reduce construction cost and time overruns compared to those expected under public procurement. Off-balance sheet: If sufficient risks are transferred to the private sector, privately financed infrastructure does not add to standard measures of public sector debt, which may be politically beneficial. Lower whole-life costs: If construction and operation contracts are bundled, as they typically are in project finance, project-specific companies will have incentives for ‘whole-life costing’ i.e. to invest more in the early stages in order to minimise later operational costs and reduce the total cost of infrastructure over the lifecycle. |

Higher financing costs: Project-specific companies typically have higher borrowing costs compared to gilt borrowing. Procurement costs: Private finance contracts require detailed and costly specification - the Highways Agency spent £80m on external advisors for the M25 PFI contract. Limited evidence of the benefits of risk transfer : The overall evidence on whether private sector involvement reduces delays, cost overruns or overall cost is mixed. Potentially inappropriate risk allocation: Some risks are more efficiently borne by the public sector - such as the risks of inflation, policy or regulatory change, reputation and ‘catastrophe’ risks. If investors are willing to take some of these risks on, it will come at significant cost. Contractual inflexibility: The public sector gives up a degree of flexibility over changes allowed to contracts in order to reduce financing costs. This can be a drawback if demand or technology changes, or if the Government needs to limit departmental spending but is unable to reduce maintenance budgets. |

| Private finance: privately-owned infrastructure |

Transferred responsibility: In theory, responsibility for investment in infrastructure is transferred to the private sector. Lower financing costs than other forms of private finance: Regulated companies typically have borrowing costs above gilts but below other private finance. |

High financing costs: Financing is still more expensive than gilt borrowing and there are further procurement transaction costs incurred at regulatory reviews. Contractual inflexibility: Contracts with private lenders reduce flexibility, though regulatory reviews do give opportunities for changes that other forms of private finance do not have. Mixed evidence of private ownership benefits: Privatisation, particularly in industries that are natural monopolies, does not always minimise prices or improve customer service. The previous owners of Thames Water, Macquarie, recently came under criticism for their management of the privatised water company. |

- Topic

- Policy making Public finances

- Keywords

- Infrastructure

- Publisher

- Institute for Government