Competition and Markets Authority

The Competition and Markets Authority is the UK’s principal authority responsible for competition and consumer protection.

What does the Competition and Markets Authority do?

The Competition and Markets Authority (CMA) is the UK’s principal authority responsible for competition and consumer protection. It enforces competition and market regulation by investigating cases, providing rulings, issuing penalties and supporting government and other market regulators. Its aim is to ensure that markets work well – the CMA valued its direct financial benefit to consumers at £2 billion per year between 2019 and 2022, and has indirect benefits through deterrence effects, advice on legislation and support to other regulators. 73 Competition and Markets Authority, Annual Report and Accounts 2021/22, www.gov.uk/government/publications/cma-annual-report-and-accounts-2021-to-2022

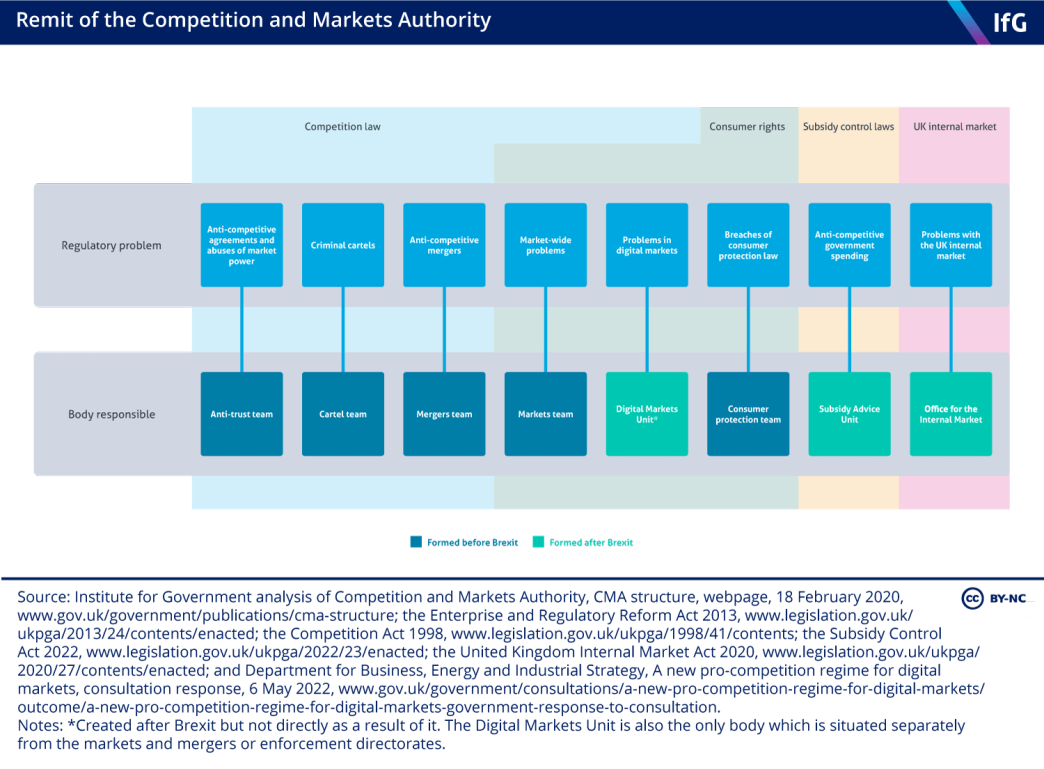

Its remit spans four legislative areas: competition law; consumer rights; the UK internal market; and subsidy control. The latter two have been brought in since the UK left the EU.

Who is the CMA accountable to?

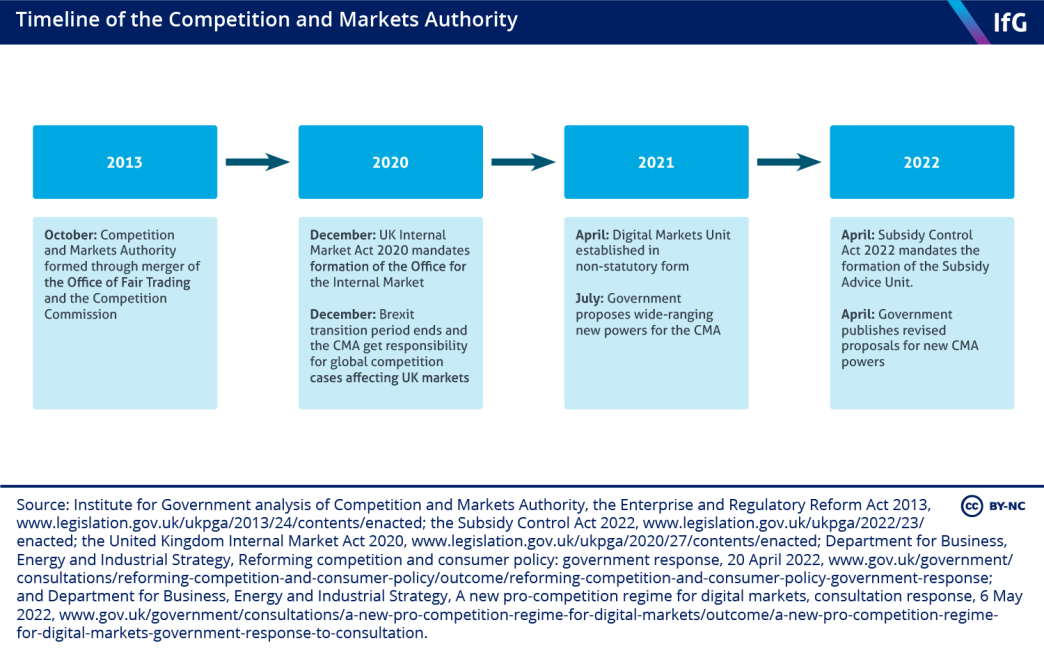

The CMA was formed in 2013 through a merger of the Office of Fair Trading and the Competition Commission, done to improve regulatory efficiency and cut costs. It is a non-ministerial department – without direct political oversight from government – though its chair, CEO and board and panel members are all appointed by the business secretary following an open competition. Board appointments are regulated by the commissioner for public appointments, as the chair is designated a ‘significant appointment’. Panel appointments are not regulated. 74 Competition and Markets Authority, ‘Our governance’ webpage, no date, www.gov.uk/government/organisations/competition-and-markets-authority/about/our-governance; UK Public General Acts, Enterprise and Regulatory Reform Act 2013, act of parliament, 10 June 2013, www.legislation.gov.uk/ukpga/2013/24/schedule/4

At the start of each parliament, the government gives the CMA a ‘non-binding strategic steer’ (a short report highlighting the key areas it thinks the CMA should focus on). 75 Department for Business, Energy and Industrial Strategy, The government’s strategic steer to the Competition and Markets Authority, 18 July 2019, www.gov.uk/government/publications/governments-strategic-steer-to-the-competition-and-markets-authority-cma The CMA is accountable to parliament through its annual reports and accounts.

How is the CMA set up internally?

The CMA’s principal authority is its board (made up of six non-executive directors, including one or more panel members, and four CMA executives). 76 Competition and Markets Authority, ‘Our governance’ webpage, no date, www.gov.uk/government/organisations/competition-and-markets-authority/about/our-governance The board delegates tasks to the panel and committees, and has the power to decide what the CMA should investigate, but any rulings and enforcement decisions are made independently of it.

The panel is made up of around 30 industry experts – who usually serve in other positions simultaneously – and is led by its chair. It leads market-wide investigations and acts as an independent decision maker in investigations of specific competition cases.

The committees are made up of senior CMA officials. These committees guide strategy, case choices and advocacy approach. Day-to-day regulation is then led by teams in either the Markets and Mergers Directorate (responsible for issues affecting whole markets), Enforcement Directorate (dealing with specific instances of anti-competitive behavior) or recently formed Digital Markets Unit (DMU).

The newly developed Office for the Internal Market (OIM) is situated within Markets and Mergers, but is unique in having a separate chair (who sits on the CMA board) and separate panel. Its chair is appointed by the business secretary, with consent required from ministers in each devolved government. 77 UK Public General Acts, United Kingdom Internal Market Act 2020, act of parliament, 31 December 2020, www.legislation.gov.uk/ukpga/2020/27/schedule/3/enacted The new Subsidy Advice Unit (SAU) will launch in 2022 as a team in Markets and Mergers. 78 Competition and Markets Authority, Annual Report and Accounts 2021/22, www.gov.uk/government/publications/cma-annual-report-and-accounts-2021-to-2022

How does the CMA enforce competition and consumer law?

Competition law

Based either on market intelligence or complaints from external sources, the CMA has powers to investigate and gather information on activities that may break competition law:

Anti-competitive mergers are those that make one player too dominant in a market. UK companies are not required to notify or seek pre-approval from the CMA of their intention to merge (as is the case in the EU), so if the CMA concludes that doing so will have an adverse effect on competition it can agree remedies with the buyer, impose orders on them or block the transaction. If a business doesn’t comply and the CMA seeks to take action, it must take the business to court.

Anti-competitive agreements and abuses of market power restrict competition, for example when companies discuss prices, limit production or unfairly discriminate between customers. The CMA selects the most important cases for investigation, and can impose legally binding remedies – and issue fines for non-compliance – or disqualify directors.

Cartels are the most serious form of anti-competitive agreement, formed when businesses agree not to compete at all. These are considered a criminal rather than civil offence, and the CMA is responsible for taking suspected cartels to criminal courts.

General market-wide problems

These are discussed by the CMA board, which can then decide to undertake a market study or investigation, the latter granting the CMA more powers. Most cases are resolved through remedies agreed with businesses or policy recommendations to government. But unlike other regulators such as the FCA or Ofcom the CMA must obtain court orders to enforce any remedies.

Consumer protection law

Various minimum consumer rights are guaranteed in the UK by laws retained from the EU (such as the right to truthful advertising and contracts without unfair clauses). The CMA normally attempts to address breaches through mediation. While it does not have powers to fine companies for non-compliance (unlike many other countries), it has special powers to ask courts for an enforcement order.

Can CMA decisions be appealed?

CMA rulings on competition law can be challenged by businesses by submitting an appeal to the Competition Appeals Tribunal (CAT). 79 Competition Appeal Tribunal, ‘About the Tribunal’, webpage, no date, https://www.catribunal.org.uk/about For rulings on anti-competitive agreements and abuses of market power, the CAT will consider the merit of a CMA decision – meaning that it will interrogate the argument or reasoning behind the decision. For decisions about mergers or market investigations, the CAT will only rule against the CMA if the CMA’s investigatory procedures are judged as having been improper.

As rulings on consumer protection are given by courts, appeals go through separate UK courts.

How has the CMA’s remit expanded since Brexit?

Competition regulation

The CMA now has responsibility for investigating cases with implications for global competition, with mergers previously done exclusively by the European Commission and anti-competitive behavior divided between the Commission and CMA. The two authorities can now investigate such cases in parallel, but the CMA will make decisions based on UK market effects. This is expected to increase its caseload both for mergers (by 40–50%) and antitrust (with several bigger and more complex cases annually). 80 Parker G, Beioley K and Giles C, ‘UK competition watchdog to gain new post-Brexit powers’, Financial Times, 17 July 2021, www.ft.com/content/917a1c17-56d2-4f2c-9a9e-85c804098e92; House of Lords European Union Committee, paragraph 224 in Brexit: competition and State aid, 2 February 2018, https://publications.parliament.uk/pa/ld201719/ldselect/ldeucom/67/6710.htm

Operation of the UK internal market

The CMA has also been given new responsibilities to oversee the operation of the UK internal market and monitor the impact of any policy divergence between the devolved governments. The OIM has been formed within the CMA to provide technical advice to UK national authorities on regulatory approaches and monitor intra-UK trade. 81 Competition and Markets Authority, Guidance on the Operation of the CMA’s UK Internal Market Functions, 21 September 2021, www.gov.uk/government/publications/guidance-on-the-operation-of-the-cmas-uk-internal-market-functions/guidance-on-the-operation-of-the-cmas-uk-intern…

Government subsidies

Government subsidies can undermine competition by, for example, alleviating pressure for a firm to be efficient, giving firms excessive market power or raising barriers for new firms entering the market.

Before Brexit, subsidies needed to comply with EU state aid rules and receive prior approval from the Commission. 82 European Commission, State Aid Overview, no date, https://ec.europa.eu/competition-policy/state-aid/state-aid-overview_en But following the Subsidy Control Act, the SAU will advise public bodies about the legality of proposed subsidies judged to be at most risk of causing distortions. The SAU will not have an enforcement role; this will be left to private challenges in court. 83 UK Parliament, Subsidy Control Act 2022, government bill, 28 April 2022, https://bills.parliament.uk/bills/3015/publications; Department for Business, Energy and Industrial Strategy, Process for granting subsidies, policy paper, 30 June 2021, www.gov.uk/government/publications/subsidy-control-bill-policy-papers/process-for-granting-subsidies

Digital markets

Though not connected to Brexit, the CMA has also recently been given an enhanced role in regulating digital markets. The largest digital firms collectively bought almost 300 companies between 2016 and 2020, with none blocked by existing merger rules despite evidence from the CMA and others illustrating harm to competition. 84 Department for Business, Energy and Industrial Strategy, A new pro-competition regime for digital markets, consultation document, 6 May 2022, www.gov.uk/government/consultations/a-new-pro-competition-regime-for-digital-markets/consultation-document-html-version To address this, the government established the DMU within the CMA, intending to later give it the statutory power to tailor bespoke codes of conduct for powerful firms. It will enforce these through constructive engagement or ‘pro-competitive interventions’. 85 Department for Business, Energy and Industrial Strategy, A new pro-competition regime for digital markets, consultation document, 6 May 2022, www.gov.uk/government/consultations/a-new-pro-competition-regime-for-digital-markets/consultation-document-html-version

More internal capacity

The CMA’s 2021/22 budget was £110m, including £20m to establish the OIM, SAU and DMU. 86 Competition and Markets Authority, Annual Plan 2021/22, 23 March 2021, https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/972070/CMA_Annual_Plan_2021_to_2022_---.pdf

The CMA grew from 620 civil servants in 2016 to around 900 in 2021 and is projected to reach over 1,000 once all new functions are fully underway. 87 House of Commons Business, Energy and Industrial Strategy Committee, Oral evidence: Post-pandemic economic growth: state aid and post-Brexit competition policy, HC 742, 1 February 2022, https://committees.parliament.uk/oralevidence/3425/html Around 19 will be in the SAU 88 Department for Business, Energy and Industrial Strategy, Subsidy Control: Designing a new approach for the UK Impact Assessment, 14 March 2022, https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1061037/subsidy-control-bill-final-impact-assessment-… and 30 in the IOM. 89 Department for Business, Energy and Industrial Strategy, Governance of the Office for the Internal Market, policy paper, 17 November 2020, www.gov.uk/government/publications/uk-internal-market-bill-2020-policy-statements/governance-of-the-office-for-the-internal-market The DMU has around 70 staff but its final numbers will not be clear until further legislation is published; additional staff may be transferred internally. 90 Hayter W, ‘Digital markets and the new pro-competition regime’, blog, Competition and Markets Authority, 10 May 2022, https://competitionandmarkets.blog.gov.uk/2022/05/10/digital-markets-and-the-new-pro-competition-regime This means most of the CMA’s new staff will work on the established areas. New offices are planned in Manchester (which will house the DMU) and Darlington.

Further proposed changes to the CMA

There are some long-standing concerns about the CMA such as lack of investigation and enforcement powers, 91 Competition and Markets Authority, Letter from Andrew Tyrie to the Secretary of State for Business, Energy and Industrial Strategy, 25 February 2019, www.gov.uk/government/publications/letter-from-andrew-tyrie-to-the-secretary-of-state-for-business-energy-and-industrial-strategy; Travers Smith, UK consumer law reform: will the tough talk be matched by action?, 23 August 2021, www.traverssmith.com/knowledge/knowledge-container/uk-consumer-law-reform-will-the-tough-talk-be-matched-by-action low public awareness, 92 Tyrie A, The Competition and Markets Authority: a reboot for the 2020s, 2 July 2021, www.kcl.ac.uk/policy-institute/assets/cma-reboot-2020s.pdf poor and non-transparent choice of cases, 93 Tyrie A, ‘The UK competition regulator is not fit for purpose’, Financial Times, 24 February 2021, www.ft.com/content/4d0e284c-c29c-4879-a408-1163386b0128 and a lack of data – especially on the digital economy 94 Tyrie A, The Competition and Markets Authority: a reboot for the 2020s, 2 July 2021, www.kcl.ac.uk/policy-institute/assets/cma-reboot-2020s.pdf and the UK internal market.

To address concern about powers, the government is planning to give the CMA more abilities to: 95 Department for Business, Energy and Industrial Strategy, Reforming competition and consumer policy: government response, 20 April 2022, www.gov.uk/government/consultations/reforming-competition-and-consumer-policy/outcome/reforming-competition-and-consumer-policy-government-response

- investigate ‘killer acquisitions’ (mergers removing potential competition before it is fully developed)

- investigate and enforce against anti-competitive behavior

- directly issue fines for breaches of consumer law.

A bill echoing these proposals (and putting the DMU on a statutory footing) was mentioned in the 2022 Queen’s speech, but it will only be published in draft in the 2022/23 parliamentary session. 96 Prime Minister's Office, 10 Downing Street and HRH The Prince of Wales, Prince Charles, Queen’s Speech 2022, speech, 10 May 2022, www.gov.uk/government/speeches/queens-speech-2022

- Keywords

- Data and digital Arm's-length bodies

- Publisher

- Institute for Government