OBR scenarios suggest that Rishi Sunak’s ‘Plan for Jobs’ may not be enough

The Office for Budget Responsibility’s newly published scenarios underline the uncertainty of the economic outlook

The Office for Budget Responsibility’s newly published scenarios underline the uncertainty of the economic outlook. They also lay bare the scale of the medium-term economic fall-out, says Thomas Pope

The Office for Budget Responsibility's (OBR) Fiscal Sustainability Report, [1] published on 14 July, sets out three possible scenarios for how the economy might evolve over the next five years. It puts in sharp focus the scale of the economic crisis – and the scale of the response which may be required from the government.

Despite costing up to £30 billion, Rishi Sunak’s ‘Plan for Jobs’, designed to address the recovery phase of the coronavirus crisis, was relatively modest in the circumstances. The chancellor’s job is not easy, but he needs to be flexible. He will also need to do more if the economic outlook, and unemployment in particular, is as bad as most scenarios suggest.

Heightened uncertainty makes the chancellor’s job especially hard

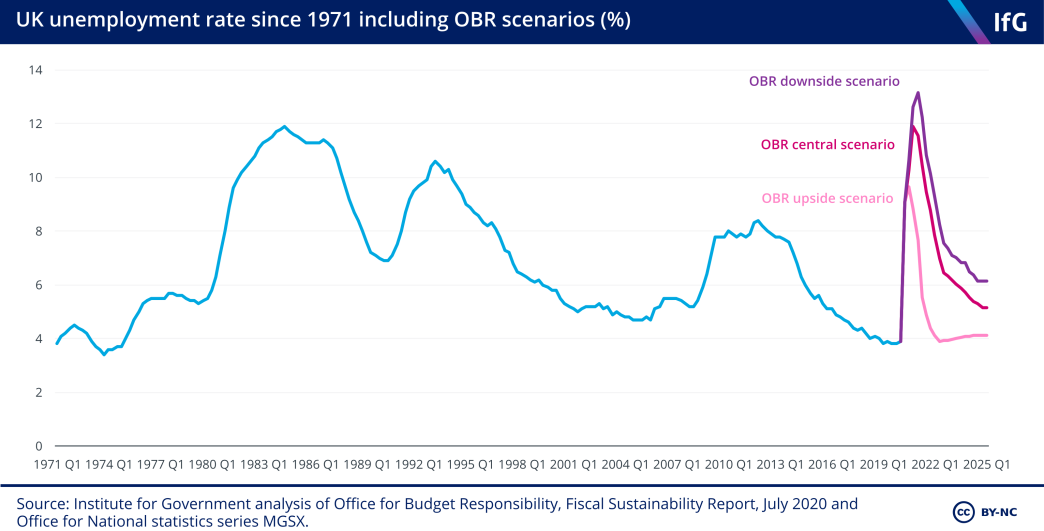

There is always a degree of uncertainty to economic forecasts, but the nature of the current crisis has left policy makers with little idea of how the economy will progress over the next few years. The three possible scenarios published by the OBR have very different implications for policy. These range from no long-term damage to GDP to a situation in which GDP is almost 6% lower than previously forecast by 2025. In one scenario, unemployment spikes a little this year before returning to normal, pre-crisis levels. In another, unemployment reaches 4.5 million next year.

This makes it very difficult for the chancellor to make policy choices. Depending on how the economy evolves, any policy he chooses could turn out to be wholly inappropriate. A quick recovery could risk a big stimulus overheating the economy and generating inflation. If the crash is worse than feared, a muted response will prove insufficient. This calls for a flexible approach that adjusts the package of measures as we learn more about the nature of the recovery.

The stakes are high, so spending now could be money well spent

The policies enacted by the government now can have long-term consequences for economic performance. That is why the government was willing to spend so much money on the Coronavirus Job Retention Scheme (CJRS) to keep workers attached to their employers and allow the recovery to happen more quickly. Even the extra £80bn spent this year on the CJRS would easily pay for itself if the economy were to grow more quickly in future as a result.

The chancellor faces a similar calculation as he shapes the long-term response. If spending more to stimulate the economy during the recovery means that the economy follows the OBR ‘central’ scenario, rather than the ‘downside’ scenario, it would be money very well spent. In the ‘downside’ scenario, the government would be borrowing an extra £57bn every year from 2025 onwards. Given that stark difference, the £30bn one-off price tag of the chancellor’s Plan for Jobs looks quite small. It could be worth spending even more to encourage a stronger recovery, especially if that recovery seems to be faltering.

The government will need to do more for the unemployed if the economic fallout is as big as feared

One aim of the chancellor’s Plan for Jobs was to stimulate the economy. The other was to help unemployed people find new jobs. While there were some small measures targeted at all unemployed people, such as an increase in job centre resources, he mostly focused on support for 16–24 year olds.

There are good reasons to focus on the young unemployed, and evidence shows that similar schemes have had positive results in the past. But most unemployed people are over 24, and the OBR scenarios show that huge increases in unemployment are likely. In the OBR ‘central’ scenario, unemployment peaks at 4 million (12%) at the end of this year; in the ‘downside’ scenario it peaks at 4.5 million (13%). This would be the highest level of unemployment since at least 1971 (see figure), and would likely require much more dramatic labour market interventions than the chancellor has so far unveiled.

Given the extent of uncertainty around the economic outlook, it is understandable that the chancellor adopted a relatively modest and cautious (in the circumstances) approach in his Plan for Jobs. However, the OBR’s report shows that the chancellor must be willing to adjust existing policies. He may also show more ambition to get the economy on a stronger growth path and to support the newly unemployed.

- Office for Budget Responsibility, Fiscal Sustainability Report – July 2020, 2020, https://obr.uk/fsr/fiscal-sustainability-report-july-2020/

- Supporting document

- bailout-business-after-coronavirus.pdf (PDF, 761.19 KB)

- Topic

- Public finances

- Keywords

- Economy Public spending

- Position

- Chancellor of the exchequer

- Administration

- Johnson government

- Department

- HM Treasury

- Public figures

- Rishi Sunak

- Publisher

- Institute for Government