Comment

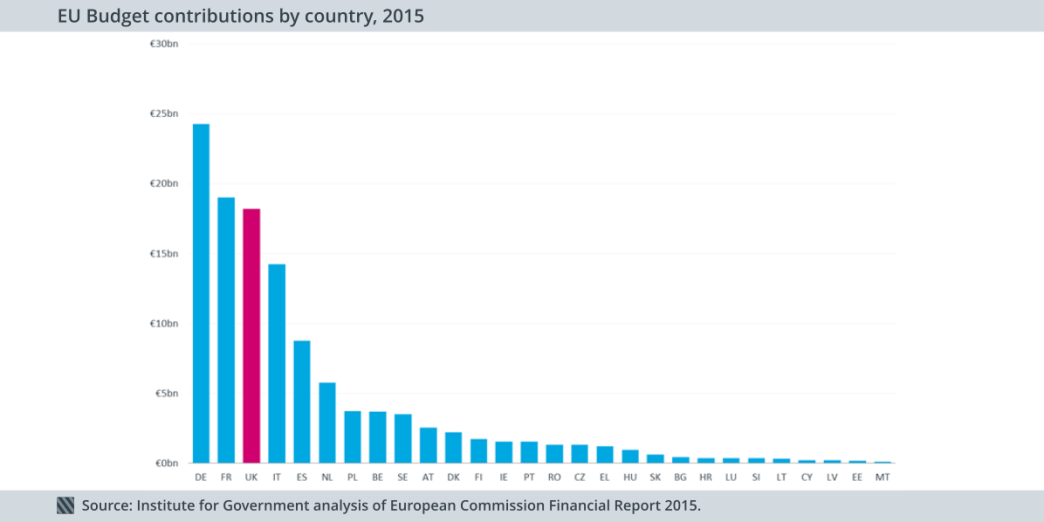

EU Budget: Could a continuing UK contribution buy time or access?

The exit bill is one element in the Brexit negotiations starting today. But, Jill Rutter argues, money may be the UK’s best negotiating card.