Budget 2021: a preview in charts

Thomas Pope runs through some of the big challenges the chancellor faces and decisions he has to make.

On Wednesday 3 March, Rishi Sunak delivers his second budget after a momentous year. Thomas Pope runs through some of the big challenges the chancellor faces and decisions he has to make.

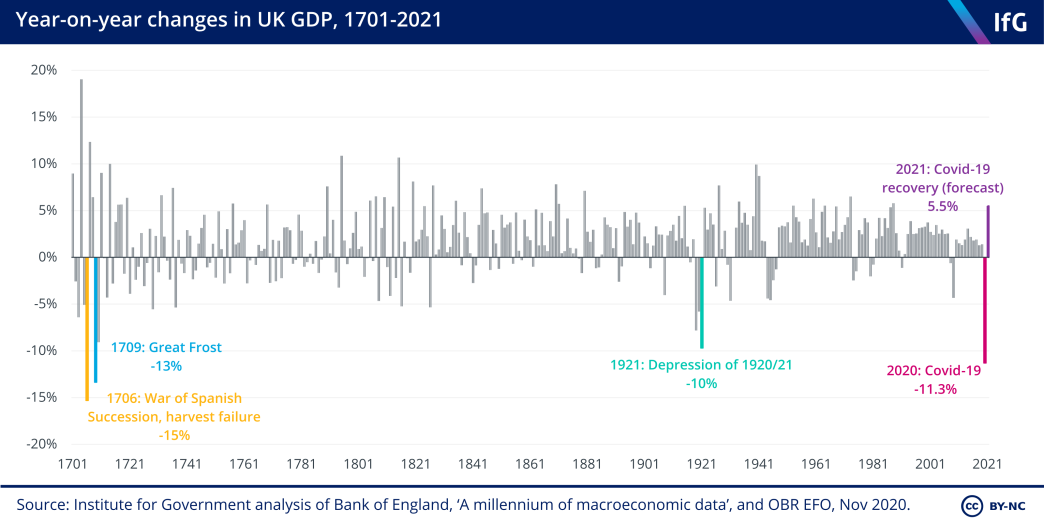

The coronavirus crisis has been a huge economic shock. Last year, GDP fell by 10% – the biggest annual drop since the 1700s. One important question is how rapidly the economy bounces back this year as restrictions are lifted and how much support the government needs to offer to help that happen. Recent reports suggest the Office for Budget Responsibility may revise up its forecast for growth this year, making it the fastest growth for 50 years.

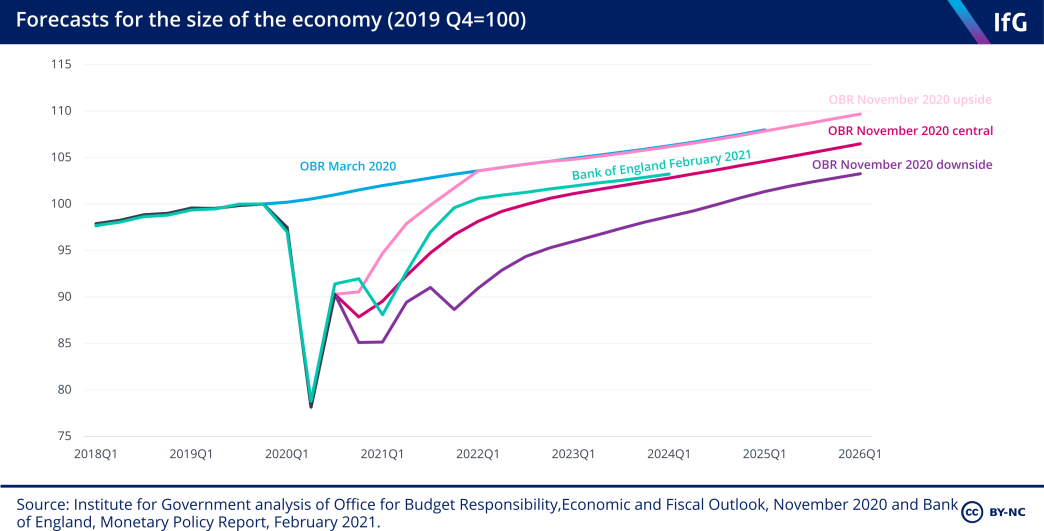

But even if growth rebounds sharply this year, the chancellor could still face tough decisions if – as most forecasters expect – the coronavirus has long-lasting effects on the economy. Both the Bank of England and last OBR forecasts suggested the economy would not return to the pre-Covid growth path.

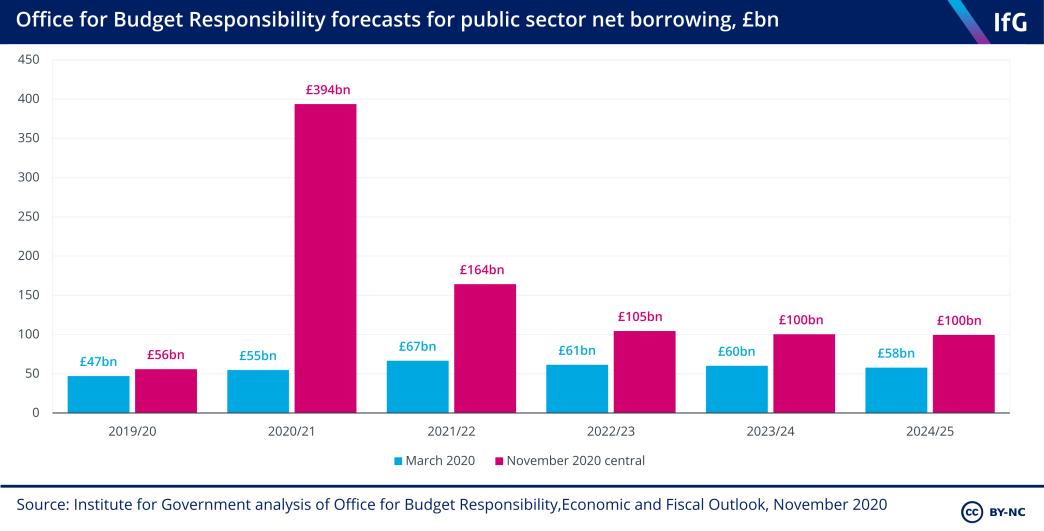

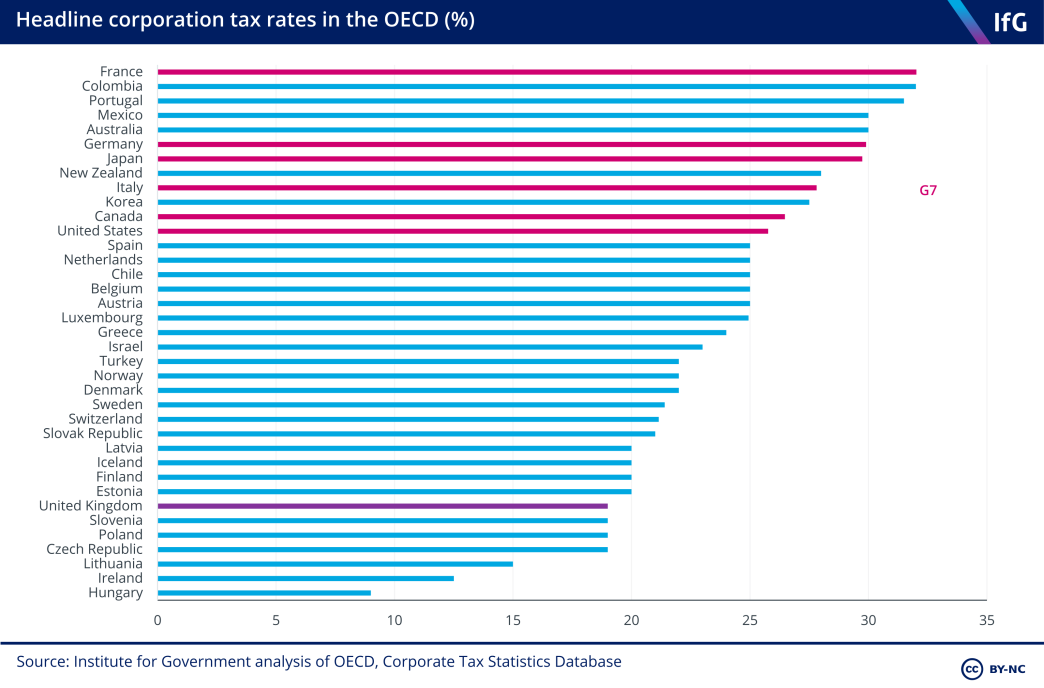

The huge policy response to Covid has led to record-high borrowing this year. But the worsened economic outlook means the deficit is set to be higher in the medium term too. This is a ‘fiscal hole’ that will have to be filled at some point – and Rishi Sunak may feel the need to fill it sooner rather than later.

Against that backdrop, the first question for Rishi Sunak is how he continues to support households and businesses.

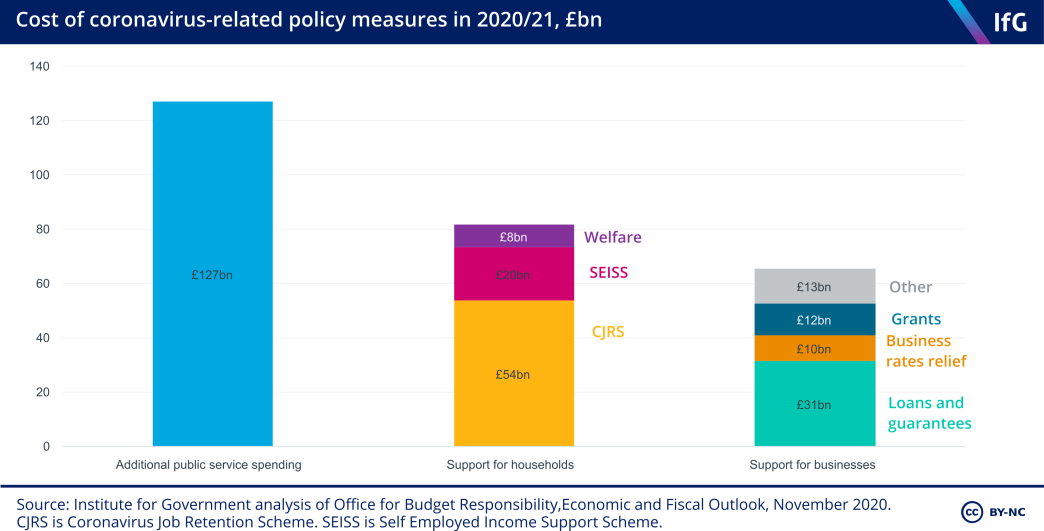

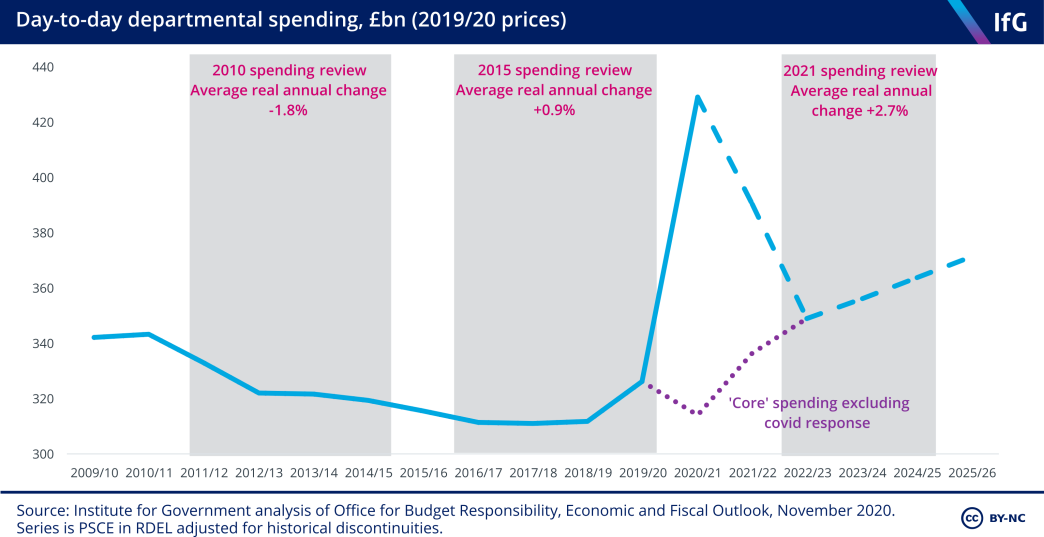

The government has spent big in 2020/21 on support for public services, households and businesses.

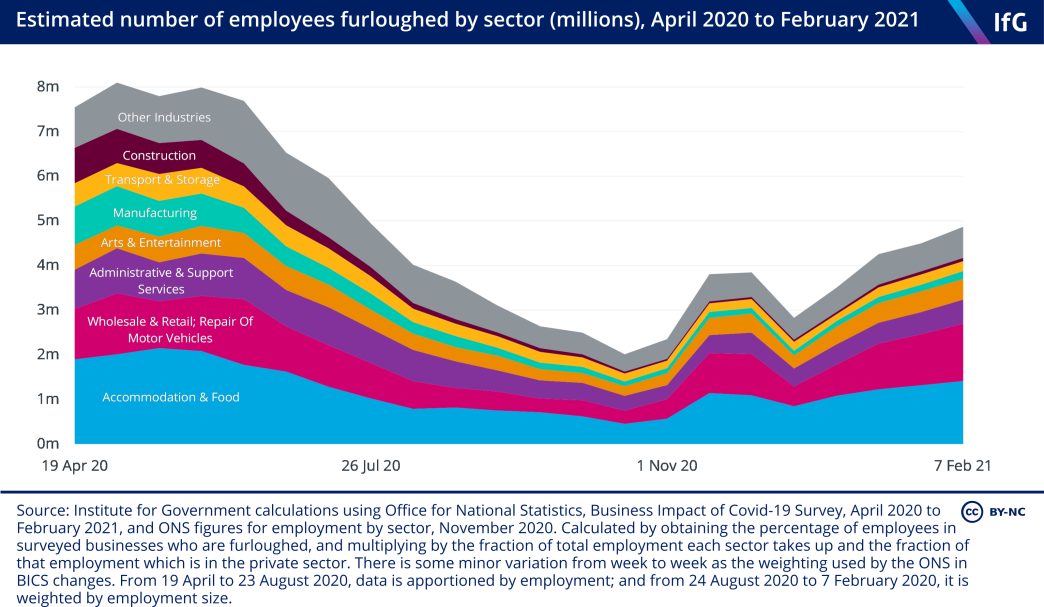

Lots of businesses are still making use of the furlough scheme. To end it at the end of April, as planned, would risk a big increase in unemployment.

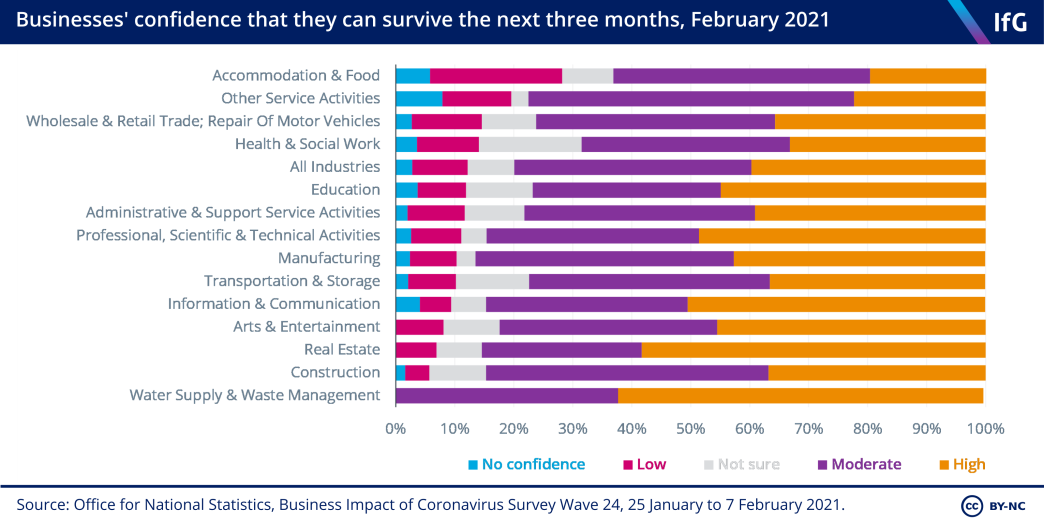

A substantial minority of businesses are unsure if they will survive the next three months, especially in those sectors where restrictions have hit hardest. It would be very risky to withdraw support for these businesses now.

The chancellor has other big decisions to make in this budget too. He will set out how much money in total will be available to allocate to public services and government departments in the multi-year spending review later this year. How generous will he decide to be? The settlement is likely to be better than the last two multi-year reviews, but could still mean tight budgets for public services outside of the NHS and schools where spending increases are already guaranteed.

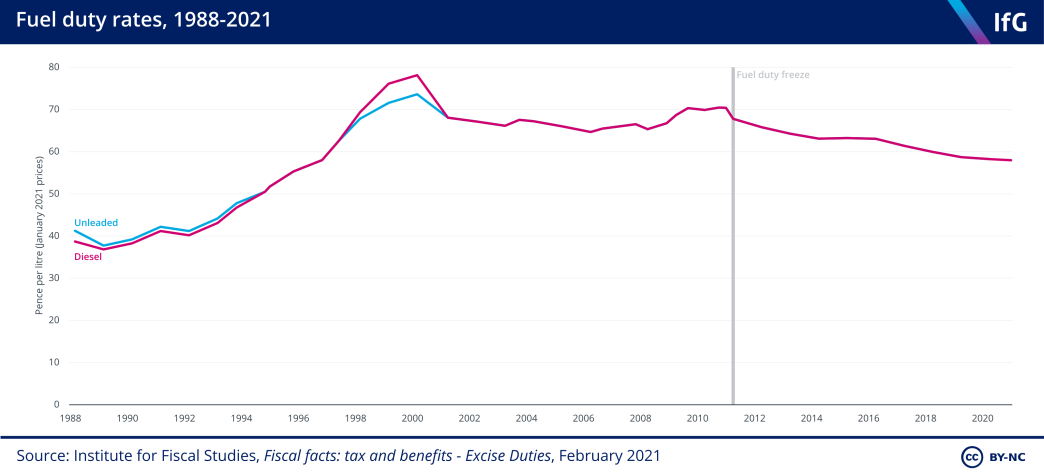

The government is committed to reaching net zero by 2050, and we have heard talk of a ‘green recovery’. One first test of how green this budget is will be what happens to fuel duty. It has not increased for a decade, despite tax law stipulating that it should increase in line with inflation every April. Will it be frozen again?

- Topic

- Public finances Coronavirus

- Position

- Chancellor of the exchequer

- Administration

- Johnson government

- Department

- HM Treasury

- Public figures

- Rishi Sunak

- Publisher

- Institute for Government