The local government finance settlement is unlikely to end council ‘bankruptcies’

Both the government and the Labour opposition should be prepared to explain how they plan to address crumbling local authority finances.

Local authorities that were hoping that the government would use this year’s local government finance settlement to help stem the tide of section 114 notices will be left disappointed, says Stuart Hoddinott

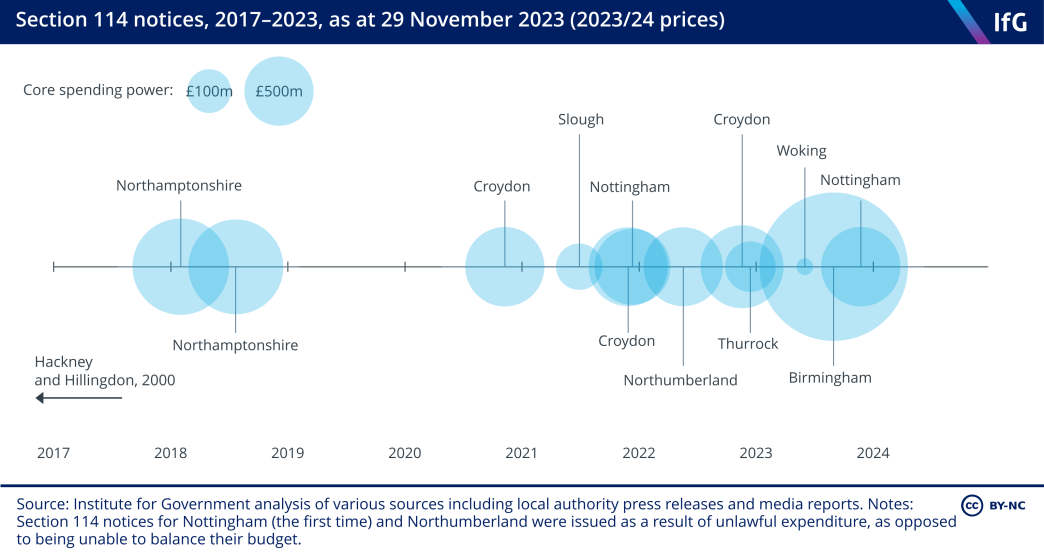

In November, it was Nottingham City Council. In September, it was Birmingham. But the latest councils to issue “bankruptcy” notices are unlikely to be last. There were more section 114 notices in 2023 than in the 30 years before 2018, with a survey from the Local Government Association showing that almost one in five councils “think it is very or fairly likely that [they] will need to issue a section 114 notice this year or next due to a lack of funding to keep key services running”. 16 Local Government Association, Section 114 fear for almost 1 in 5 council leaders and chief executives after cashless Autumn Statement, 6 December 2023, www.local.gov.uk/about/news/section-114-fear-almost-1-5-council-leaders-and-chief-executives-after-cashless-autumn Given this gloomy outlook, for councils across the country the unveiling of the government’s new local government finance settlement this week was a critical moment. However, nothing that the government announced will change those authorities’ prospects. Indeed, the settlement may in fact worsen the outlook for some of the most deprived councils.

Inflation and national live wage increases have eroded council budgets

The government was relatively generous to local authorities at the 2022 autumn statement, providing £0.7bn and £1.2bn of additional funding for adult social care in 2023/24 and 2024/25 respectively, while also allowing authorities to further increase council tax. Since that announcement, however, local authority finances have tightened. Inflation will be higher in 2023/24 and 2024/25 than was forecast in 2022, eroding the value of both years’ settlements.

Despite that higher inflation, the government chose not to provide additional funding at this week’s finance settlement (the means by which central government allocates funding to local government). As a result, authorities’ 2024/25 spending power is now 4.7% lower in real terms than it would have been if inflation had remained at the level forecast in 2022. The government would have needed to provide an additional £3.1bn of funding this week to bring the generosity back to autumn statement 2022 levels in 2024/25. This also leaves 2024/25 spending power at approximately the same level as in 2013/14, and about 12% lower in real-terms than in 2010/11.

The above calculation likely understates the extent of pressure on authority budgets. Councils are also highly exposed to changes in the National Living Wage (NLW). The NLW will rise by 9.8% in 2024/25, after increasing 9.7% in 2023/24. Local authorities pay many of their own staff the NLW and will also face calls for higher fees from service providers who employ staff on the NLW. In Performance Tracker, published in partnership with CIPFA, we estimated that the 2023/24 NLW increase added £1bn of cost to the adult social care sector. The 2024/25 increase would add a further £1.1bn. Other services will face similar requirements for more spending, though not of the same magnitude as adult social care, which is the single service that local authorities spend the most on annually.

The government chose to be less redistributive than in recent finance settlements

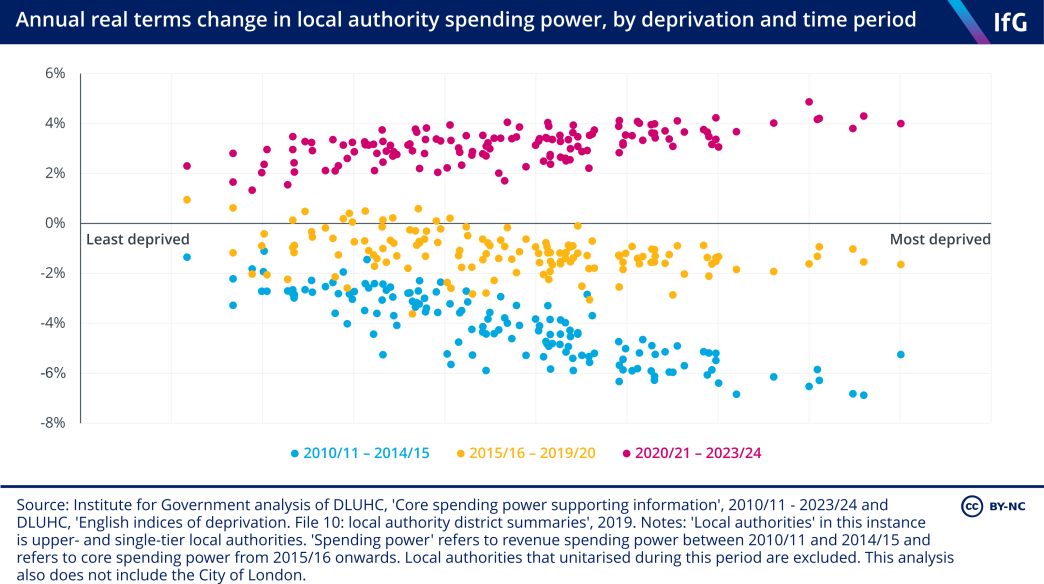

During the first half of the 2010s, the coalition government’s cut to local authority grant funding fell most heavily on the most deprived authorities. The government reversed this pattern towards the end of the decade, and has used recent settlements to direct more funding towards more deprived parts of the country.

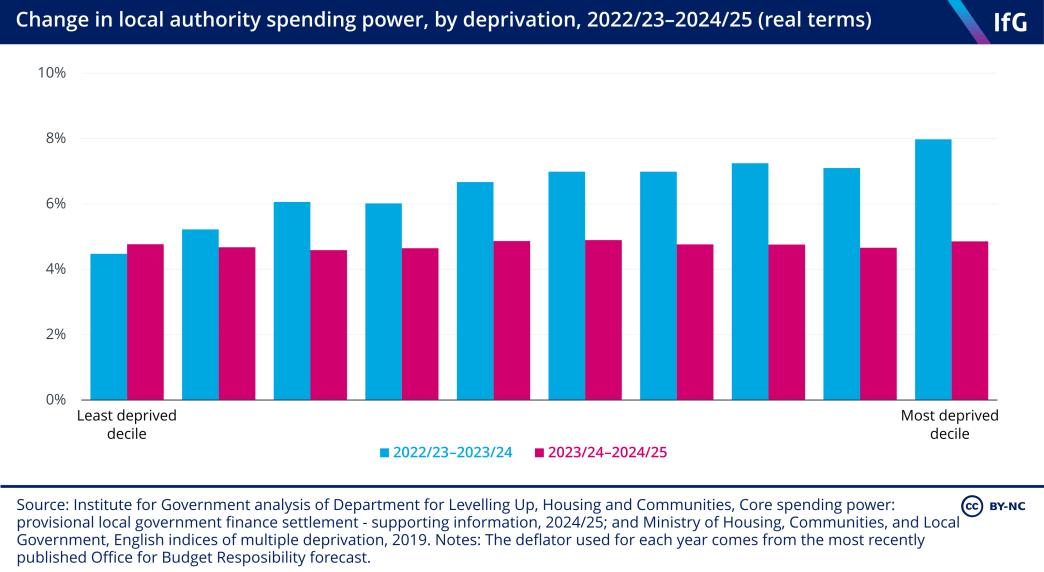

In last year’s finance settlement the most deprived decile of local authorities received a 4.5% real-terms average increase in spending power while the most deprived decile received an 8.0% increase., but the government has taken a different approach this year: the range of uplifts was far more uniform across all deciles of deprivation.

Higher levels of deprivation are associated with higher demands for local authority-provided services. 18 London Councils, Deprivation, www.londoncouncils.gov.uk/our-key-themes/local-government-finance/fair-funding-review-2018/deprivation By abandoning the redistributive approach of recent finance settlements, the government could therefore further squeeze the finances of local authorities that are already seeing some of the most intensive demand pressures.

Local government section 114 (bankruptcy) notices

What is a section 114 notice, and why have councils been issuing more of them recently?

Read our explainer

It is likely that more councils will issue ‘bankruptcy’ notices

This finance settlement confirmed that the government still has no serious answer to the recent spate of local authority ‘bankruptcies’. When pressed in a recent evidence session to the Levelling Up, Housing, and Communities Committee, levelling up secretary Michael Gove stuck to the government’s position that ‘bankruptcies’ are due to council mismanagement. His claim that Nottingham issued a section 114 notice due to “systemic problems with leadership and governance” 24 House of Commons Levelling Up, Housing and Communities Committee, Oral evidence: Financial distress in local authorities, HC 56, Wednesday 6 December 2023, https://committees.parliament.uk/oralevidence/13964/default/ is a stretch. Unlike other authorities that have issued section 114 notices, Nottingham is remarkable for how unremarkable it is. There was no risky investment gone wrong, as happened in Thurrock, Woking, and others. There was no eye-watering equal pay claim, as happened in Birmingham. Instead, Nottingham seemed to fall victim to the triple pressures of insufficient funding, rising demand – particularly for adult and children’s social care, homelessness, and SEND services – and increasing costs. 25 Nottingham City Council, Report made under part VIII s.114(3) of the Local Government Finance Act 1988 (‘The Act’), www.nottinghamcity.gov.uk/media/jmzb22b0/report-made-under-part-viii-s114-3-of-the-local-government-finance-act-1988-291123.pdf Those pressures are far from unique to Nottingham.

The government’s claim that mismanagement is solely to blame for council ‘bankruptcies’ is not credible. No local authority is perfectly managed, and nor have they ever been, but they are not responsible for plummeting local government financial resilience. The margin of error for council mismanagement is now paper thin. A council might have been able to absorb the cost of a management misstep in 2010 by making savings elsewhere in its budget. In 2023, that same misstep could force an authority to issue a section 114 notice.

It is time for politicians to confront what is now a clearly unsustainable trend. An overhaul of local government finances is needed. In such a constrained fiscal environment, both parties will baulk at the prospect of substantially increasing grant funding. But that is not the only option available. The council tax system is highly regressive and is still calculated using property values from 1991. 26 Adam S, Hodge L, Phillips D, Xu X, Revaluation and reform: bringing council tax in England into the 21st century, Institute for Fiscal Studies, March 2020, https://ifs.org.uk/publications/revaluation-and-reform-bringing-council-tax-england-21st-century It is ripe for reform. The government could allow local government more discretion over raising tax revenues locally. Kent and Hampshire county councils have called for the government to reduce their statutory duties. 27 Kent County Council, County council leaders press for urgent Government action to help avert financial crisis, 14 November 2022, https://news.kent.gov.uk/articles/county-council-leaders-press-for-urgent-government-action-to-help-avert-financial-crisis That is certainly an option, though it is often the most vulnerable residents who rely on statutory services such as adult and children’s social care and homelessness services; the government would therefore need to find a way to support those people if not through local authorities. At the less glamorous – but still important – end of the spectrum: the government should implement its own Fair Funding Review, which would update funding formulae to direct more money towards the most disadvantaged parts of the country. The government first announced that review in 2016 and has repeatedly delayed its implementation. 28 Kenyon M and Hill J, Government delays fair funding review, Local Government Chronicle, 5 October 2022, www.lgcplus.com/finance/government-delays-fair-funding-review-05-10-2022/

A rash of section 114s in an election year could thrust the topic into the spotlight. If that happens, both the government and the Labour opposition should be prepared to explain how they plan to address crumbling local authority finances. So far, neither have given any indication that they have any credible plan.

- Keywords

- Local government Social care Public sector Public spending Autumn statement Regional economic growth

- United Kingdom

- England

- Political party

- Conservative

- Position

- Chancellor of the exchequer

- Administration

- Sunak government

- Public figures

- Michael Gove

- Publisher

- Institute for Government