A new deal for funding devolution in Wales

A new fiscal framework for Wales was published this week. Aron Cheung considers the implications.

A new fiscal framework for Wales was published this week, after agreement was reached between the UK and the Welsh Governments on how Welsh public services will be funded in future. Aron Cheung considers the implications.

The announcement this week that a new fiscal framework has been agreed for the Welsh Government paves the way for significant changes in Wales’ devolution settlement. The Wales Bill now looks set to become law in early 2017. Agreeing a new funding arrangement for Wales was a prerequisite of the Bill receiving legislative consent from the Welsh Assembly, so this week’s announcement marks a key milestone.

Once the bill is implemented, the Welsh Assembly will gain the power to legislate in any area not explicitly reserved to Westminster. In addition, income tax powers will be partly devolved. In a more limited version of tax devolution than the Scottish model, the Welsh Assembly will from 2019 set the rates of income tax in Wales, while Westminster will retain control of tax bands including, crucially, the level of the tax-free personal allowance. Revenue from income tax will be shared.

Council tax and business rates already fully devolved the Welsh Assembly, and stamp duty and landfill tax will also be devolved in 2018. The new powers will leave the Welsh Government (including local authorities) responsible for raising around 21% of its budget.

Deadline day drama averted

During the negotiations on the Scottish fiscal framework earlier this year, both the UK and Scottish governments adopted combative positions on how much revenue risk should accompany Scotland’s new tax powers. This resulted in a period of stalemate, before agreement was reached on the deadline day for concluding negotiations (with the UK Government largely conceding to the Scottish Government’s demands).

By comparison, the deal for Wales seems to have been reached with relative ease, and ahead of schedule. The terms of the deal suggest that the Welsh Government benefited from the concessions secured by Scottish Government in their earlier negotiations, although they did not get everything their way.

One key feature of the Welsh deal is the introduction of a new needs-based element into the Barnett formula, which has been used to determine the allocation of resources to Scotland, Wales and Northern Ireland since 1979. The formula’s failure to account for higher relative need in Wales, and the ‘Barnett squeeze’ which causes convergence between comparable spending in the devolved nations and England, have been longstanding grievances of the Welsh Government.

Fair funding for Wales?

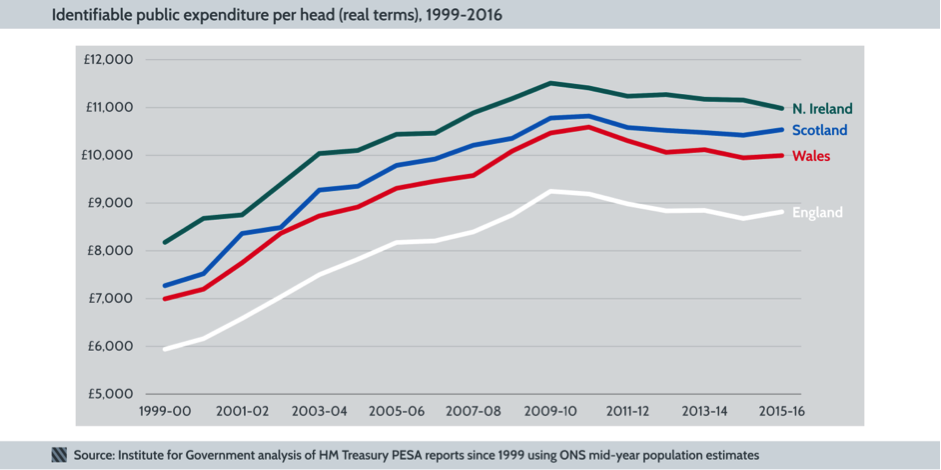

Analysis of UK Government data shows that while public spending per head in Wales has consistently been higher than in England, it lags behind spending in Scotland and Northern Ireland.

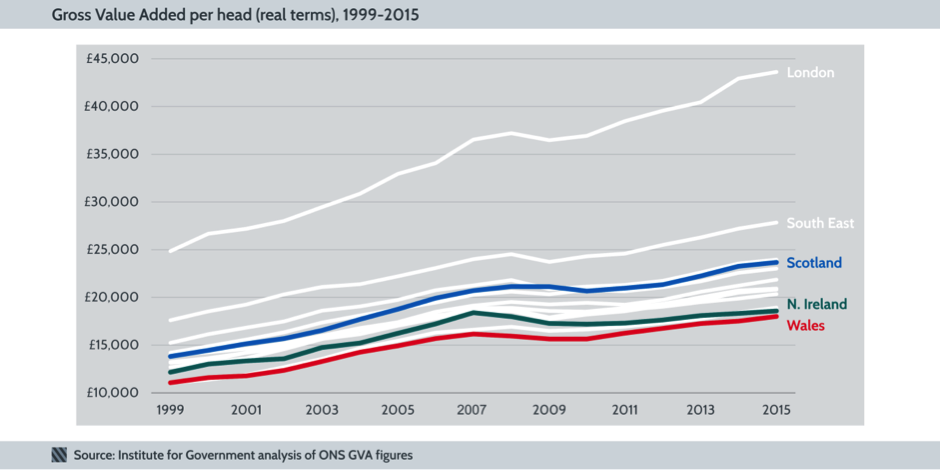

This is despite Wales having the lowest economic output of any part of the UK (measured by gross value added (GVA) per head):

This week’s announcement on a needs-based funding floor mechanism means that from 2018, per capita public spending in devolved areas in Wales will converge towards 115% of comparable spending in England, instead of 100%. Currently, Welsh per capita public spending in devolved areas is 120% of comparable spending in England – so this will converge downwards towards 115%, but not beyond this point. This safeguard for Wales is unique within the context of UK devolution.

The agreements for Wales and Scotland also differ in terms of how the devolved government’s block grants from the Treasury will be adjusted to account for the devolution of tax powers. The deal will give the Welsh Government protection against the impact on its budget that would occur in the event of the UK Government increasing the UK-wide income tax personal allowance. The issue is that due to the income distribution in Wales being skewed towards the lower end of the spectrum, any increase in the personal allowance has a disproportionate effect on Welsh income tax revenue.

On the other hand, the Welsh Government’s budget will not be protected from population risk, while that of the Scottish Government will be until 2021/22 at least. If tax revenues in Scotland grow more slowly than in the rest of the UK purely as a result of slower population growth, the Scottish Government’s budget will be unaffected. If the same scenario were to occur in Wales, the Welsh Government’s budget would fall. Given that population growth in both Scotland and Wales lags behind the UK average, it is not clear why this risk is being treated differently in the two nations.

Bespoke devolution?

The fiscal frameworks for Wales and Scotland continue a long tradition of bespoke deals for each of the devolved nations, shaped by local political and economic circumstances. As a result, we are now seeing the emergence of distinct fiscal settlements in the different parts of the UK. While some of these differences do reflect local needs and priorities, others do not seem to reflect any clear principle. As the devolution settlement becomes ever more complex, the UK Government may need to consider whether this absence of coherence across the system matters.

- Topic

- Devolution

- United Kingdom

- Wales

- Administration

- May government

- Department

- Office of the Secretary of State for Wales

- Devolved administration

- Welsh government

- Legislature

- Senedd

- Publisher

- Institute for Government