Coronavirus: how countries supported wages during the pandemic

This explainer summarises how different countries supported wages during the pandemic, and how those schemes developed and changed during the crisis.

At the height of the coronavirus pandemic, when many advanced economies were in lockdown, most governments put in place, or extended existing, schemes to support wages. The purpose of these schemes was to protect employer–employee relationships and prevent mass layoffs.

Most countries had ended this support by autumn 2021. This explainer summarises how different countries supported wages, and how those schemes developed and changed during the crisis.

Broadly, these schemes took two forms:

- Wage subsidy schemes covered a percentage of businesses’ wage costs whether or not employees were working as long as the business met certain conditions (such as having experienced a large fall in turnover).

- Short-time working schemes provided payments only for the hours an employee did not work. Examples included the UK’s Coronavirus Job Retention Scheme (CJRS), which, in its original incarnation, paid 80% of the wages of workers who were furloughed – that is, not working at all – up to a monthly cap of £2,500.

Countries that adopted wage subsidy schemes were mainly those with no pre-existing scheme of this sort – including Canada, Ireland and Australia. Short-time working schemes already existed in Germany, France and some other continental European countries – these were made more generous during the pandemic. The UK is unusual in having had no existing scheme but opting for a (continental-style) short-time working scheme rather than a broader wage subsidy scheme.

This explainer describes how seven countries – Australia, Canada, France, Germany, Ireland, the UK and the US – initiated and adapted their wage support schemes during the crisis, and subsequently wound down these schemes as their economies recovered. The table at the bottom of this explainer summarises the policies adopted in each country. Another explainer details how these countries supported the unemployed during the crisis.

When did countries introduce pandemic-related wage-support policies?

Countries were forced to react quickly to the economic downturn in March 2020 as coronavirus spread across the world. Wage support schemes, or special pandemic-related terms of existing programmes, were announced in all the countries surveyed here between 13 March and 30 March 2020.

Ireland was the first country to actually issue payments to workers, on 27 March. The UK, Australia and Canada did not start to make payments until the beginning of May, as payments were made in arrears.

How did countries vary the eligibility and generosity of their programmes as the severity of the crisis evolved?

Public support for wages continued far longer than most governments envisaged at the start of the crisis in March 2020. Countries which introduced special coronavirus wage-support programmes, particularly the UK, Australia, Canada and Ireland, intended to end these schemes over the autumn of 2020 at the latest. In practice, all of these schemes were extended, or replaced with similar schemes, so that support was provided until at least the end of March 2021. However, countries did adjust the generosity of payments, and who was eligible for them, over the course of the pandemic.

Some countries reduced the generosity of payments in summer 2020 as the pandemic appeared to be receding. For example, in the UK, the government contribution to wages was reduced to 60% (from 80%) in September 2020 (although this then increased later in the autumn). When the Australian government extended the JobKeeper programme in September 2020 and January 2021, it reduced the size of payments from AUS$1,500 per employee per fortnight (£400 per week*) to AUS$1,200 (£320 per week) and then AUS$1,000 (£270 per week).

As economies reopened in 2021, most countries also reduced the generosity of payments available under their scheme. This was true in the UK, Canada, Ireland and France. By this time, the US and Australia had withdrawn their support programmes, so Germany was the only country that retained a system with the same generosity of payments in summer 2021.

Another way that the schemes were adjusted was through changes to eligibility criteria. This was especially prevalent in countries which had wage subsidy, rather than short-time work, programmes. In Ireland, the Employment Wage Subsidy Scheme, which replaced the Temporary Wage Subsidy Scheme from July 2020, increased the turnover reduction requirement to 30% from 25%. Canada also introduced higher turnover thresholds. In the US, the second round of Paycheck Protection Program (PPP) loans in December 2020 introduced more stringent requirements: only small businesses who could demonstrate a 25% reduction in revenue in 2020 compared to the same quarter in 2019 and with up to 300 employees (compared to 500 previously) could access a second loan.

In France, the special pandemic-related terms were made less generous from June 2020, but businesses in sectors more severely affected by public health restrictions continued to receive more generous rates. This is the only example across the countries we have surveyed where access was explicitly restricted based on the industry the business was working in rather than turnover.

*All currency conversions based on market rates on 5 January 2022 and rounded to nearest £10.

When is support due to end?

All the countries we compare here extended temporary support beyond their initial termination date, although most finally terminated their schemes in the autumn of 2021. In the UK, the CJRS ended on 30 September 2021, as did the special pandemic terms of France’s partial activity (Activité partielle) scheme for most firms (although France also has a Long-term Partial Activity programme available until June 2022). Australia and the US closed their schemes in March and May 2021, respectively.

Some schemes are still ongoing. Ireland intends to close its programme on 30 April 2022. Canada closed its original wage subsidy scheme on 23 October 2021, but it replaced this with a suite of targeted programmes (including support for wages) to support the hospitality and tourism sectors and the most severely affected businesses, which are due to run until 7 May 2022.

Germany’s Kurzarbeit short-time work programme is due to revert to usual terms from 1 July 2022, although workers already registered on the scheme can benefit from special pandemic generosity for up to two more years.

Has support returned to deal with the Omicron wave?

As the Omicron wave has spread around the world, some countries have reintroduced public health restrictions. In France, firms affected by public health restrictions (such as nightclubs, which have been closed) will be able to claim 70% of employee gross pay under the partial activity scheme. This is also available to firms unaffected by restrictions, if they can demonstrate a 65% reduction in turnover, initially until 31 January 2022.

In mid-December, Canada relaxed the eligibility of its ongoing wage subsidy programmes by reducing monthly revenue decline requirements to 25% for businesses which have a capacity-limiting public health restriction of 50%. The eligibility of these programmes reverted to normal from 12 March 2022.

Were the schemes successful?

The main aim of these schemes was to limit any increase in unemployment so as to maintain employer–employee relationships and allow for a stronger recovery once public health restrictions were lifted.

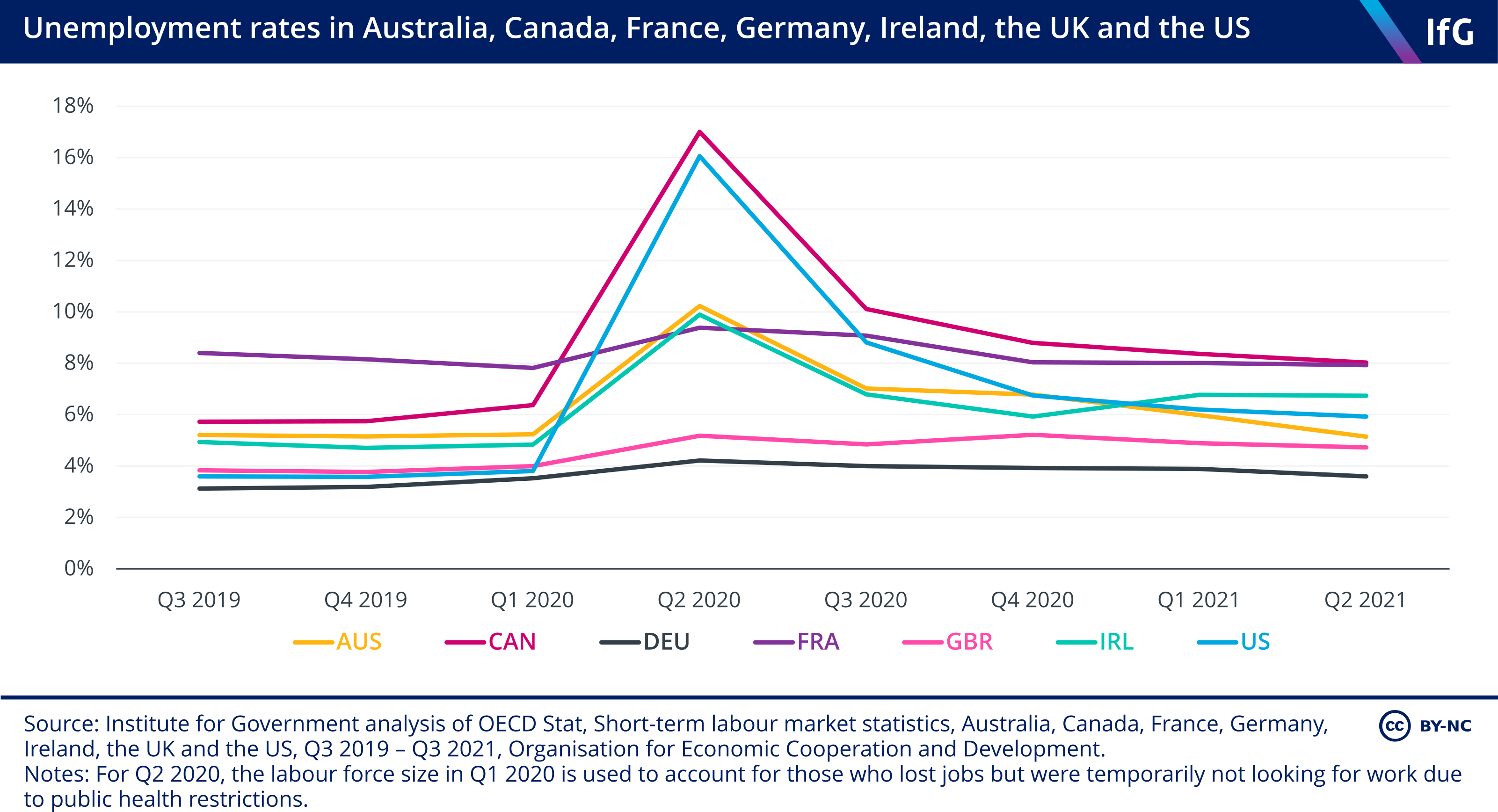

As the figure shows, the spike in unemployment after the onset of the crisis in the second quarter of 2020 varied extensively. Countries which prioritised wage support to keep employers and employees attached, such as the UK and Germany, saw much smaller increases in the headline unemployment rate.

By contrast, countries which centred their wage support on subsidies rather than short-time work, such as Ireland, Canada and the US, experienced bigger increases in unemployment rates, suggesting short-time work is a more effective policy tool to preserve employer–employee relationships in a crisis. This could reflect the more targeted nature of short-time work. Employers are compensated almost fully for hours not worked by employees, whereas under a wage subsidy scheme they are compensated partially for each employee whether or not that employee is still working. In the former system, the incentive to keep on an idle employee is therefore greater.

However, wage support schemes were not the only policies that affected changes in the unemployment rate. The countries that subsidised wages (Australia, Ireland, Canada and the US) also made their unemployment benefits much more generous. In the Irish and American cases, special pandemic-related unemployment benefit were so generous that initially workers could receive more in benefits than if they stayed in work, which perversely incentivised employers to lay-off workers. When unemployment support was prioritised over wage support, countries had higher increases in unemployment and were not as successful in preserving the employee–employer relationship.

It is still too early to answer definitively whether one approach was more effective than another at promoting a strong recovery from coronavirus because the recoveries are only just getting underway. However, Institute for Government research has found that, at least initially, countries that retained employer–employee links saw a faster bounce back in employee numbers. This should allow those countries to recover more quickly if it is sustained.

Table 1: Closure of labour market support in different countries

Country |

Change made at start of pandemic |

Did the scheme change during the pandemic? |

How was the programme extended beyond its original end date? |

Due date of expiry/date programme ended |

|---|---|---|---|---|

|

UK |

Coronavirus Job Retention Scheme paid furloughed workers 80% of their previous salary, up to a cap of £2,500 a month. |

Partial furlough was introduced in July 2020 with the government continuing to pay 80% of the wages for the unworked hours of part-time workers. Scheme wound down with decreasing generosity over summer of 2020 (ahead of intended closure) and summer of 2021 (ahead of actual closure). |

Set up in March 2020, initially for three months and then quickly extended to last until 31 October. Further extensions were announced, to December 2020, March 2021, April 2021 until the scheme finally closed on 30 September 2021. |

30 September 2021 |

|

Australia |

JobKeeper paid AU$1,500 per employee per fortnight (£400 per week) to eligible businesses |

Support beyond 1 September 2020, businesses had to demonstrate turnover was lower than it was in the same quarter a year previously. Generosity of payments reduced after 27 September 2020 and 4 January 2021. |

JobKeeper was introduced on 30 March 2020, initially until 27 September 2020. It was extended to 28 March 2021. | 28 March 2021 |

|

Canada |

Canada Emergency Wage Subsidy (CEWS) paid 75% of eligible employees' remuneration, up to a maximum of $847 (£500) per week. Businesses had to demonstrate a 30% reduction in revenue (15% for the first month). |

From July 2020, wage subsidy was calculated using the rate revenue had dropped and was made up of a base rate (for all firms) and a top up rate (for firms who had suffered a fall in turnover over 50%). New Canada Recovery Hiring Program (CRHP) introduced in July 2021 which provides 50% wage subsidy for firms with a 10% revenue loss. |

CEWS was initially due to end in June 2020 but was extended on a monthly basis until November 2020, when an extension to June 2021 was announced. It was finally extended to 23 October 2021 and replaced with:

|

23 October 2021 (CEWS) 7 May 2022 (CRHP) |

|

France |

Partial activity expanded to cover all private sector workers and parents affected by school closures who couldn’t work from home. Payments to employees were 70% of pre-crisis pay up to a cap. Before the pandemic, employers received a lump sum payment per employee equal to the minimum wage, but in the pandemic they were fully reimbursed the salary cost. Workers could be on scheme for 12 months rather than usual six. |

From June 2020 the scheme required some contribution from employers in sectors unaffected by restrictions. From summer 2021, contributions were also required from employers in affected sectors. Long-term partial activity introduced from July 2020 – subject to agreement between employer and employees, firms can reduce worker hours by up to 40% and employees receive 70% of gross pay. |

Introduced as an emergency measure on 28 March 2020, initially until 31 December 2020. The scheme stopped at the end of August 2021 for unaffected sectors, at which point pre-pandemic terms resumed. Support for the most severely affected sectors, such as closed ski resorts, was extended in October until 31 December 2021. |

30 September 2021 for most firms, (Activité partielle). 31 December 2021 for the most severely affected sectors. Long-term partial activity is available for up to 24 months over three years as long as firms apply by 30 June 2022. More generous support restarted in early December 2021 in response to Omicron, which ended on 28 February 2022. |

|

Germany |

Proportion of prior wages paid by the government increased from 60% for the first three months to 70% for the fourth to sixth months and then to 80% from the seventh month (extra 7% for parents). Employer social security contributions reimbursed in full. Employers only needed to reduce working hours for 10% of their staff to be eligible, rather than 30%. Period short-time work could be claimed for extended from 12 to 24 months. |

From June 2020, employers were not taxed on voluntary top-ups to salary of furloughed workers above the state subsidy. Employer social security contributions only reimbursed by 50% from January to June 2022. |

Changes retrospectively applied from 1 March 2020 and initially intended to run until 31 December 2020. Extended in October 2020 until the end of 2021 and was extended again in November 2021 until March 2022; final extension in February until June 2022. |

Relaxed eligibility requirement and more generous support ends 30 June 2022. For employees already claiming, terms will continue until their two-year period has elapsed. |

|

Ireland |

Temporary Wage Subsidy Scheme (TWSS) provided a weekly €410 (£350) per worker subsidy for firms who experienced a 25% fall in turnover. From 16 April, the subsidy was varied according to previous earnings with payments varying between €205 and €410 (between £175 and £350) until 31 August. |

TWSS was replaced by the Employment Wage Subsidy Scheme, which is open to businesses who experience a 30% reduction in turnover Subsidy per employee from October 2020 to January 2022 varied between €203 and €350 (£175 and £300) per week, depending on previous gross earnings Subsidy will decrease to a flat-rate of €100 (£80) per week per worker in March and April 2022 |

TWSS ran from 24 March to 31 August 2020. EWSS was introduced on 1 July 2020, originally until April 2021, but was extended twice, first until 31 December 2021 and is now due to expire on 30 April 2022. | 30 April 2022 |

|

US |

The Paycheck Protection program was Introduced as part of the CARES Act in March 2020. Government guaranteed PPP loans covered wage and other costs, such as healthcare insurance, for small businesses with fewer than 500 employees for up to eight weeks. |

PPP second round loans required firms to demonstrate a loss in revenue of at least 25% in 2020 on the same quarter in 2019 and was restricted to businesses with up to 300 employees. |

Round one funding from the CARES Act guaranteed loans from 15 February to 30 June. Applications for round 1 loans were subsequently extended to 8 August 2020. A second round of PPP loans was introduced in December 2020, initially until 31 March 2021, and was again extended to 31 May 2021. |

31 May 2021 |

Sources:

- UK: www.gov.uk/government/news/further-details-of-coronavirus-job-retention-scheme-announced; www.gov.uk/government/news/chancellor-extends-self-employment-support-scheme-and-confirms-furlough-next-steps; www.gov.uk/government/speeches/chancellor-statement-to-the-house-furlough-extension

- Australia: https://treasury.gov.au/coronavirus/jobkeeper; www.ato.gov.au/General/JobKeeper-Payment/JobKeeper-extension-announcement/

- Canada: www.canada.ca/en/revenue-agency/services/subsidy/emergency-wage-subsidy/cews-what-changes.html; www.canada.ca/en/department-finance/news/2021/10/government-announces-targeted-covid-19-support-measures-to-create-jobs-and-growth.html; www.canada.ca/en/department-finance/news/2022/02/government-extends-expanded-access-to-local-lockdown-program-and-worker-lockdown-benefit.html

- France: https://web.archive.org/web/20200115162641/https://travail-emploi.gouv.fr/emploi/accompagnement-des-mutations-economiques/activite-partielle; http://web.archive.org/web/20200423195020/www.economie.gouv.fr/covid19-soutien-entreprises/dispositif-de-chomage-partiel; https://static.eurofound.europa.eu/covid19db/cases/FR-2020-27_1030.html; https://static.eurofound.europa.eu/covid19db/cases/FR-2020-27_1030.html; www.economie.gouv.fr/covid19-soutien-entreprises/dispositif-de-chomage-partiel#

- Germany: www.bmas.de/SharedDocs/Downloads/DE/Arbeitsmarkt/kug-faq-kurzarbeit-und-qualifizierung-englisch.pdf;jsessionid=5EE32E6BBAF0466CA2D883BAAB209DD0.delivery2-; www.arbeitsagentur.de/finanzielle-hilfen/kurzarbeitergeld-arbeitnehmer; www.bmas.de/DE/Service/Presse/Pressemitteilungen/2022/mit-kurzarbeit-weiter-arbeitsplaetze-sichern.html

- Ireland: www.revenue.ie/en/employing-people/twss/information-about-twss/rules-for-the-rate-of-wage-subsidy-payable.aspx; www.gov.ie/en/service/578596-covid-19-wage-subsidy/#rate-of-payment; www.citizensinformation.ie/en/employment/unemployment_and_redundancy/employment_support_scheme.html#l0b797

- US: www.congress.gov/bill/116th-congress/house-bill/748; https://bench.co/blog/operations/second-ppp-loan/

- Topic

- Coronavirus Public finances

- Keywords

- Economy

- Publisher

- Institute for Government