Six things we learnt from the spring budget 2023

What the chancellor's announcement revealed about the government's plans for tax and spending policy.

On 15 March 2023, chancellor Jeremy Hunt presented his first budget. This set out the government’s plans for tax and spending policy. Alongside it, the Office for Budget Responsibility (OBR) published updated economic and fiscal forecasts for the next five years – running up to and beyond the next election. Here are six things we at the Institute for Government learnt from the chancellor’s announcement.

The chancellor used some of this fiscal space in the near term to keep the energy price guarantee limit at £2,500 per year for the average household.

The OBR has forecast that the UK’s GDP will be higher than previously expected at the end of the forecast.

Jeremy Hunt's measures on spending increases and tax cuts have left the chancellor with just £6.5bn of headroom against his main fiscal rule on debt.

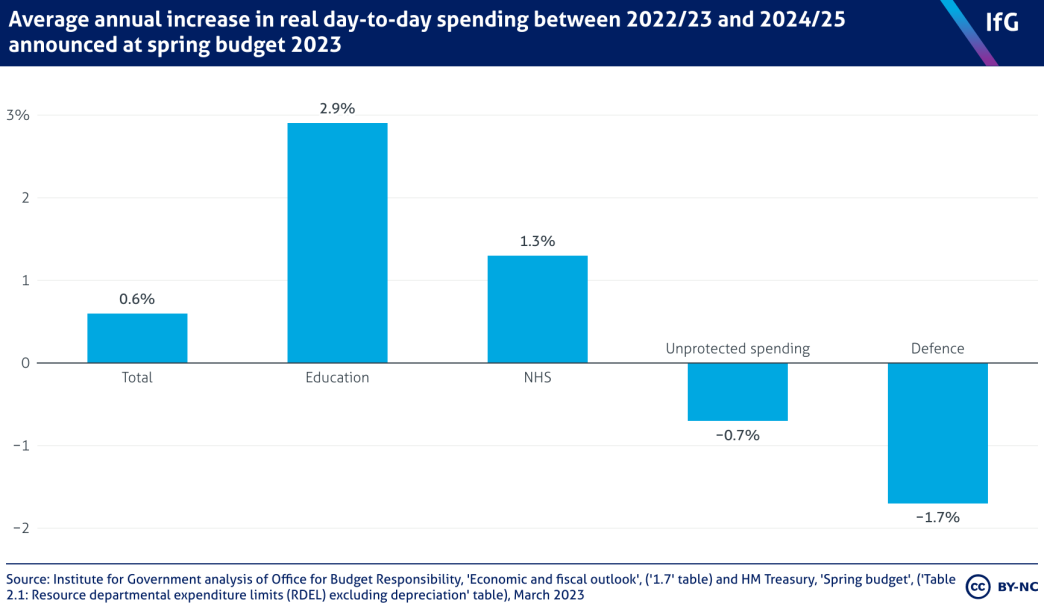

The notable omission from Hunt’s long speech was much discussion of public services.

The chancellor was silent on public sector capital spending plans.

Jeremy Hunt announced a series of big tax giveaways in the budget, including a permanent increase in the generosity of pensions tax allowance.