Coronavirus: what support did government provide for individuals and businesses?

This explainer lays out the main economic support schemes provided by the UK government during the pandemic, how much they cost and who benefited.

The pandemic caused major social and economic disruption. Following the first national lockdown in March 2020, the UK and devolved governments implemented a series of financial measures to mitigate the impact of restrictions. These policies were continued, sometimes in slightly revised form, during subsequent Covid waves in the autumn and winter of 2020–21.

Although funding came from the UK government, with the devolved administrations receiving a share according to the Barnett formula, many business support schemes were administered by local authorities, which could provide some discretion on how to distribute resources. This explainer lays out the main economic support schemes provided by the UK government during the pandemic, how much they cost and who they benefited.

Other explainers document the support for wages and support for the unemployed in the UK, and internationally.

How much did the government spend in total on support for individuals and businesses?

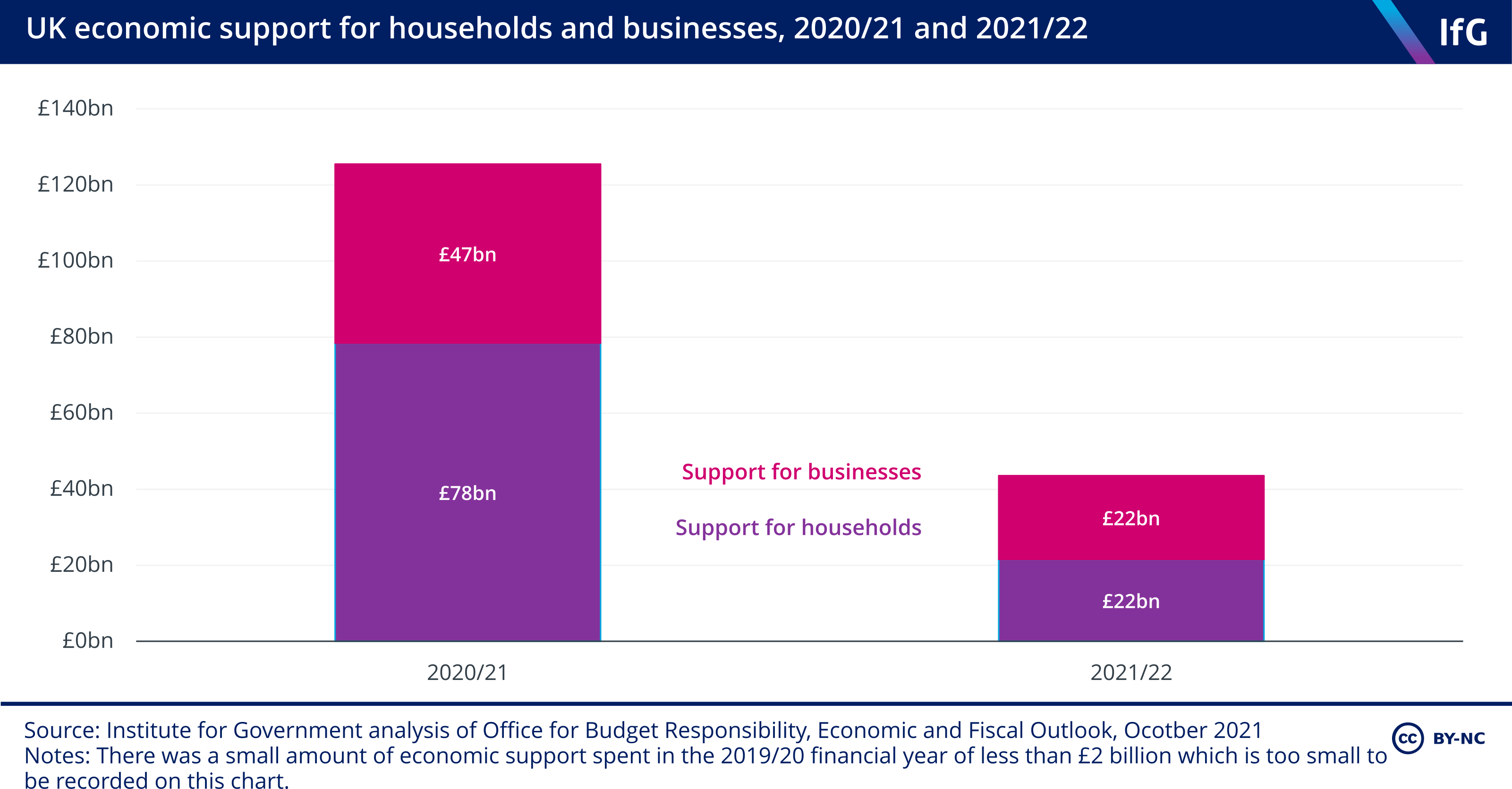

The latest figures from the Office for Budget Responsibility (OBR, the UK’s official economic forecaster) estimate that government Covid support measures totalled £169bn since 2020. Most of this extra spending went to individuals, at £100bn, with the remaining £69bn spent on business support schemes. Almost two thirds of the total was spent in 2020/21 (£126bn), with forecasts for 2021/22 set at £44bn.

When did support end?

Support programmes were gradually phased out over the summer and early autumn of 2021 as public restrictions were lifted and the economy reopened. The final support measures to end – as part of the government’s ‘Living with Covid’ strategy – were the payments for self-isolation and the Coronavirus Statutory Sick Pay Rebate Scheme, in February and March 2022 respectively.

Other programmes introduced during the pandemic but targeted at recovery include the Kickstart scheme, the Recovery Loan Scheme and the Job Entry Targeted Support programme, and are set to continue to March, June and September 2022 respectively.

What support was provided for individuals?

An unprecedented package of support for individuals was announced at the start of the crisis in March 2020. The bulk of support for workers was provided through the Coronavirus Job Retention Scheme (CJRS, or ‘furlough’) and the Self-Employment Income Support Scheme (SEISS). A £20 a week uplift in Universal Credit supported the lowest-paid and unemployed.

These programmes were wide-ranging in their eligibility and benefited lots of people. Over the course of CJRS, 11.7m jobs were supported, out of a total of around 28.7m jobs eligible for furlough. Of the 5m self-employed workers in the UK, around 2.9m received at least one of the five SEISS grants. When the £20 a week uplift ended there were 5.7m people on Universal Credit.

Following periods of lockdown, the government initiated different types of schemes to support people find work and encourage economic recovery. The Kickstart scheme provides job placements for people under 25: it has provided 217,000 placements with 100,000 applicants subsequently finding employment. As part of the Restart scheme, long-term unemployed Universal Credit claimants are provided with intensive job searching support under Job Entry Targeted Support. As of 5 January 2022 there had been 176,000 referrals to the programme.

What support was provided for businesses?

Business support consisted of a mix of grants, loans, and temporary tax cuts.

The government guaranteed loans, either in part or in full, to provide liquidity to businesses across the economy and prevent insolvencies when uncertainty was too high for private-sector financial institutions to take on the risk. A total of 1.7m loans have been awarded across the five different schemes. By far the biggest scheme was the Bounce Back Loan Scheme (BBLS). These loans are only a cost to the taxpayer if they are not repaid. However, it is predicted that many will not be repaid either due to subsequent business failure or fraud.

Business grants – direct payments from government that didn’t need to be repaid – were designed to compensate businesses forced to close or significantly adjust operations due to restrictions. During the first lockdown in 2020 small businesses and firms in the retail, hospitality and leisure sectors received cash grants between £10,000 and £25,000. Over subsequent lockdowns in the autumn and winter of 2020–21 some 3m grants were paid out under the Local Restrictions Support Grants scheme. The government also waived business rates for hospitality and retail businesses and nurseries for the 2020/21 financial year, benefiting almost 400,000 businesses.

The government also introduced other smaller measures to support businesses. It temporarily reduced the rate of VAT for hospitality businesses between July 2020 and March 2022, and introduced the Eat Out to Help Out scheme to encourage hospitality spending in August 2020.

How did support provided change over the crisis?

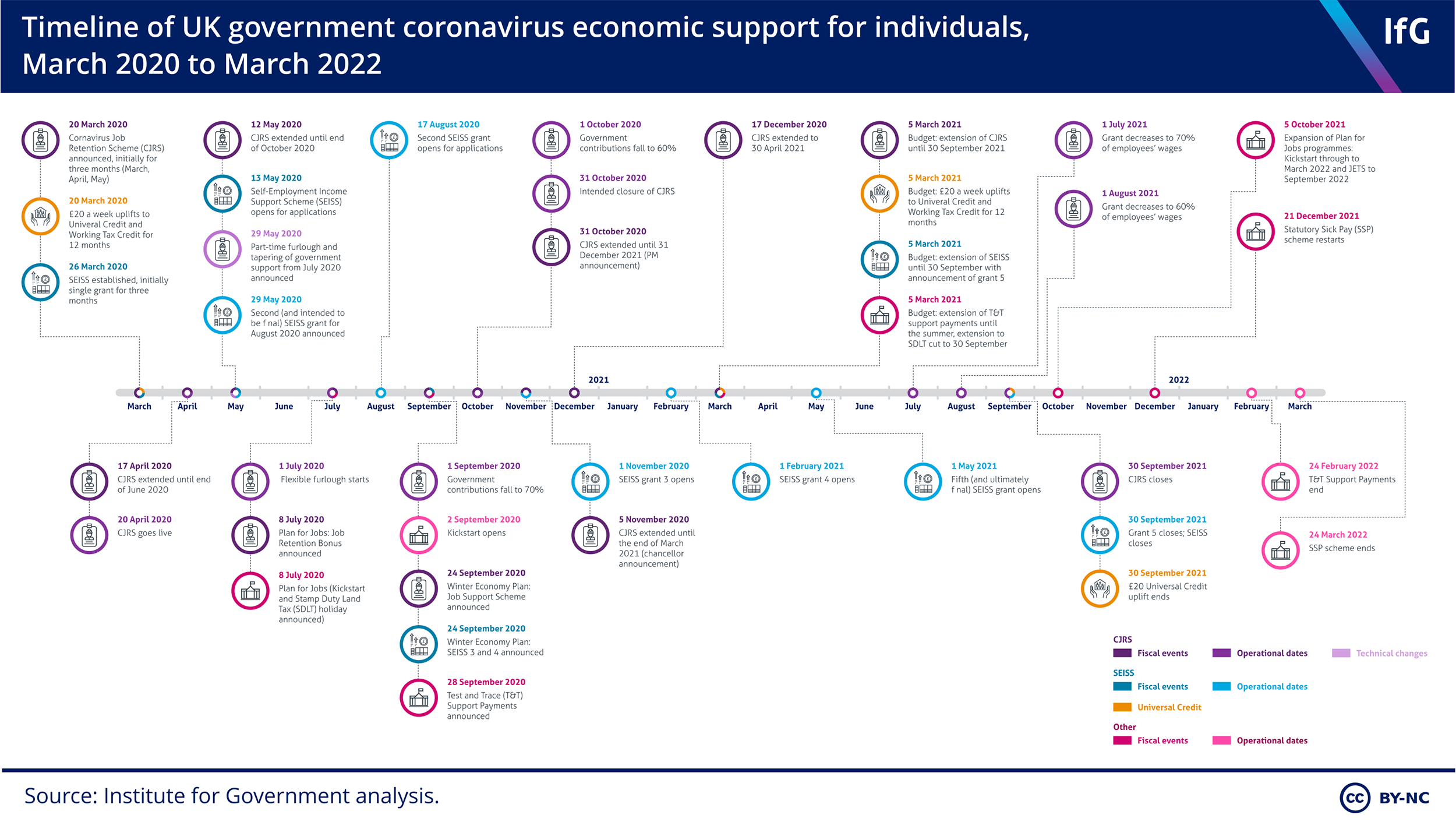

When support was initially announced, it was only expected to last for a few months, but the need for continuing restrictions led to extensions. The timeline shows how economic support programmes for individuals and businesses were adapted over the course of the pandemic.

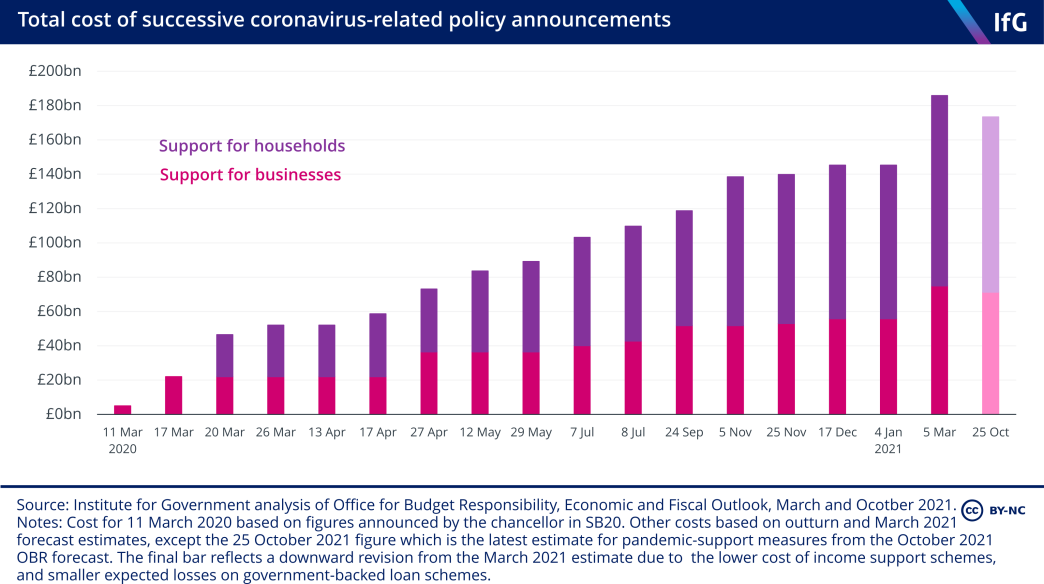

The government delivered a series of 'mini-budgets' through the crisis when changes to support programmes were announced. These had implications for tax and spending. The increasing cost of economic support is shown in the following graph.

Has support returned to deal with new variants, such as Omicron?

The government introduced its ‘Plan B’ Covid restrictions, which included working from home guidance, on 8 December 2021 and advised people to reduce social contacts. A £1bn package of support was announced on 21 December, which included grants of up to £6,000 for businesses in the retail, hospitality and leisure sectors and the government resumed paying statutory sick pay costs for small businesses. ‘Plan B’ measures expired as planned on 27 January with all remaining Covid regulations ending by 1 April.

Summary of support for individuals

Scheme |

Details of support |

Duration |

Estimated cost |

Estimated beneficiaries |

|---|---|---|---|---|

| Support measures | ||||

|

Coronavirus Job Retention Scheme (CJRS)

|

Paid 80% of the wages of ‘furloughed’ workers, who remained attached to their employer but could not work, up to a limit of £2,500 per month. From summer 2020 workers could return to work part time with the government continuing to support wages of unworked hours

|

Start: March 2020 End: September 2021 |

£70.0bn (HMRC cost up to 16 December 2021) 142 www.gov.uk/government/statistics/coronavirus-job-retention-scheme-statistics-16-december-2021/coronavirus-job-retention-scheme-statistics-16-december… |

11.7m jobs supported (10.8m individuals benefitted as a worker could have had more than one job put on furlough) 143 |

|

Self-Employment Income Support Scheme (SEISS) |

Scheme paid out five taxable grants which covered three months of 80% of average profits for the previous three years up to a maximum of £7,500 for grants 1, 3 and 4 (second grant was set at 70% up to a limit £6,570; for the fifth grant, those with a turnover reduction of 30% or less received only 30% of average profits, up to a limit of £2,850) |

Start: March 2020 End: September 2021 |

£28.1bn (HMRC Cost up to 28 October 2021) 144 www.gov.uk/government/statistics/self-employment-income-support-scheme-statistics-december-2021/self-employment-income-support-scheme-statistics-dece… |

2.9m individuals have received at least one grant[4] 10.4m grants have been claimed in total 145 www.gov.uk/government/statistics/self-employment-income-support-scheme-statistics-december-2021/self-employment-income-support-scheme-statistics-dece… |

|

Universal Credit (UC) and Working Tax Credits (WTC) |

Payments to recipients of UC and WTC were increased by £20 a week, initially until April 2021. The UC uplift was continued for a further six months and WTC claimants were given a one-off additional £500 payment (equivalent to six months of £20 a week) |

Start: March 2020 End: September 2021 |

£8.7bn 146 https://obr.uk/efo/economic-and-fiscal-outlook-october-2021/ |

5.8m people on UC when uplift ended |

|

Test and Trace Support Payment scheme |

One-off payment of £500 to people who are unable to work when they are asked to self-isolate by NHS Test and Trace |

Start: 28 September 2020 End: 24 February 2022 |

£285.8m (as of 14 April 2022)

147

UK Health Security Agency, Weekly statistics for NHS Test and Trace (England) 31 March 2022 to 6 April 2022, 14 April 2022, retrieved 21 April 2023, https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1069303/NHS-Test-and-Trace-14-april-2022.pdf |

571,548 successful claims 148 UK Health Security Agency, Weekly statistics for NHS Test and Trace (England) 31 March 2022 to 6 April 2022, 14 April 2022, retrieved 21 April 2023, https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1069303/NHS-Test-and-Trace-14-april-2022.pdf |

| Recovery measures (first announced at July 2020 fiscal event or later) | ||||

|

Kickstart scheme |

Six-month work placements for 16–24-year-old unemployed; government covers national minimum wage, NICs and pension costs |

Start: September 2020 End: Extended by Sunak in conference speech until 2022; applications closed 17 December 2021; funding continues to 31 March 2022 |

Funding of £2.1bn allocated in July 2020 Plan for Job

149

HM Treasury, ‘A Plan for Jobs 2020’, 8 July 2020, retrieved 21 April 2023, www.gov.uk/government/publications/a-plan-for-jobs-documents/a-plan-for-jobs-2020 |

As of 24 April 2022, 162,000 young people had been reported as having started a Kickstart job, and a further increase is expected as more employers report the commencement of employment. During the period that the Kickstart scheme was open, 305,000 job placements were approved and 235,000 were advertised. 151 Powell A, Coronavirus: Getting people back into work, House of Commons Library, 2022, retrieved 21 April 2023, https://commonslibrary.parliament.uk/research-briefings/cbp-8965 |

|

Job Entry Targeted Support (JETS) |

Tailored CV and interview coaching for people unemployed for more than three months |

Start: 5 October 2020 (England and Wales); 25 January 2021 (Scotland) End: September 2022 |

£238m initial investment; October 2021 extension of Plan for Jobs schemes headline cost of £500m |

176,000 have started on the programme with 43,000 having gone on to start work (as of January 2022) 152 UK Parliament, ‘PAYE Scotland’, Question for Treasury (UIN 94330), 5 January 2022, retrieved 25 April 2023, https://questions-statements.parliament.uk/written-questions/detail/2021-12-16/94330 |

Summary of support for businesses

Scheme |

Details of support |

Duration |

Estimated cost |

Estimated beneficiaries |

|---|---|---|---|---|

|

Coronavirus Statutory Sick Pay Rebate Scheme

|

Government paid statutory sick pay costs for up to two weeks (£95.85 a week) per employee for businesses with fewer than 250 employees

|

Start: 26 May 2020 for employers to claim for employees who were off sick after 13 March 2020 End: 30 September 2021 (for employees off before this date) Restart: 21 December 2021 (in response to Omicron variant) Final closure: 24 March 2022 |

£123m 153 National Audit Office, ‘COVID-19 cost tracker’, 23 June 2022, retrieved 21 April 2023, www.nao.org.uk/overviews/covid-19-cost-tracker/ |

Not known |

| Grants | ||||

|

Retail, Hospitality and Leisure Grant Fund (RHLGF) & Small Business Grant Fund (SBGF) |

RHLGF: Cash grants of £10,000 (for businesses with a rateable value of under £15,000) or £25,000 (for businesses with rateable value between £15,000 and £51,000) SBGF: Cash grants of £10,000 for businesses eligible for small business rate relief or rural rate relief |

Start: April 2020 End: 30 September 2020 |

£12.3bn paid out to local authorities; £11.1bn paid out to businesses. 154 Department for Business and Trade and Department for Business, Energy & Industrial Strategy, ‘COVID-19 Business Grants schemes: insights (August 2022), 19 August 2022, retrieved 21 April 2023, www.gov.uk/government/publications/coronavirus-grant-funding-local-authority-payments-to-small-and-medium-businesses/covid-19-business-grants-schemes… | 900,000 grants paid out. 155 Department for Business and Trade and Department for Business, Energy & Industrial Strategy, ‘COVID-19 Business Grants schemes: insights (August 2022), 19 August 2022, retrieved 21 April 2023, www.gov.uk/government/publications/coronavirus-grant-funding-local-authority-payments-to-small-and-medium-businesses/covid-19-business-grants-schemes… |

|

Local Restrictions Support Grants |

Cash grants of £3,000 for businesses who were forced to close under the tier system of local restrictions from October 2020 (originally set at £1,500/£1,000 for large/small firms) |

Start: 9 September 2020 End: Applications closed 31 March 2021 |

£7.8bn paid to local authorities; £5.3bn paid out to businesses (both open and closed payments)[18] |

2.2m grants paid out (0.2m open grants and 2.0m closed grants) by local authorities (businesses with multiple premises could receive one grant per premises and could receive multiple grants through time so fewer than 3m businesses actually received grants) 156 Department for Business and Trade and Department for Business, Energy & Industrial Strategy, ‘COVID-19 Business Grants schemes: insights (August 2022), 19 August 2022, retrieved 21 April 2023, www.gov.uk/government/publications/coronavirus-grant-funding-local-authority-payments-to-small-and-medium-businesses/covid-19-business-grants-schemes… |

|

Additional Restrictions Grant |

Provided grants to local authorities to support businesses which require additional support and/or are not covered by other schemes. Eligibility determined by local authorities |

Start: 31 October 2020 End: 30 June 2021 |

£2.1bn paid out to local authorities; £2.0bn paid out to businesses

157

Department for Business and Trade and Department for Business, Energy & Industrial Strategy, ‘COVID-19 Business Grants schemes: insights (August 2022), 19 August 2022, retrieved 21 April 2023, www.gov.uk/government/publications/coronavirus-grant-funding-local-authority-payments-to-small-and-medium-businesses/covid-19-business-grants-schemes… |

752,000 grants paid out by local authorities as of August 2022

158

Department for Business and Trade and Department for Business, Energy & Industrial Strategy, ‘COVID-19 Business Grants schemes: insights (August 2022), 19 August 2022, retrieved 21 April 2023, www.gov.uk/government/publications/coronavirus-grant-funding-local-authority-payments-to-small-and-medium-businesses/covid-19-business-grants-schemes… |

|

Closed business lockdown payment |

A one-off cash grant of £9,000 was paid to businesses that were required to close due to the January 2021 national lockdown |

Start: 5 January 2021 End: 31 March 2021 |

£2.1bn estimated cost

159

National Audit Office, ‘COVID-19 cost tracker’, 23 June 2022, retrieved 21 April 2023, www.nao.org.uk/overviews/covid-19-cost-tracker/ |

|

|

Restart grant |

One-off grant of £6,000 to non-essential retail businesses to support reopening costs following end restrictions |

Start: 1 April 2021 End: Applications closed 30 June 2021 |

£3.4bn paid to local authorities; £3bn paid out to businesses 160 www.gov.uk/government/publications/coronavirus-grant-funding-local-authority-payments-to-small-and-medium-businesses |

395,000 grants paid out by local authorities as of August 2021 |

|

Omicron Hospitality and Leisure Grant |

One-off grants between £2,700 and £6,000 (depending on rateable value) for hospitality and leisure businesses in England and discretionary funding of £100m for local authorities to support the economy with the Omicron variant |

Start: January 2022 End: March 2022 |

Grants in England: £635m paid out to local authorities; £456m paid out to businesses 161 Department for Business and Trade and Department for Business, Energy & Industrial Strategy, ‘COVID-19 Business Grants schemes: insights (August 2022), 19 August 2022, retrieved 21 April 2023, www.gov.uk/government/publications/coronavirus-grant-funding-local-authority-payments-to-small-and-medium-businesses/covid-19-business-grants-schemes… |

90,000 grants paid out by local authorities as of August 2022 162 Department for Business and Trade and Department for Business, Energy & Industrial Strategy, ‘COVID-19 Business Grants schemes: insights (August 2022), 19 August 2022, retrieved 21 April 2023, www.gov.uk/government/publications/coronavirus-grant-funding-local-authority-payments-to-small-and-medium-businesses/covid-19-business-grants-schemes… |

| Loans | ||||

|

Covid-19 Corporate Financing Facility (CCFF) |

Bank of England purchase short-term debt in the form of commercial paper of larger firms to support their liquidity |

Start: 17 March 2020 End: 23 March 2021 |

£38bn lent to companies participating in scheme; expected write-offs of £0.

163

Office for Budget Responsibility, Major Balance Sheet Interventions (online annex to Economic and fiscal outlook March 2023), 2023, retrieved 21 April 2023, https://obr.uk/docs/dlm_uploads/March-2023-Major-balance-sheet-interventions.pdf |

107 companies took part in scheme 164 Bank of England, Covid Corporate Financing Facility Limited Annual Report and Accounts 1 March 2020 – 28 February 2021, HC 226, The Stationery Office, 2021, retrieved 21 April 2023, www.bankofengland.co.uk/-/media/boe/files/annual-report/2021/ccff%20annual%20report%202020-21%20web.pdf |

| Coronavirus Business Interruption Loan Scheme (CBILS) |

Government guaranteed 80% of loans up to a value of £5m to SMEs with annual turnover under £45m and paid interest and fees for the first 12 months. |

Start: March 2020 End: 31 March 2021 |

Value of loans approved: £26.39bn 165 www.gov.uk/government/collections/hm-treasury-coronavirus-covid-19-business-loan-scheme-statistics#Coronavirus-Business-Interruption-Loan-Scheme Estimated write-offs over lifetime of scheme: £1.6bn as of March 2023

166

Office for Budget Responsibility, Major Balance Sheet Interventions (online annex to Economic and fiscal outlook March 2023), 2023, retrieved 21 April 2023, https://obr.uk/docs/dlm_uploads/March-2023-Major-balance-sheet-interventions.pdf |

110,000 facilities approved 167 www.gov.uk/government/collections/hm-treasury-coronavirus-covid-19-business-loan-scheme-statistics#Coronavirus-Business-Interruption-Loan-Scheme |

| Coronavirus Large Business Interruption Loan Scheme (CLBILS) |

Government guaranteed 80% of loans up to a value of £200m to larger businesses with an annual turnover more than £45m Loans could be up to 25% of firm turnover and capped at £200m Unlike CBILS, government did not pay interest costs Not available to businesses that were eligible for CCFF |

Start: March 2020 End: 31 March 2021 |

Value of loans approved: £5.56bn 168 www.gov.uk/government/collections/hm-treasury-coronavirus-covid-19-business-loan-scheme-statistics#Coronavirus-Large-Business-Interruption-Loan-Scheme Estimated write-offs over lifetime of scheme: £0.1bn 169 Office for Budget Responsibility, Major Balance Sheet Interventions (online annex to Economic and fiscal outlook March 2023), 2023, retrieved 21 April 2023, https://obr.uk/docs/dlm_uploads/March-2023-Major-balance-sheet-interventions.pdf |

753 loans approved 170 www.gov.uk/government/collections/hm-treasury-coronavirus-covid-19-business-loan-scheme-statistics#Coronavirus-Large-Business-Interruption-Loan-Scheme

|

|

Bounce Back Loans |

Government guaranteed 100% of loans of value between £2,000 and £50,000 and paid interest and fees for the first 12 months. Interest rate 2.5% after first year |

Start: 4 May 2020 End: 31 March 2021 |

Value of loans approved: £47.36bn 171 HM Treasury, ‘HM Treasury coronavirus (COVID-19) business loan scheme statistics’, 8 July 2021, retrieved 21 April 2023, www.gov.uk/government/collections/hm-treasury-coronavirus-covid-19-business-loan-scheme-statistics Estimated write-offs over lifetime of scheme: £13.8bn 172 Office for Budget Responsibility, Major Balance Sheet Interventions (online annex to Economic and fiscal outlook March 2023), 2023, retrieved 21 April 2023, https://obr.uk/docs/dlm_uploads/March-2023-Major-balance-sheet-interventions.pdf |

1,560,309 loans approved 173 www.gov.uk/government/collections/hm-treasury-coronavirus-covid-19-business-loan-scheme-statistics#Bounce-Back-Loan-Scheme |

|

Future Fund |

Provided government loans of between £125,000 and £5m to non-listed UK based companies to match funding raised by private investors. Eligibility required firms to have raised at least £250,000 in equity investment from third parties in the last five years |

Start: May 2020 End: Closed to new applications on 31 January 2021 |

Value of convertible loans approved: £1.14bn[39] Estimated write-offs over lifetime of scheme: £0.2bn 174 HM Treasury, ‘HM Treasury coronavirus (COVID-19) business loan scheme statistics’, 8 July 2021, retrieved 21 April 2023, www.gov.uk/government/collections/hm-treasury-coronavirus-covid-19-business-loan-scheme-statistics |

1,190 convertible loans approved 175 www.gov.uk/government/collections/hm-treasury-coronavirus-covid-19-business-loan-scheme-statistics#Future-Fund |

|

Recovery Loan Scheme |

Replaced Bounce Back Loans and CBILS/CLBILS. Government guarantees 80% (falls to 70% from 1 January 2022) of loans or overdrafts of up to £10m (falls to £2m after 1 January 2022) |

Start: 6 April 2021

Due to end: June 2024 (Initially to 31 December 2021; a second iteration was announced autumn Budget to 30 June 2022, with modifications; a third iteration was announced in August 2022

176

British Business Bank, ‘Details released today of a new iteration of the Recovery Loan Scheme aimed at helping businesses access the finance they need to invest and grow’, 1 August 2022, retrieved 21 April 2023, www.british-business-bank.co.uk/press-release/details-released-today-of-a-new-iteration-of-the-recovery-loan-scheme-aimed-at-helping-businesses-acces… |

£4.33bn in the first two iterations of the scheme, which closed June 2022

177

British Business Bank, ‘Over £4.3bn of Recovery Loan Scheme loans drawn by smaller UK businesses’, 21 February 2023, retrieved 21 April 2023, www.british-business-bank.co.uk/press-release/over-4-3bn-of-recovery-loan-scheme-loans-drawn-by-smaller-uk-businesses/ Based on an earlier estimate of a total scheme size of £3.0bn, the OBR expected write-offs to total £0.5bn 178 Office for Budget Responsibility, Major Balance Sheet Interventions (online annex to Economic and fiscal outlook March 2023), 2023, retrieved 21 April 2023, https://obr.uk/docs/dlm_uploads/March-2023-Major-balance-sheet-interventions.pdf |

20,643 facilities approved in the first two iterations of the scheme

179

British Business Bank, ‘Over £4.3bn of Recovery Loan Scheme loans drawn by smaller UK businesses’, 21 February 2023, retrieved 21 April 2023, www.british-business-bank.co.uk/press-release/over-4-3bn-of-recovery-loan-scheme-loans-drawn-by-smaller-uk-businesses/ |

| Other | ||||

|

Business rates relief |

Retail, hospitality and leisure businesses, and nurseries, in England had their business rates waived for the 2020/21 tax year. This was extended until 30 June 2021 when rates were reintroduced at a two-thirds discount |

Start: 6 April 2020 End: 30 June 2021 (100% relief); 31 March 2022 (discounted by two thirds) |

Estimated lifetime cost of £17.0bn

180

National Audit Office, ‘COVID-19 cost tracker’, 23 June 2022, retrieved 21 April 2023, www.nao.org.uk/overviews/covid-19-cost-tracker/ |

374,000 retail businesses and 8,000 nurseries eligible for discount 181 www.gov.uk/government/publications/covid-19-business-rates-reliefs-by-parliamentary-constituency |

|

Trade Credit Reinsurance Scheme |

Government guaranteed up to £10bn of transactions to protect businesses against default of payment from companies they are selling goods to |

Start: Backdated to 1 April 2020 End: 30 June 2021 |

Estimated lifetime cost of £1.7bn

182

National Audit Office, ‘COVID-19 cost tracker’, 23 June 2022, retrieved 21 April 2023, www.nao.org.uk/overviews/covid-19-cost-tracker/ |

Provided £210bn in insurance cover to 500,000 businesses 183 www.gov.uk/government/publications/statement-on-the-closure-of-the-trade-credit-reinsurance-scheme/joint-statement-on-the-closure-of-the-trade-credit… |

|

VAT rate cut |

VAT was reduced to 5% for hospitality businesses from July 2020 until September 2021 and to 12.5% from September until March 2022 |

Start: 15 July 2020 End: the 5% rate of VAT for tourism and hospitality rose to 12.5% on 1 October 2021, and then to the (normal) 20% rate on 31 March 2022. |

£8.3bn 184 https://obr.uk/efo/economic-and-fiscal-outlook-october-2021/ |

There were 192,000 trading businesses paying VAT in the accommodation and food service and the arts, entertainment and recreation sectors in 2020/21 185 www.gov.uk/government/statistics/value-added-tax-vat-annual-statistics |

|

Eat Out to Help Out |

Government provided 50% of the cost of food and/or non-alcoholic drinks at participating restaurants up to a cap of £10 a head |

Start: 3 August 2020 End: 31 August 2020 |

£849m 186 www.gov.uk/government/statistics/eat-out-to-help-out-statistics/eat-out-to-help-out-statistics-commentary |

52,000 businesses registered 187 www.gov.uk/government/statistics/eat-out-to-help-out-statistics/eat-out-to-help-out-statistics-commentary 160m meals served 188 www.gov.uk/government/statistics/eat-out-to-help-out-statistics/eat-out-to-help-out-statistics-commentary |

- Topic

- Coronavirus Public finances

- Keywords

- Economy

- Publisher

- Institute for Government