With the triggering of Article 50 only days away, Jill Rutter highlights three ways Brexit might affect the Budget calculations.

A post-Brexit economy

Last autumn the independent Office for Budget Responsibility (OBR) reported that it had asked the Government how it should account for Brexit in the forecast; they were told little more than “Brexit means Brexit”. So the OBR was forced to make its own assumptions, set out in the box below.

Positions have clarified since then. The OBR has to forecast on the basis of government policy. One option would be to assume that the Prime Minister gets the deal she set out in her Lancaster House speech, with Brexit meaning leaving the Single Market and the Customs Union, having a comprehensive free trade deal in place from day one, and the promised frictionless border in place. Another will be to take to heart the Secretary of State for Exiting the EU, David Davis’s warnings to Cabinet to prepare to leave with no deal. It will be interesting to see how the OBR deals with this binary risk in their forecast. Whatever route it chooses, those prepared to burrow into the detail of the OBR’s forecasts may find the first government analysis of the economic implications of the Government’s negotiating position.

In the past, migration has been a big driver of economic growth. A second thing to look out for is whether the OBR changes its November view on the impact of any post-Brexit arrangements – and indeed the post-referendum rhetoric – on future flows of migrants.

Post-Brexit public finances

The economy is a big determinant of the state of the public finances, and the stronger economic growth than forecast at the time of the Autumn Statement is likely to be reflected in healthier public finances in the short term. But it is not the only route for Brexit impact.

In the autumn, the OBR assumed that any savings on the UK’s net contribution to the EU would be recycled into other public spending, allowing them to show no effect. Indeed, the commitments the Government has made to beneficiary sectors such as farming and universities means that at least some of this is committed to 2020 and beyond.

But there is a big potential liability lurking in the Brexit talks, with an opening bid from the EU side of a divorce payment of some 60 billion euros. Even half that amount (to cover outstanding pension liabilities and forward spending commitments) would cause a sizeable blip to borrowing in any year – though it is pretty minimal in terms of the overall UK national debt of some £1.6 trillion. So a second question is whether and how any future liability is noted in the forecast.

Costs of Brexit

The direct public spending costs of Brexit are relative chickenfeed compared to the macro-impacts and the potential exit payment, but they are vital for good housekeeping and planning. In the Autumn Statement, the Chancellor found money to create budgets for the new Department for Exiting the EU and the Department for International Trade and provided some money to strengthen trade policy capacity in the Foreign and Commonwealth Office.

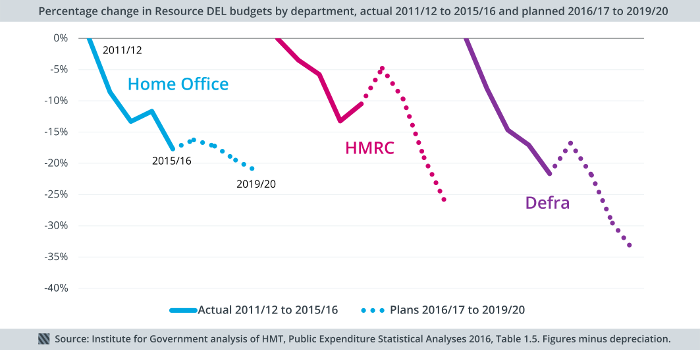

But other affected departments, such as the Department for Environment, Food and Rural Affairs, the Home Office and HM Revenue and Customs, were not given any relief from the planned savings to their administration budgets, nor any allowance for new spending on the systems they will need to implement for new border controls, customs checks and a new migration regime. These departments have already faced significant cuts – and are slated for a lot more to come in the pre-Brexit Spending Review. The slower pace of cuts in the Home Office reflect the relatively generous settlement for the police in 2015.

Departments have clearly been given the go-ahead to recruit staff to draw up plans to meet the challenge of Brexit. Those costs are in tens of millions. Important for departmental budgeting, but fiscally trivial.

But there are big upfront costs coming down the line for the new systems to be put in place. Spending will need to start soon if there is any chance of meeting a March 2019 deadline. After the Budget, the scale of those costs may become clearer – as well as whether departments are being asked to cut their business-as-usual programmes to pay for them.

- Topic

- Brexit