Hammond could use Autumn Statement to make better tax policy

Next week’s Autumn Statement will be an opportunity for a fiscal reset post-Brexit

Next week’s Autumn Statement will be an opportunity for a fiscal reset post-Brexit. But Jill Rutter argues the Chancellor should also use his speech to set out a new (and better) approach to making tax policy.

The Government has to get on with business-as-usual while preparing for Brexit, and next week we see one of the great government set-pieces: the Autumn Statement. There will be new forecasts, new fiscal rules, and maybe even announcements on infrastructure.

But the Chancellor also needs to make clear that the UK is ‘open for business’ and up to meeting future challenges.

We think that starts by changing the approach to Budgets and tax policymaking, eschewing what former Treasury second permanent secretary Sir John Kingman recently called ‘wasteful gimmicks’ invented at the last minute, and instead chart a clear way forward over the years to come.

In September, the Institute for Government, the Chartered Institute of Taxation and the Institute for Fiscal Studies wrote to the Chancellor setting out changes that we believe would allow him to make tax policy better:

- Establish clear guiding principles and priorities – so we have clarity on the Chancellor’s direction for the rest of Parliament

- Start consultation at an earlier stage – to avoid the surprises that lead to costly errors and embarrassing U-turns and sticking to the commitments in the former Chancellor’s ‘New Approach to Tax Policy Making’

- Prepare the ground for future policy change – potentially through external reviews to open up new policy options

- Return to a single fiscal event – to stop Autumn Statements becoming second Budgets and reduce the pressure to come up with changes for the sake of having something to announce.

The last proposal appears to be getting traction. There are rumours that Mr Hammond is examining the option of downgrading the Autumn Statement – and the International Monetary Fund has just called on him to do that, noting ‘the frequency with which fiscal policy objectives appear to change, combined with the Autumn Statement effectively evolving, in recent years, into a mini budget makes it difficult to fully grasp how fiscal policy is being implemented through the Budget’.

We also suggested building on one innovation that did work: George Osborne’s introduction of a ‘roadmap’ for reform – setting out the timetable for reform over a Parliament. The 2010 Corporate Tax Roadmap was widely welcomed, while views on the 2016 Business Tax roadmap were more mixed with many feeling it simply relabelled existing policies.

We think that approach to reform could and should be used much more widely – for example, on savings and pensions where there have been changes in most fiscal events over the past ten years and which would benefit from longer lead-times for providers of savings products, and greater integration with the Department for Work and Pensions’ policies. And one feature of those roadmaps would be to be clear where reform was off the table – to offer the stability people need to plan.

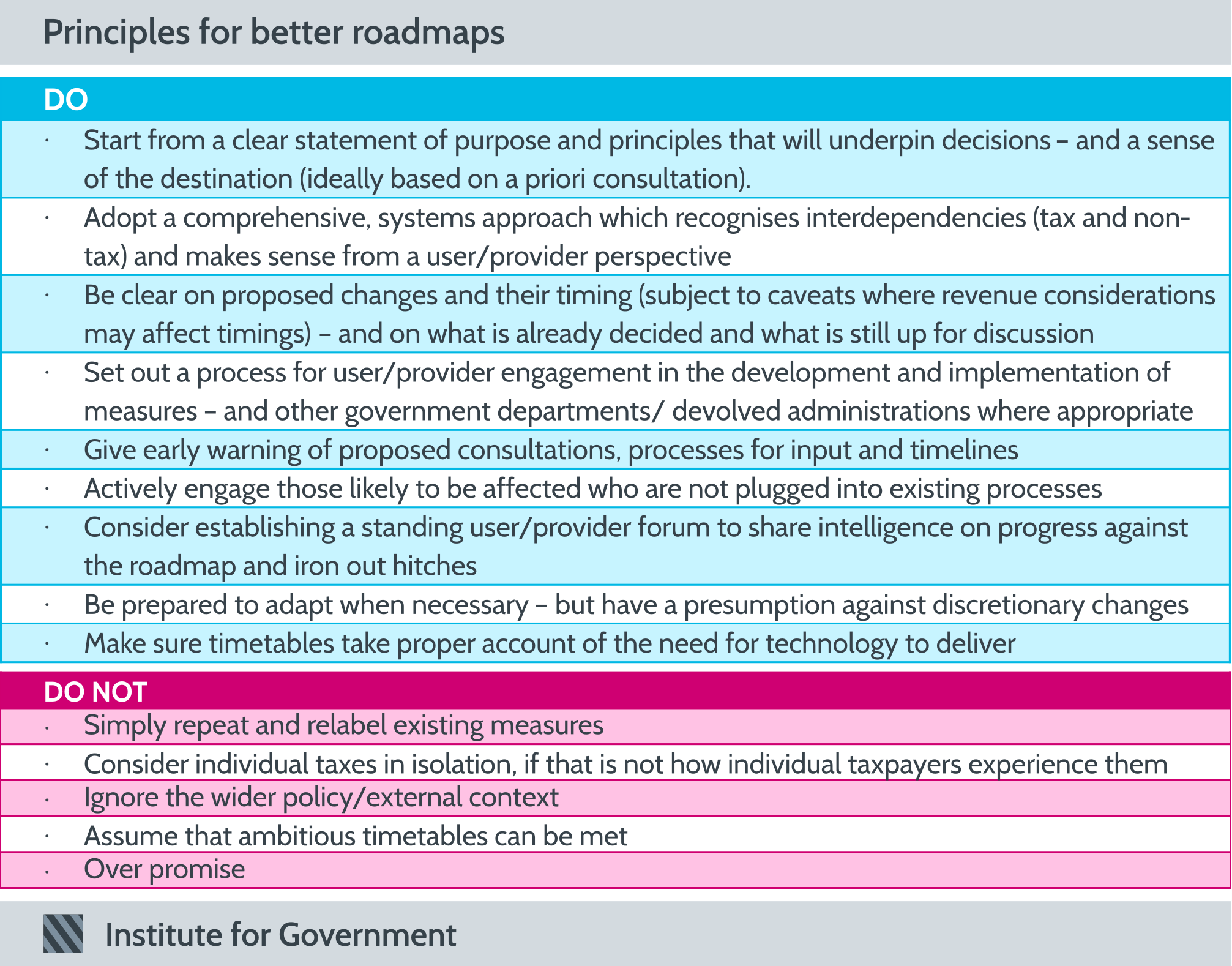

To be useful, there are certain principles that need to be observed – and some traps to be avoided. We have developed some principles for better roadmaps, which we think HM Treasury and HM Revenue & Customs could adopt as a way to give taxpayers greater certainty.

So as the Chancellor seeks to set out on a new course next week, he needs to chart a roadmap to the future – not just on the big numbers but also on the approach he will take to tax policy.

This is a new administration, with a big new agenda, operating in conditions of unprecedented uncertainty. It is the right time to signal a new approach to give business and individuals confidence in the future. Philip Hammond should take it.

- Topic

- Policy making Public finances

- Keywords

- Tax Public spending Budget

- Political party

- Conservative

- Position

- Chancellor of the exchequer

- Administration

- May government

- Department

- HM Treasury HM Revenue and Customs

- Publisher

- Institute for Government