In the upcoming Budget, the Chancellor must address the potential loss of access to cheap European Investment Bank finance for vital infrastructure, argues Nick Davies.

The run-up to the Budget has seen plenty of debate about how to finance vitally needed infrastructure. The Chancellor has seemingly rejected calls by Sajid Javid, Secretary of State for Communities and Local Government, to “borrow more to invest” in housing infrastructure. Meanwhile, questioning the value of existing public finance initiative (PFI) contracts is back in mainstream political debate and Labour has suggested that it might cancel them if in government.

Yet the Government expects private investors to contribute over 60% of the finance for planned infrastructure projects – mainly in energy, communications and utilities.

If the Government is committed to this target, then the Budget must include a plan to replace the finance currently provided by the European Investment Bank (EIB) along with a clear indication of when it will publish its long-promised data on the private finance requirements for future infrastructure projects.

The UK will need new money for infrastructure after Brexit

When the UK leaves the EU, it will lose access to the EIB - a significant source of cheap finance for infrastructure projects.

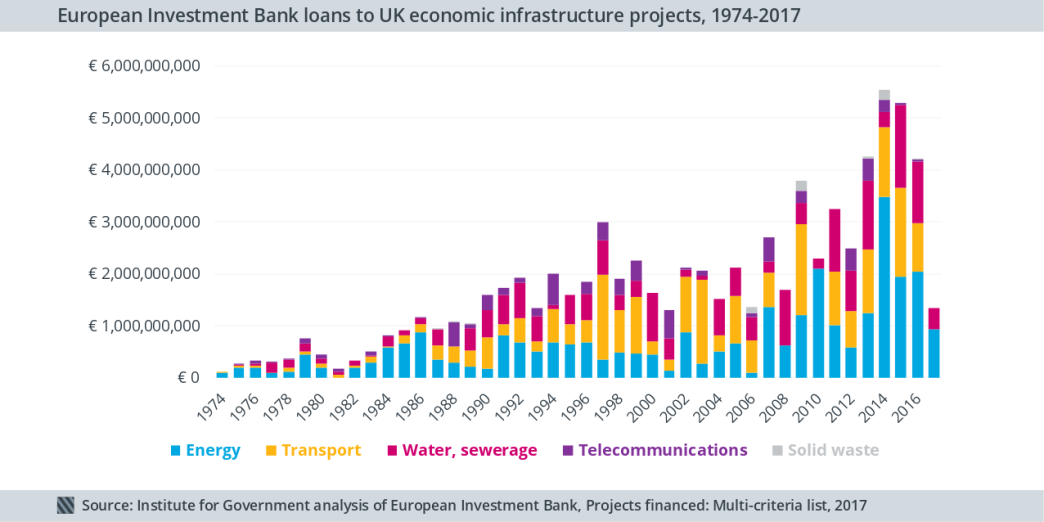

Since 2010, the EIB has directly provided almost €30bn in finance to UK energy, waste, communications, transport and water infrastructure projects. Critically, this is usually at a better rate than can be obtained from other private investors.

Without it, we should expect higher bills for taxpayers and consumers, particularly in water and energy which benefit from extensive EIB lending.

The EIB has also helped crowd in other private finance too. By undertaking due diligence for, and investing in, new technologies such as offshore wind the EIB has sent positive signals to other private investors about the commercial viability of these projects.

There is a risk that without the EIB, private investment in new technologies and sectors may decrease.

There are two options open to the Chancellor, but neither of them are easy

Negotiating continued or associate membership of the EIB, which the Chancellor reportedly favours, would minimise the potential disruption to financing infrastructure. But this depends on the progress of Brexit negotiations. The European Commission’s current position is that the UK should lose access to the EIB after it leaves the EU.

An alternative could be to establish a new UK infrastructure bank, as the Infrastructure and Projects Authority is reportedly considering - but this could take at least a decade.

The Chancellor must publish the data on private finance required for future projects

The Government is not getting the best deal from private finance because the number and scope of upcoming UK infrastructure projects that require private finance is a mystery. Basic information is currently unavailable, for example: when finance will be sought by government, the eventual source of funding, the proposed contract structure and sometimes even basic contact information.

As a result, investors are less interested and competition is stifled - and that in turn means higher costs for taxpayers and consumers.

To help improve this, the Chancellor announced in the 2016 Autumn Statement that a new private finance ‘pipeline’ would be published by the Government. One year on, we’re still waiting.

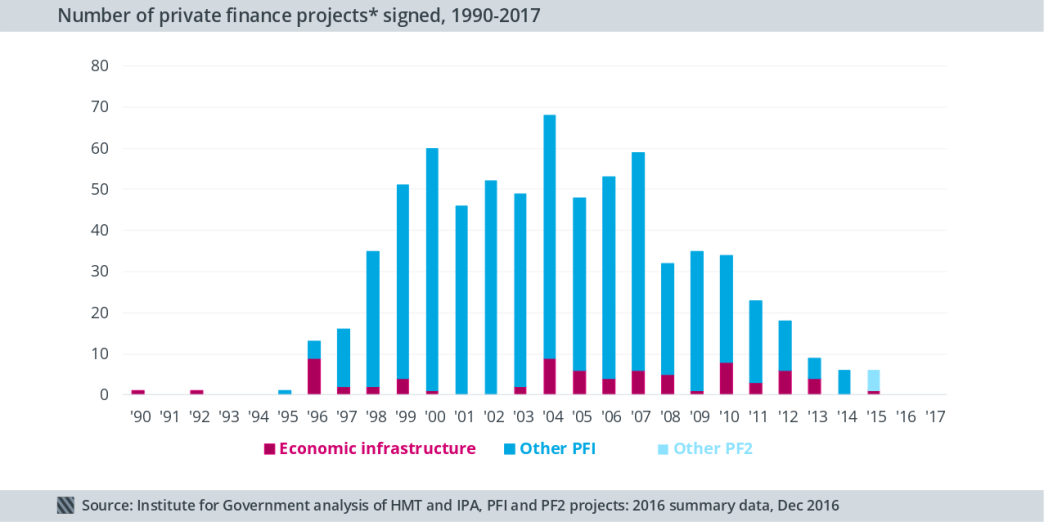

The number of new private finance deals for infrastructure projects has slowed to a trickle. If the Government wants to turn the tap back on, the Chancellor needs to set a date in next week’s Budget for when this 'pipeline' will be published.

*This data only includes Private Finance Initiative and Private Finance 2 projects, as reported by the Infrastructure and Projects Authority. It excludes privately financed projects which are privately owned such as low-carbon energy generation and trains.