Budgets in the devolved nations

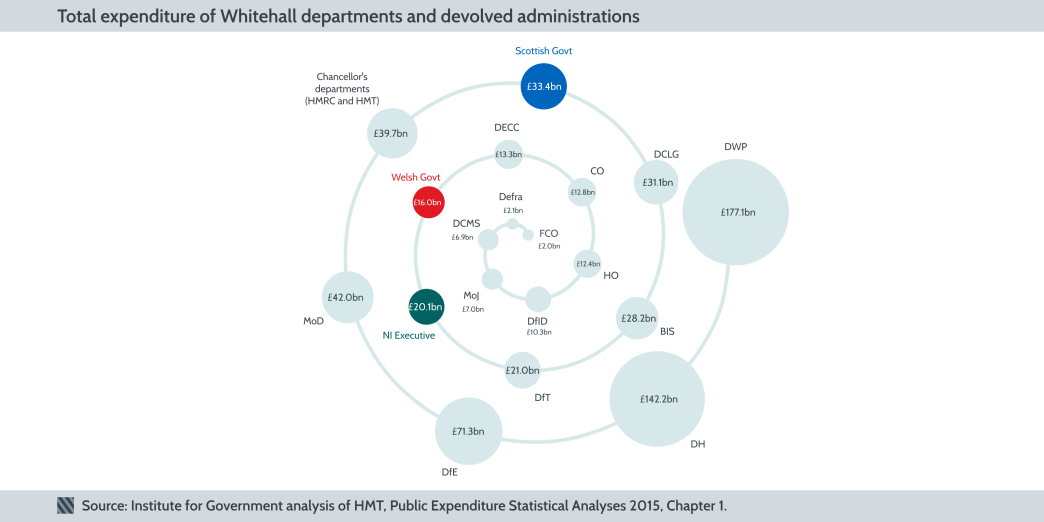

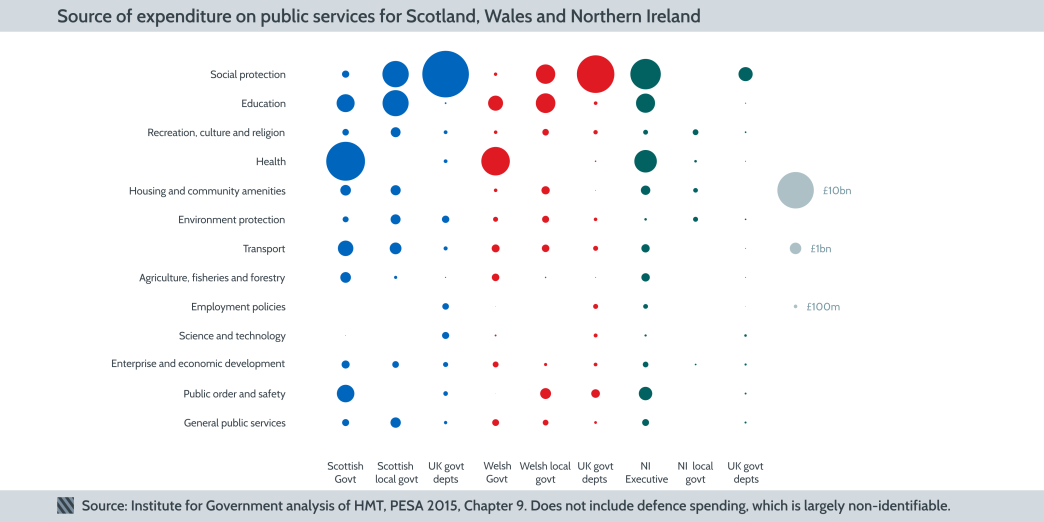

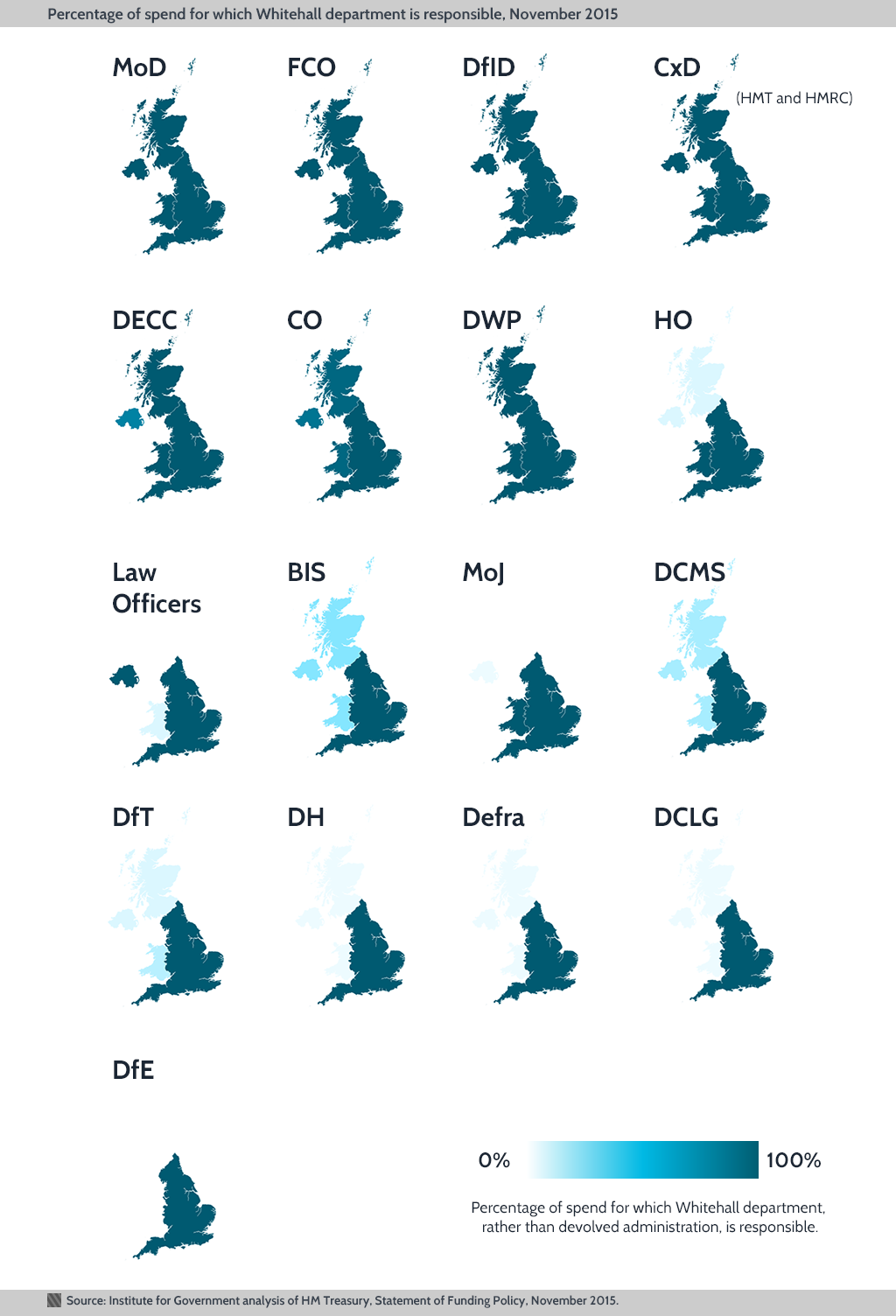

Following the elections in the devolved nations on 5 May, governments have now been formed in Scotland, Wales and Northern Ireland. But what resources – money and people – do they have available to them? In the first of two posts, Oliver Ilott and Gavin Freeguard look at budgets.