The Chancellor’s eye-catching Budget measures, like the sugar tax, distract attention from some serious sleight of hand designed to deliver his 2019/20 surplus. Oliver Ilott and Jill Rutter argue that this sort of fiscal manoeuvring is not conducive to effective government.

The Office for Budget Responsibility (OBR)’s less optimistic view of the productive capacity of the UK economy was bad news for the Chancellor. The Treasury pre-briefed snippets of “good news” – some money for rough sleepers, the recycling of a Labour policy on savings and a dramatic move to take all schools away from local authority control by 2022. But when it came to the day, the Chancellor had no option but to come clean on his figures.

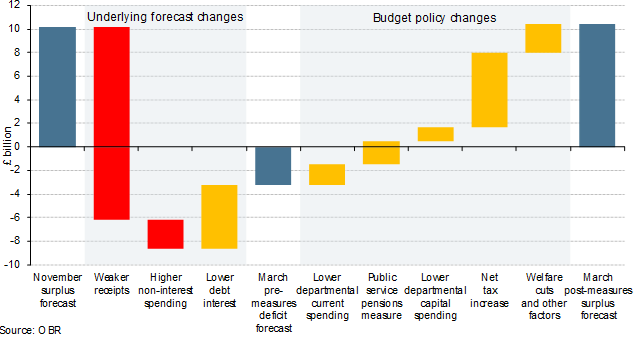

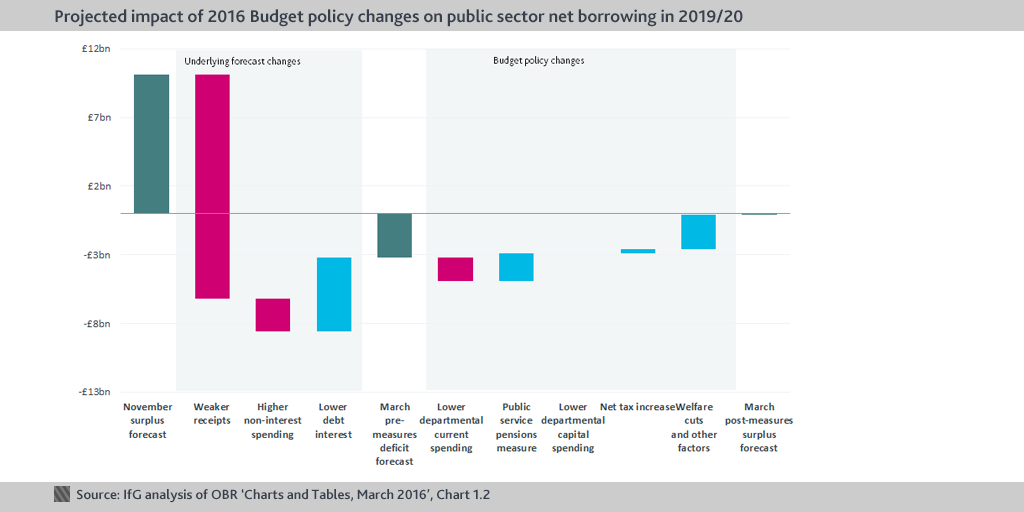

If the Chancellor was being coy in his comments, at least the OBR published the grisly truth. Chart 1.2 (reproduced above) from the Office for Budget Responsibility (OBR) overview of the Budget shows that, before Wednesday’s budget, a combination of weaker tax receipts and higher spending was turning the Chancellor’s £10bn surplus (the left-hand blue bar in the chart) into a £3.2bn deficit in 2019/20 (the middle blue bar).

Despite being blown £13bn off course, the Chancellor appears to have produced a budget that restores his £10bn surplus (the right-hand blue bar). But, looked at more closely, these budget measures raise more questions than they answer – about the Chancellor’s commitment to responsible fiscal management and, in one case, about the judgement of the OBR. The Chancellor has resorted to a couple of one-off specials, which just happen to help the figures in 2019/20.

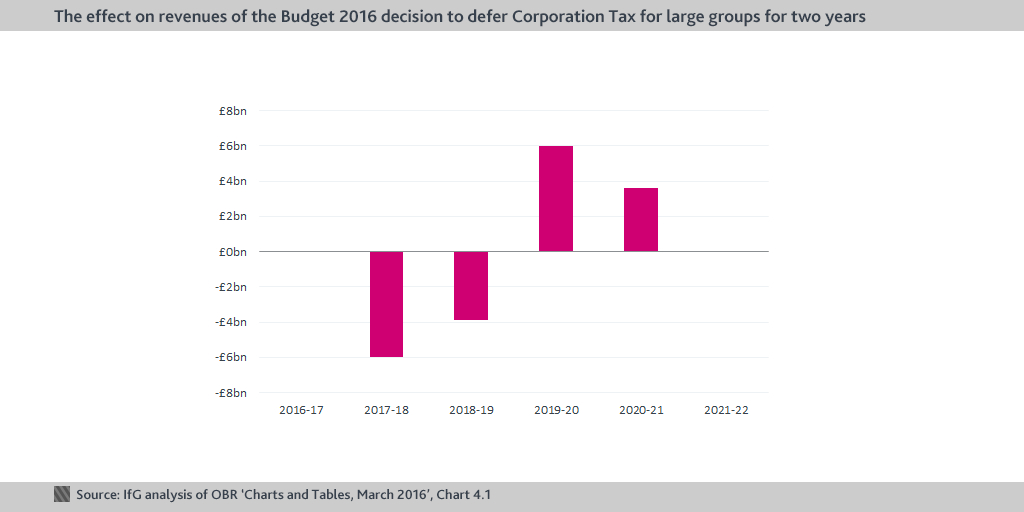

- First, the Chancellor has delayed a change in the payment date for corporation tax – moving £6bn of revenue originally forecast for 2017/18 to 2019/20. Of course, delaying a tax increase weakens the public finances overall, and the Chancellor is borrowing £6bn more in 2017/18. But he gets to borrow £6bn less in the crucial year – 2019/20. And of course, as this revenue is one-off, it falls out of the equation in later years. The pattern of corporation tax decreases and increases resulting from this measure is shown in the graph below.

- Second, for all the Chancellor’s commitment to capital and infrastructure, and attendant hi-vis photo opportunities, the profile of capital spending has been massaged to dip dramatically in 2019/20. It’s unlikely that any of the people planning major projects are thinking of taking a deserved break in 2019/20 to reflect and come back with a bang in 2020/21 – yet that is what the Chancellor’s plans imply.

Ironically, given this is about meeting the Chancellor’s fiscal rules, the net effect of both these measures is that these “savings” actually cost the Exchequer money over the Budget period – and add (marginally) to public debt in the long run.

The OBR has also accepted the Chancellor’s claim that he will find £3.5bn of unspecified “efficiency” savings. That partly offsets the cost of the £1.8bn of very specific spending increases the Chancellor has also announced for 2019/20. But while those are concrete measures, all the Chancellor has promised to find his £3.5bn of savings is an “efficiency review”, which will not report until 2018. This is real “the cheque’s in the post” territory!

The Government’s track record on delivering unspecified cuts is not good. Remember all those tight spending totals in the March and July 2015 budgets, that ended up being considerably looser after the November Spending Review forced the Chancellor to say which departments the cuts would actually come from? The OBR would have done better to wait until it saw the results of the review and specifically how the findings translated into lower departmental spending totals.

If you eliminate these three, rather dubious, measures then the OBR’s chart would look rather different. “Lower” departmental spending is actually higher departmental spending, the lower capital spending disappears, and the net tax increase falls from £6.3bn to a mere £0.3bn.

The result, once you discount the Chancellor’s sleights of hand, is that the £10bn surplus in 2019/20 would have been a £0.1bn deficit. The Chancellor would be on course to miss the fiscal target he set himself, but the massaging of the numbers made it appear otherwise.

These sorts of Budgetary shenanigans have been seen before. But, back in 2010, the Chancellor established the OBR with one aim – to re-establish public trust in the numbers on which Budgets were based. The OBR has had many positive effects, not least setting out the effects of the underlying forecast changes. But it also had a difficult time last autumn, appearing to ‘help’ the Chancellor with modelling changes and some dubious presentation at the time of the Autumn Statement. This time, it has drawn attention to the Chancellor’s sleight of hand around timing. That helps make those changes more transparent and is a useful step.

But, given its role as fiscal watchdog, the OBR should be prepared to go further. First, it should explicitly refuse to grant its ‘imprimatur’ to measures that have been put in place solely to deliver a desired trajectory and, in doing so, worsen the overall public finances. That would deter Chancellors from indulging in these short-term tactics, which undermine long-term credibility. And second, it needs to adopt rules on when it is prepared to recognise savings. It has a rule that it does not recognise aspirational commitments (like the Government’s carbon reduction targets) until there are concrete measures in place to deliver them. It should treat unallocated savings with the same scepticism and not have signed off £3.5bn of “cheque in the post” savings.

The OBR is a success – accepted across Parliament as a useful addition to the institutional landscape. But it needs to take a more muscular approach to achieve the purpose for which the Chancellor set it up. That is in the long-term interest both of the OBR, and current and future Chancellors.

- Topic

- Brexit